By Thomas Paulson, Head of Market Insights

Dick’s Sporting Goods, Inc. reported solid results, including an underlying sales increase of 6% based upon a 6.4% comp-sales increase and improved gross margin rate. The comp-sales increase was composed of increases of 4.4% in comp-ticket, 2.0% in comp-transactions, and a modest decrease in comp-traffic (Advan) of -1.1%. Assuming online comp-transactions were up high-single-digits and stripping that from the 2.0% increase in transactions, lowers estimated store comp-transactions to the Advan’s measure of comp-traffic, which implies a stable conversion rate. Advan’s estimate for comp-ticket of +4.2% aligned with the reported increase. The decline in traffic was partially the result of the shortened holiday period, as well as a soft pre-season trend. The comp-sales increase moved the 2- and 3-yr CAGRs higher, and the business is now 45% larger than 2019 on a comp-basis. Said differently, it was a Gold Medal winning performance for the important holiday season.

Other observations from the results and Advan’s data include a strong start to the 2025 golf season as shown by Golf Galaxy traffic in the chart above, as well as Dick’s for the start of spring. In terms of the medium-term, CEO Lauan Hobart said, “Our business has incredible momentum. We also see tremendous strength and momentum in the U.S. sports industry, a trend we expect to continue through 2030 and beyond. With the continued excitement around women’s sports, enthusiasm surrounding next year’s soccer World Cup matches on U.S. soil and the anticipation for the 2028 L.A. Olympics and the 2031 Rugby World Cup, which will be held in the U.S. for the first time, the convergence of sport and culture has never been stronger, and DICK’S sits squarely at the center of this exciting intersection. We’re a nation obsessed with sport and no one is better positioned to harness this opportunity than DICK’S Sporting Goods.”

Hobart continued, “From this position of strength, we will make significant investments in digital and in-store opportunities to drive our business forward and further expand our market position… Our first key growth area is delivering an elevated omnichannel athlete experience through the ongoing work to reposition our real estate owned store portfolio with House of Sport, Field House and Golf Galaxy Performance Center. Since opening our first House of Sport location in 2021, our excitement and conviction in this innovative concept continues to build. Over the past 4 years, House of Sport has disrupted and redefined sports retail and at approximately $35 million in year-1 omnichannel sales, this highly experiential destination is delivering powerful financial results, which Navdeep will speak to shortly. House of Sport has also driven strong engagement with our athletes, brand partners and communities. In fact, we see our house of sport locations attracting more athletes who not only spend more time in the store, but have a significantly higher spend than our typical DICK’S athletes. Importantly, House of Sport is opening doors to new brand partnerships and strengthening existing relationships as this concept showcases our brand partners in a way no one else can. In addition to driving strong athlete excitement, House of Sport is drawing unprecedented landlord interest, which gives us the opportunity to join some of the best retail centers. After opening seven more House of Sport locations during 2024, we ended the year with 19 total locations, and we look forward to adding approximately 16 more in 2025. **By the end of 2027, we expect to have between 75 to 100 House of Sports locations across the country.” **

