By Thomas Paulson, Head of Market Insights

Lululemon’s quarterly results in the Americas segment (Canada and the United States) were flat on a comparable basis; the segment’s revenue increased +2% (ex-unusuals) reflecting the contribution of more locations. Advan estimates that traffic per location increased +4%, but that was offset by a decline in the conversion rate and store-level average-ticket; as such, the reported results align with Advan’s estimates. In Wall Street lingo, LULU is known as a “battleground stock,” with the different sides debating / fighting over whether Lulu is facing competitive encroachment by Vuori and Alo Yoga. That debate flared up again as Lulu guided for softer-than-expected revenue growth in 2025, and so, what does Advan see as of late?

Quarter-to-date, Advan estimates that traffic has slowed by -280 bps and the conversion rate has softened further. As such, we were not surprised to hear CEO Calvin McDonald, “As I have shared before, the missed opportunity from last year was the level of newness across our merchandise mix. The teams worked with our vendors to chase what was possible and improve the penetration of newness in the second half of 2024. These efforts contributed to a stabilization in the US business as the guests responded well to many of the updates we brought into the assortment. I would also note that, importantly, our new guest acquisition and retention metrics remain strong, and our opportunity is to drive increased revenue per guest as we continue to bring newness and innovation into the mix. As you have seen, we started this year with several compelling new product launches, but we also believe the dynamic macro environment has contributed to a more cautious consumer. In fact, based on the survey we conducted earlier this month in conjunction with Ipsos, consumers are spending less due to increased concerns about inflation and the economy. This is manifesting itself into slower traffic across the industry in the US in quarter-1, which we are experiencing in our business as well. However, we see guests who visit us responding to the newness and innovations we’ve brought into our assortment. We believe this is a positive indication as we continue to flow new product engagements with our guests through unique and compelling activations and launch brand campaigns. We are controlling what we can control, and we expect to see modest growth in US revenue for the full year of 2025.” We read these remarks to indicate lighter traffic, a lower conversion rate, and some pressure on average unit retail and / or average basket size. Are those the results of the macro, competition, or something else? While the macro isn’t ideal for Lulu, we don’t think that it’s worsened. We also don’t believe that the brick & mortar competition (i.e. Alo and Vuori) has intensified. We do suspect “something else”, in other words – fashion.

As McDonald highlighted, delivering exciting and compelling newness is key to both traffic and conversion, and as they have missed before, why is that not a factor this time?To put the blame on the “macro” he cites the Ipsos survey; surveys are troubled in predicting sales, but as we’ve written, consumer sentiment has plummeted for democrats, with Michigan reading down -55% from prior to the election. However, sentiment rarely translates into spending behavior, outside of massive events like COVID-19 and the Great Financial Crisis. Moreover, Lulu is aligned with the affluent, and the affluent are spending . However, other transitory macro factors have impacted the near-term; as we’ve observed, the weather has also been a huge driver to volatility in shopper traffic so far in 2025. The Los Angeles market is also very significant to Lulu as the region has 36 locations out of the US total of 374. Other fashion brands have noted that the devastating fires disrupted their customer engagement and traffic; why Lulu wouldn’t also be effected is illusive to us. Moreover, Lulu has two stores in highly impacted areas.

The larger 374 figure and the $6.5B in sales that they produce also deserve consideration as Lulu is no longer an “upstart brand” that has substantial penetration potential in front of it; rather, this is a rather mature brand facing the law-of-large-numbers and that is facing some encroachment from upstarts and others. In terms of “others,” dupes and Chinese brands have been disruptive to the category during the past 18 months, while we don’t monitor the prices for dupes, Shein, and Temu and or their activity on Meta and TikTok, given the change to import rules and de minimus that took effect on February 4th, there may be some thing there as well. Finally, Canada is also a large business for Lulu at $1.4B in sales; Lululemon is a Canadian company and brand, and there is a lot of concern about the economy and politics up there as well. Advan data shows a good amount of recent deceleration in traffic in Lulu’s Canadian business.

