By Thomas Paulson, Head of Market Insights

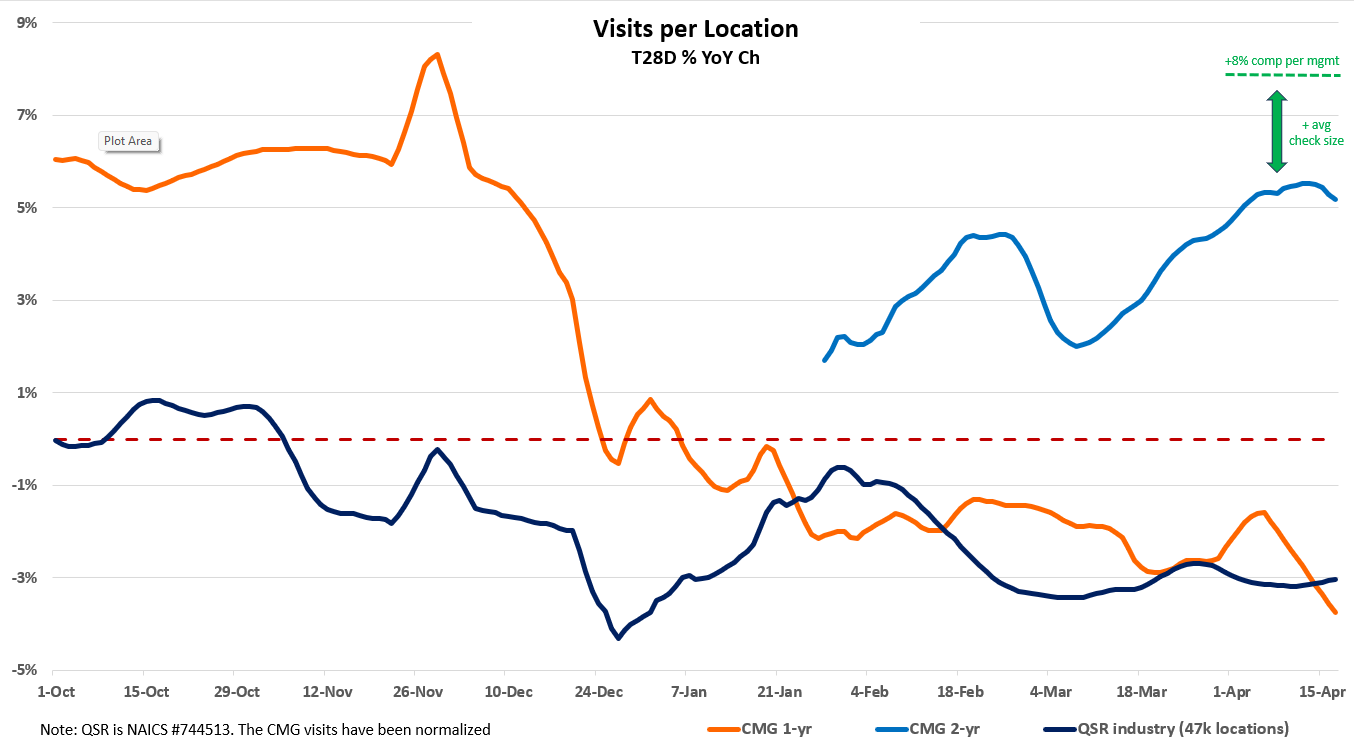

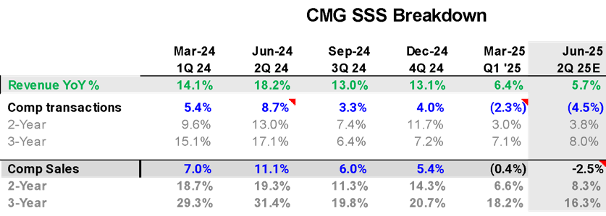

Chipotle reported a +6.4% revenue increase for Q1, composed of a comp-sales decline of -0.4% and a +680 bps contribution from more locations. Breaking down the comp increase, transaction fell -2.3% (-630 bps QoQ) and check grew by +1.9%. Advan traffic data pointed to a -690 bps deceleration QoQ to -3.2% on an adjusted basis. As shown in the chart below, traffic has notably softened in April; as such, we were not too surprised that management lowered guidance from low-to-mid single-digits to +LSD comps for the year. While the drop in April is largely a difficult compare and the timing of Easter, as shown in the 2-year trend, the updated guidance still embeds a step-up in comp-transactions on a 2-, 3-, and 4-yr basis from Q1’s level. Moreover, comp-transactions will have to improve to an average +1.0% rate to hit the guidance. Given the Q1 and April’s trend, that seems ambitious and dependent upon a winning new marketing campaign and menu innovations, and meaningfully dialing up promotions / loyalty offers, which is what they plan to do per management’s comments.

As shown in the chart above, Chipotle’s deceleration is more severe than the broader industry slowdown. That also shows in the 2- and 3-yr comp transaction CAGRs shown in the table below. (Yes, management is pushing down expectations for the Q2 comp to be around a -2.5% decline.) The difference between Chipotle and the industry may reflect a sharper pull back by the less affluent that are burnt out on inflation which is less severe for lower-priced QSR brands such as McDonald’s; McDonald’s traffic (per Advan) has not experienced a negative inflection and has been running around flat YoY. The difference could also imply more encroachment by competitors, something that we will be looking into in the weeks to come. On the call, CEO Scott Boatwright said, “We took a hard look at the consumer by income cohort, which we’re not seeing any divergence in any cohort, specific cohort, and we took a look at it by geography. And we see that the slowdown is more macro versus generalized or by geography or by cohort. So we’re not seeing anything that would lead us to believe that there’s a problem with the consumer today as it relates to Chipotle’s consumers.” (Again, more on this from Advan in the weeks to come.)

On the call CEO Scott Boatwright said, “In February, we began to see that the elevated level of uncertainty felt by consumers are starting to impact their spending habits. We could see this in our visitation study where saving money because of concerns around the economy was the overwhelming reason consumers were reducing the frequency of restaurant visits. This drove a slowdown in our underlying transaction trends. This trend has continued into April… Current underlying trends would result in a low single-digit full year comp and return to positive transaction growth in the second half of the year. We also have several near-term initiatives that I’m confident will accelerate this trend…. Looking forward, our marketing team has an enhanced plan for this summer and the remainder of the year to make Chipotle more visible, more relevant and more loved to drive difference, drive purchase and drive culture. For example, beginning in May and continuing through the summer, we will meaningfully ramp up our marketing spend to reach more guests and meet them where they are. This will include menu innovation around the possible side or dip, increasing marketing in our digital and social channels and leveraging our rewards platform to target specific customer cohorts and group occasions.”

On the question of price and whether the brand has become too expensive, Boatwright said, “We continue to lean into my idea or our idea of value, which is a benefit over price. We’re going to hold the price constant… We’re going to continue to lean into the benefit of the offering. We’re going to lean into high-quality great culinary, abundant portioning throughout all restaurant occasions and all channels and then lean into the customer experience in a more meaningful way, which I talked about in the prepared remarks.” Time and traffic will tell.

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.

LOGIN

LOGIN