By Thomas Paulson, Head of Market Insights

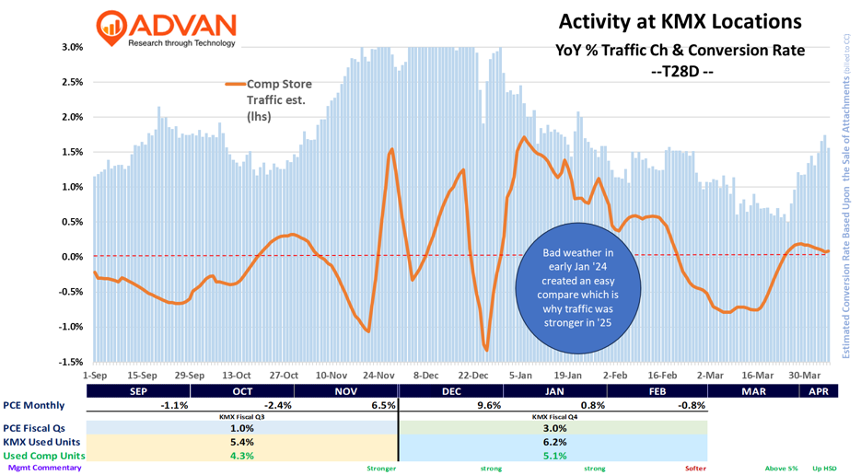

CarMax reported strong quarterly results with increases of +6.2% for comp-unit sales, +3.0% for gross profit per retail used unit, and +8.2% for CAF income. Additionally, management shared that trends in March / April had strengthened; healthy sourcing of 15% more vehicles in the quarter will allow CarMax to meet that increased demand. The chart below shows the T28D trend in traffic and conversion rate at its locations, and that is overlaid onto BEA PCE figures industry-wide for used cars (% ch YoY), as well as CarMax’s results and commentary. (The BEA figures for March are to be released later this month.) As is evident, the past six months have been volatile, with declines in September / October, high growth in November / December, a slump again in January / February, and a pick up again in March / April. (Note that the strength in March was back-end loaded.) Of note, CarMax has a relatively low conversion rate (10%-ish), so conversion rate is a more important driver to sales than small changes in traffic. And so, to that point, CarMax was able to boost conversion rate during the strong periods of demand, which demonstrates that CarMax had inventory of in-demand vehicles at the right time, i.e. CarMax’s merchandise and operational execution were strong.

Looking forward, the Q&A on the call spiked anxieties by investors (stock closed down 17%) that used prices at wholesale are going up a lot in response to tariffs with the fear being that CarMax and others will face gross profit pressure with the spike in demand for “supply” outpacing what consumers can afford. (Anxiety was already high given that Amazon has been reported to be entering the used car industry.) Moreover, investors are wondering if the Jan / Feb trend more reflects the true pace of demand with Mar / Apr being an ephemeral pull-forward. (A good, but impossible to answer questions.) That potential eventual margin squeeze retailers remains to be seen (one can’t disprove a future event); however, CEO Bill Nash did provide some perspective, “I think we manage inventory better than anybody in the business. We’ve been doing it for over 30 years. We are very familiar with operating and changing a fluid type of environment. Keep in mind, we have the benefit of professional buyers who are on the ground, they’re seeing things coupled with data that we’re getting coupled with our own auctions. So I feel really good about where we are, both from an inventory on the ground and our inventory going forward. And I have no doubt that the team will continue to execute at a very high level.” All this said and as we’ve said many times, “retail is detail” which means executing on the basics and that is what CarMax has demonstrated over the past six months. We’re betting on precedent vs. hypotheticals.

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.

LOGIN

LOGIN