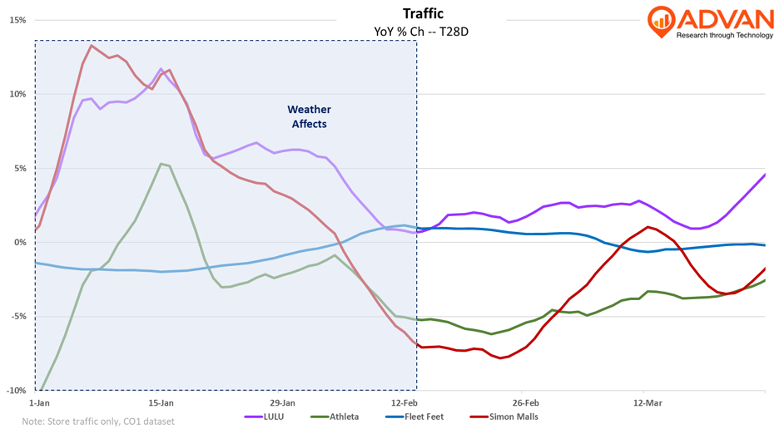

On the traffic question, which management characterized as “broad and macro” – Lulu generally tracks / correlates with Simon Property Group’s mall traffic, and as shown, Lulu has outperformed Simon, as well as Athleta. And so, while it is true that traffic did slow appreciably in the 2H of January, that was largely weather-related. Also as shown, Lulu’s traffic, as well as Simon’s and Altheta’s, has recently picked up. Fleet Feet’s traffic is very stable thus far in the year, and so if there was a change in the macro, why isn’t it appearing in Fleet Feet’s trend? Looking at today’s BEA Personal Consumption report and the women’s clothing category, February’s growth was +3.5% and +50 bps ahead of the 2H ‘24, i.e. stronger, not weaker. And so, our conclusion is that Lulu’s more cautious outlook reflects: (1) justified uncertainty as it relates to tariffs and their impact on consumer spend and the economy, (2) some issues with product vis-à-vis a dip in conversion rate and basket size, and (3) a higher level of conservatism (which they are known for) given the first two and the recent traffic volatility.

As to the “battleground” and Vuori and Alo Yoga, we last did an analysis of the topic last summer, our conclusion then was: yes, the three share some shoppers, which isn’t a surprise given that the three often are in the same trade area, but what hit the category in 2024 was simply a broad category slowdown starting early in the year. Our hypothesis for why this happened was that the growth in demand and visits was principally driven by social media influencers. Moreover, that push, as was the strategy, also allowed Lulu to press into higher price points on new releases; that pushed the mix higher and contributed to top-line growth. In late 2023, these influencers shifted “their story” as they observed that their followers were more interested in saving money (via dopes and off-price discoveries) than paying up for the latest releases and product from Lulu (as well as Alo and Vuori). This change in interest stemmed from a change in consumer spending patterns / mindsets as all consumers became fed up with the absolute level of prices across all categories (vacations, hotel rooms, the price of a cocktail in a bar, grocery and restaurant prices, etc. etc). That frustration led them to seek out retailers and brands that offered absolutely lower price points and hurt brands like Lulu where there were fewer low entry-level priced products as part of the assortment. One good example of the consumer change is Costco’s general merchandise comp-sales which went from being up low-single digits to consistently double-digits in 2024, and so far in 2025 (Costco is very well positioned for our current thrifty-K-shaped economy, other brands, less so.)

