By Thomas Paulson, Head of Market Insights

Similarly to Chipotle , Domino’s reported softer comps for the quarter with U.S system comp-sales falling -0.5%, a figure that aligned with Advan’s -0.8% estimate* and the weaker traffic for limited-service category overall. While down, the 2- and 3-yr CAGRs strengthened and the comp to ’19 remains inline with last year’s rate. Delivery comp-sales were down -1.5% and carry-out increased +1.0%. Delivery has been more impacted by affordability challenges for lower-income households; however, that has now spread to carry-out, which slowed -220 bps with both traffic (-100 bps QoQ per Advan) and mix negative. (Delivery comps matched Q4’s)

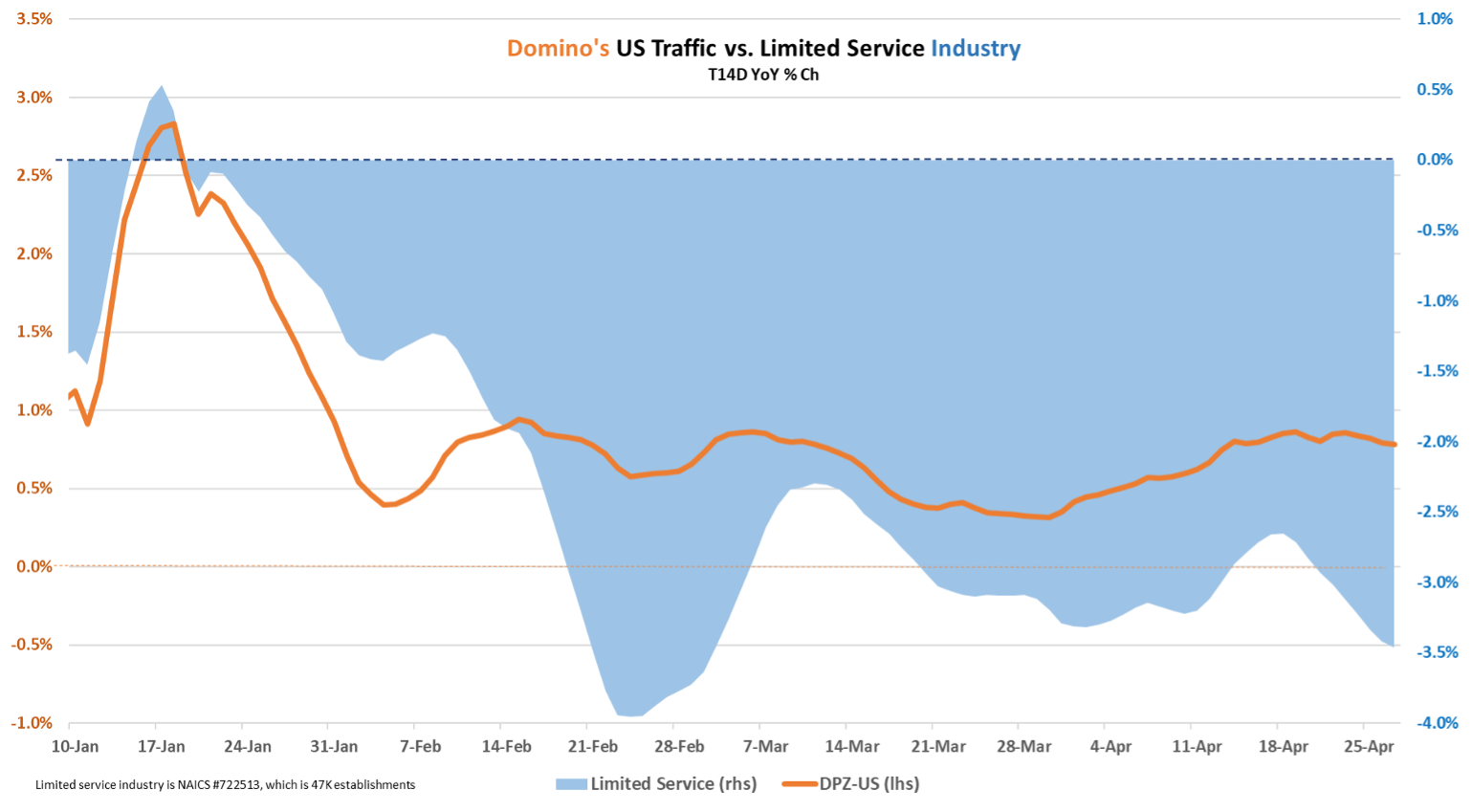

As shown in the chart above, traffic has been softer since February, but still outperforms the industry (+340 bps). That outperformance comes from Domino’s value positioning (Domino’s only had +1.8% pricing in Q1 vs. an industry that’s twice that rate), and something that CEO Russell Weiner spoke to on the earnings call, “I’m proud of how our team effectively executed our Hungry for MORE strategy. Against the backdrop of consumer and industry headwinds and we drove market share gains across both our U.S. and international businesses. Sustained market share growth reflects the company’s ability to control what’s under its control, a key to long-term success… Our third Hungry for MORE pillar is renowned value. This has been a key strength for Domino’s. We’re driving renowned value through national promotions, Domino’s rewards and by growing on aggregator platforms. In the first quarter, we have several value-driving initiatives such as our best deal ever promotion, that we believe broke through industry clutter. We have a strong slate of initiatives primed and ready to go for the rest of the year as we will continue to give customers what they want, which is more value in this challenging economic environment.”

On the lower-end consumer and the softness, Weiner said, “… The lower-income customer is not just a Domino’s customer, it’s a pizza customer, it’s a QSR customer. So, it’s something that I think a big part of this category… how they’re being affected is not really necessarily them leaving Domino’s to go to another brand. We’re leaving the category in general… I don’t think that’s going to change anytime soon.”

*Maiden Century model

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.

LOGIN

LOGIN