Walmart U.S. Q4 results showed sales up +5.0%, comp-sales up +4.6%, and operating margin up +12 bps. The sales increase was ahead of Advan’s +4.3% estimate* (+/- 90 bps T4Q Moe, 55% T8Q correlation). Excluding e-commerce, curbside, store delivery, and marketplace, comp-sales increased +1.7%. Excluding the average ticket increase of +1.8% implies a slight comp-traffic increase for the period, right in line with Advan’s +0.6% estimate. (Management did say in-store comp transactions were positive.) The average ticket increase was driven by GLP-1 drugs and gains with more affluent households shopping at Walmart (these shoppers add more items to the basket, shop at higher price points, and use curbside and store-delivery – both higher ticket channels). CEO Dough McMillion, “That’s what’s driving our growth? Our prices are low, and we’re becoming more convenient. Customers are shopping with us more often and buying more items.” More often and more items reflect the increase in affluent households, i.e. it’s a customer mix artifact. Relatedly, Advan also shows the time spent in the store per visits (i.e. dwell time) is down -4.5% YoY; that decrease aligns with fewer items in the basket per trip (UPTs) and the presence of the paycheck cycle for less-affluent households. When excluding the gains in affluent customers and the marketplace business, general merchandise sales were down mid-single-digits per our estimate, i.e. demonstrating ongoing soft discretionary spending by non-affluent households (which will also likely be the case for the dollar stores and the like).

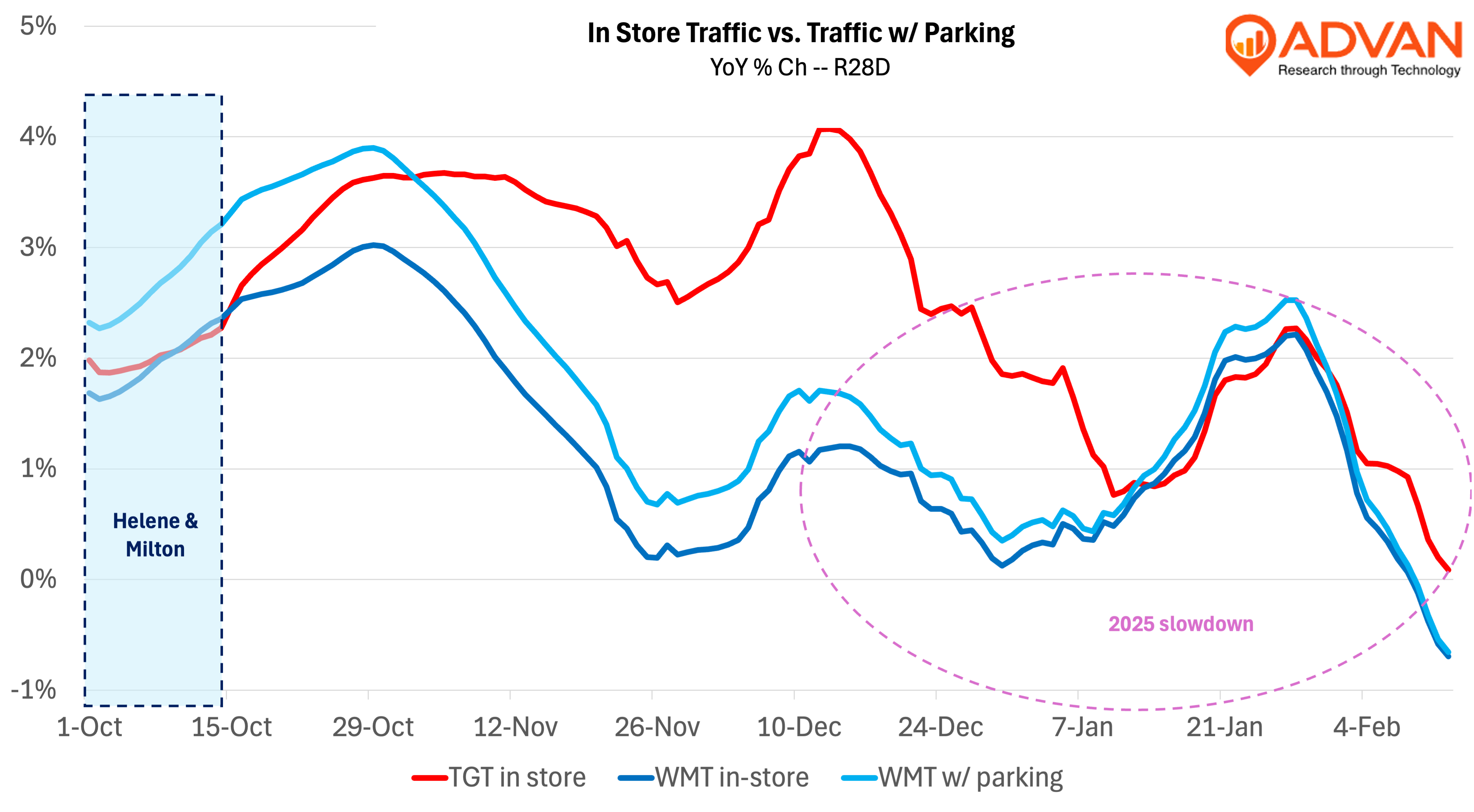

Guidance for Q1 at the corporate-level is for approximately +3.5% revenue growth, which is a -180bps lower rate than Q4’s +5.3%; some of that is the leap year lap and the remainder is just lower growth, including the U.S. retail business. Applying the deceleration relative to the US’ Q4 sales rate implies +3.2% sales growth, just above Advan’s +3.0% current estimate*. Said differently, the lower outlook should not be a surprise to Advan Research customers. Moreover as shown in the chart below, the slowdown includes the curbside and in-store businesses, as well as for Target, i.e. it’s macro in nature. (Management did confirm the positive bump in January.)

The guidance for slower Q1 company-wide operating income growth of +0.5% to 2.0% also embeds lower profit growth for the US business, particularly the grocery business, which we wrote about last week with Ahold’s results . In that story, we shared that the grocery industry was likely to have an incrementally more difficult time to grow profits this year, especially the national-branded side of the industry (vs. private label and produce). While Walmart has a large and successful private label business (approximately +8% in the quarter), the bulk of its business is driven / hurt by national brands. Excluding private label and produce, Walmart’s grocery business for Q4 was flat to down per our estimate. Lastly, at this week’s CAGNY conference (the CPG industry’s biggest conference of the year), not only did national brands like General Mills and Conagra call out a slower 2025, home and personal care branded manufacturers, like Procter & Gamble, Clorox, and Coty, also noted slower market growth and an environment where retailers were cautious on their orders.

Sam’s Club Q4 results showed sales up +5.7% and comp-sales up +6.8% ex-fuel. The comp increase was ahead of Advan’s +5.2% estimate* (+/-60 bps T4Q Moe, 75% T8Q correlation). Comp-transaction, ex-fuel was up +5.4% and more aligned with our estimate. Like Walmart US, comps were driven by produce, private label, and GLP-1 prescriptions. Aside from electronics and apparel, general merchandise comps were roughly even. Sam’s Club continued to grow membership counts and increase its penetration of Plus members. Also favorably, Advan shows shopper frequency up +4.4% YoY for CQ4.

*Utilizing the Maiden Century model.

LOGIN

LOGIN