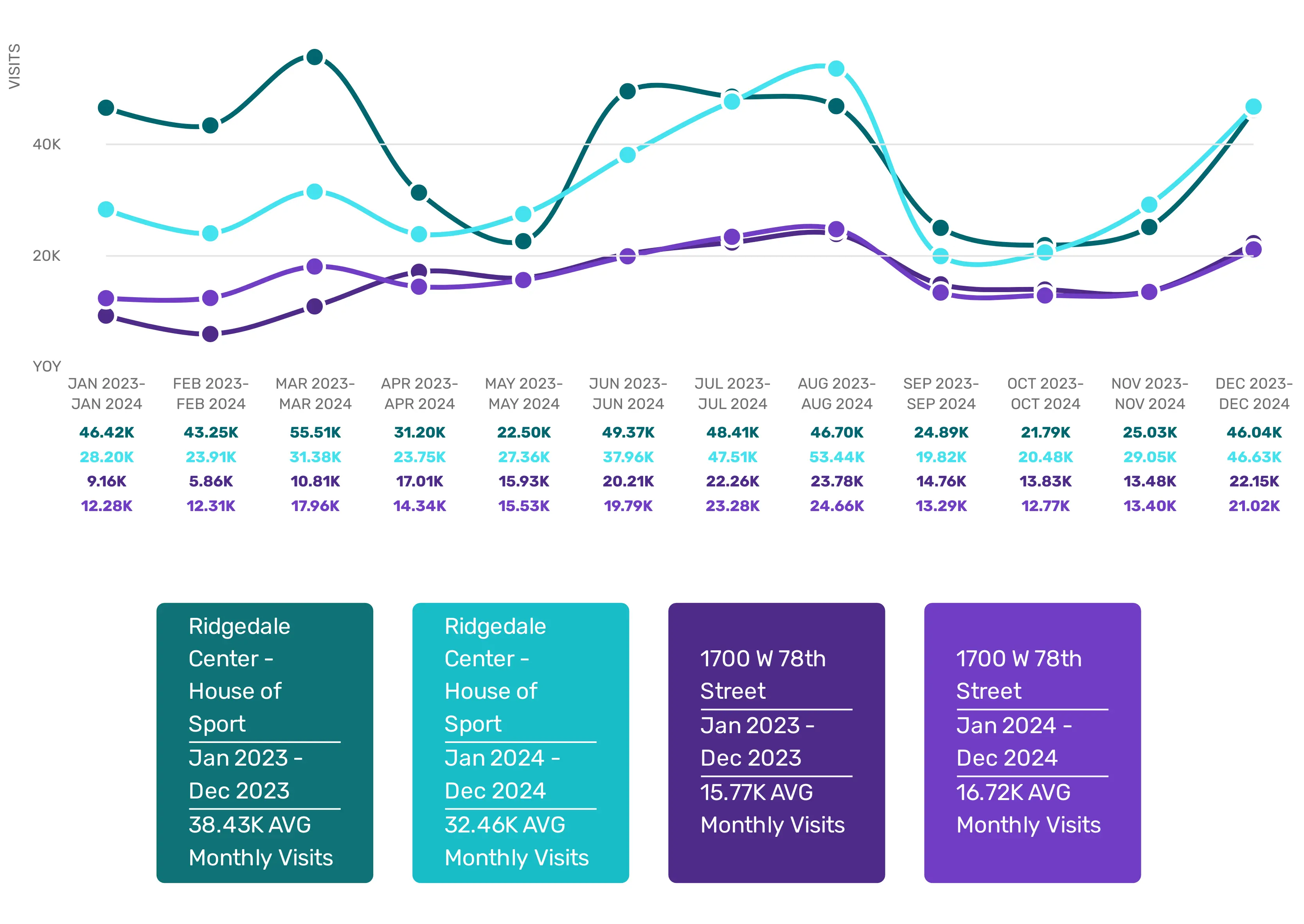

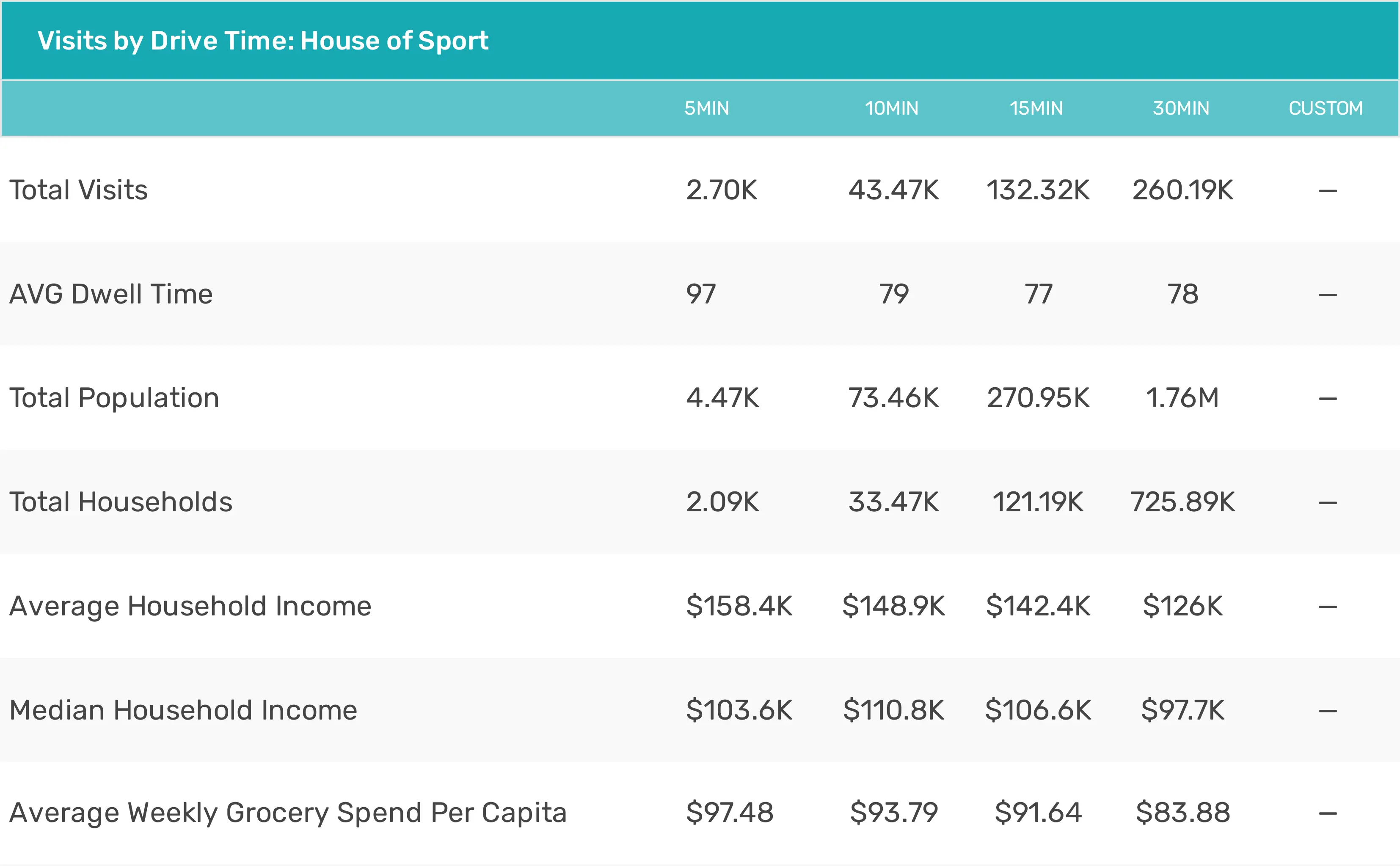

Looking at the Twin Cities market, the House of Sports location in the western suburbs has twice the draw as a very well run Dick’s Sporting Goods location in the southern suburbs. (We are from the market and have a good feel for both locations). That draw expands with drive time, as does the dwell time. The House of Sports location is the only one in Minnesota and the noted Dick’s store is only a 20-minute drive (16 miles); despite the proximity, there is only 10.5% cross-visitation between the two, thus affirming management’s comments that the two brands have a complementary / synergistic relationship. That dynamic, applied to other markets, supports the investment case for increasing the number of House locations to 75 to 100. We also reach that conclusion when looking at traffic for the comp House locations, where the trailing-twelve-month running average remains at 1.3M visits, well above the Dick’s 2024 average of 977K.

*Utilizing the Maiden Century model.

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.

LOGIN

LOGIN