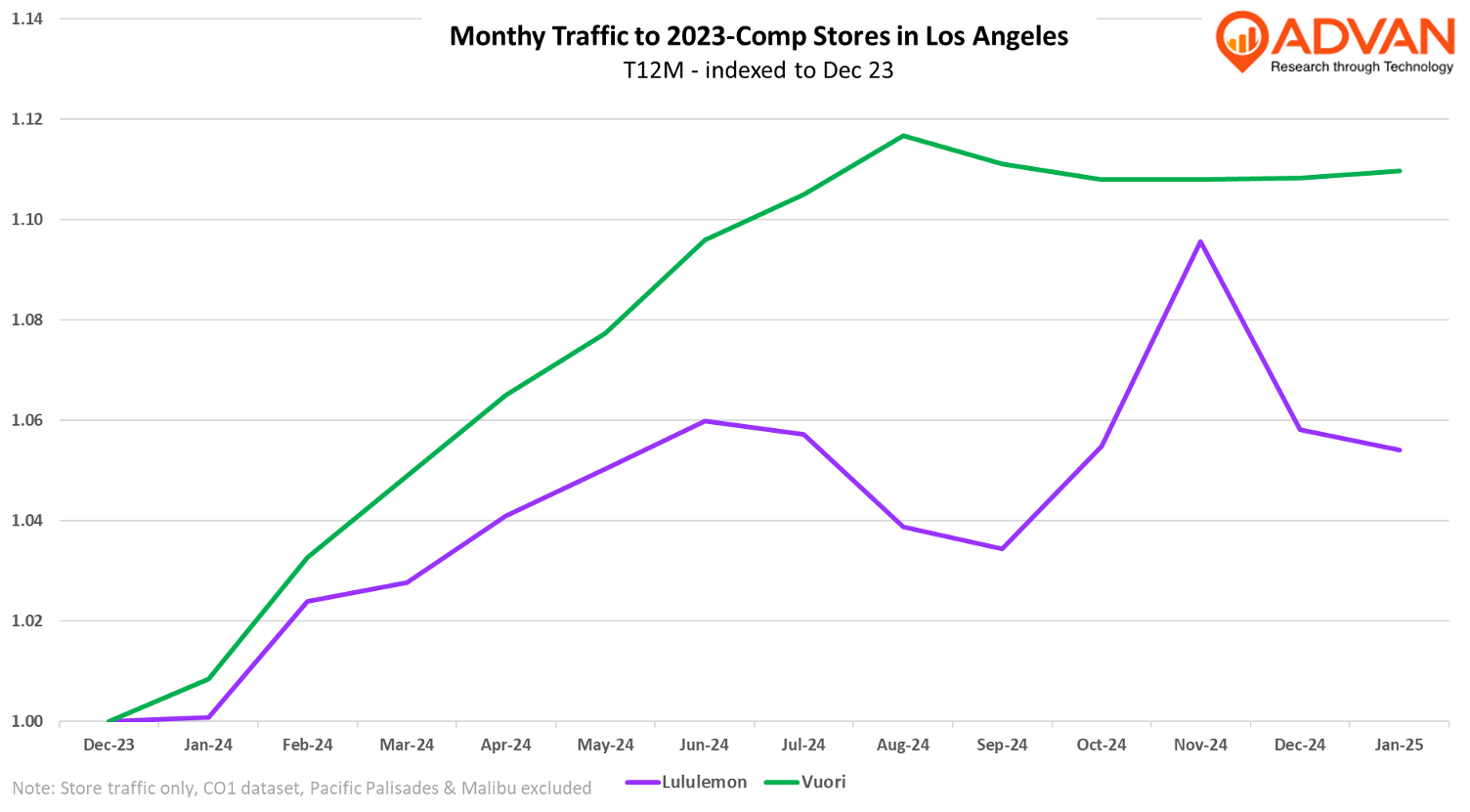

Looking at the competitive dynamic again and focusing on just Lulu and Vuori in the Los Angeles region (large market with lots of influencers), we again see that visitor growth (for geofenced locations) slowed through the 2H 2024 for both brands, as shown in the chart. While Vuori hit 1.1X in January ’25 from December ’23 vs Lulu’s 1.05X, given Lulu’s much larger size, it grew the number of visits by 3.5X Vuori’s growth. And so, we still believe that the issue for Lulu is more “perceptions around value” during this current moment when frugality has sway than Vuori and Alo. Going one level deeper, two of Lulu’s locations in the region are pulling down the average: Valencia and Glendale. The drag for Valencia appears to be the location as the store is outperforming the Valencia Town Center mall, which has been consistently down. For Glendale, that appears to be the store and not the location, as its capture rate of the Glendale Gallery’s traffic peaked in September 2022, and is now 32% below that peak. (We’d have to visit the store for a more precise explanation.) Excluding these two locations, Lulu traffic would be at 1.07X on the chart.

Success in retail is “detail” and “value”. Lulu can’t really do anything about the macro and the current perceptions of what “value” is; however, the first word / challenge is totally in their control. To conclude, we think that Lulu’s softer guidance DOES NOT reflect a change in the consumer and a softening in spending; we think that the environment is largely consistent with the 2H of ’24 as it relates to Lululemon and the category; moreover, their guidance DOES reflect conservatism and factors completely within their control.

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.

LOGIN

LOGIN