- In a difficult industry backdrop, Albertsons Co. is driving stronger traffic and less-bad unit trends by amplifying its loyalty offers and passing less cost inflation on to its shoppers; both of which eat into margin.

- Management doesn’t expect the environment to improve anytime soon, and so, they are doing what they can control – reorganizing, restructuring work streams, and cutting costs to pay for the greater value presented to shoppers, while also contemporizing their services – expanded and fast store delivery (more than half of the quarters digital orders were delivered in 3 hours or less), AI shopping agents, etc.

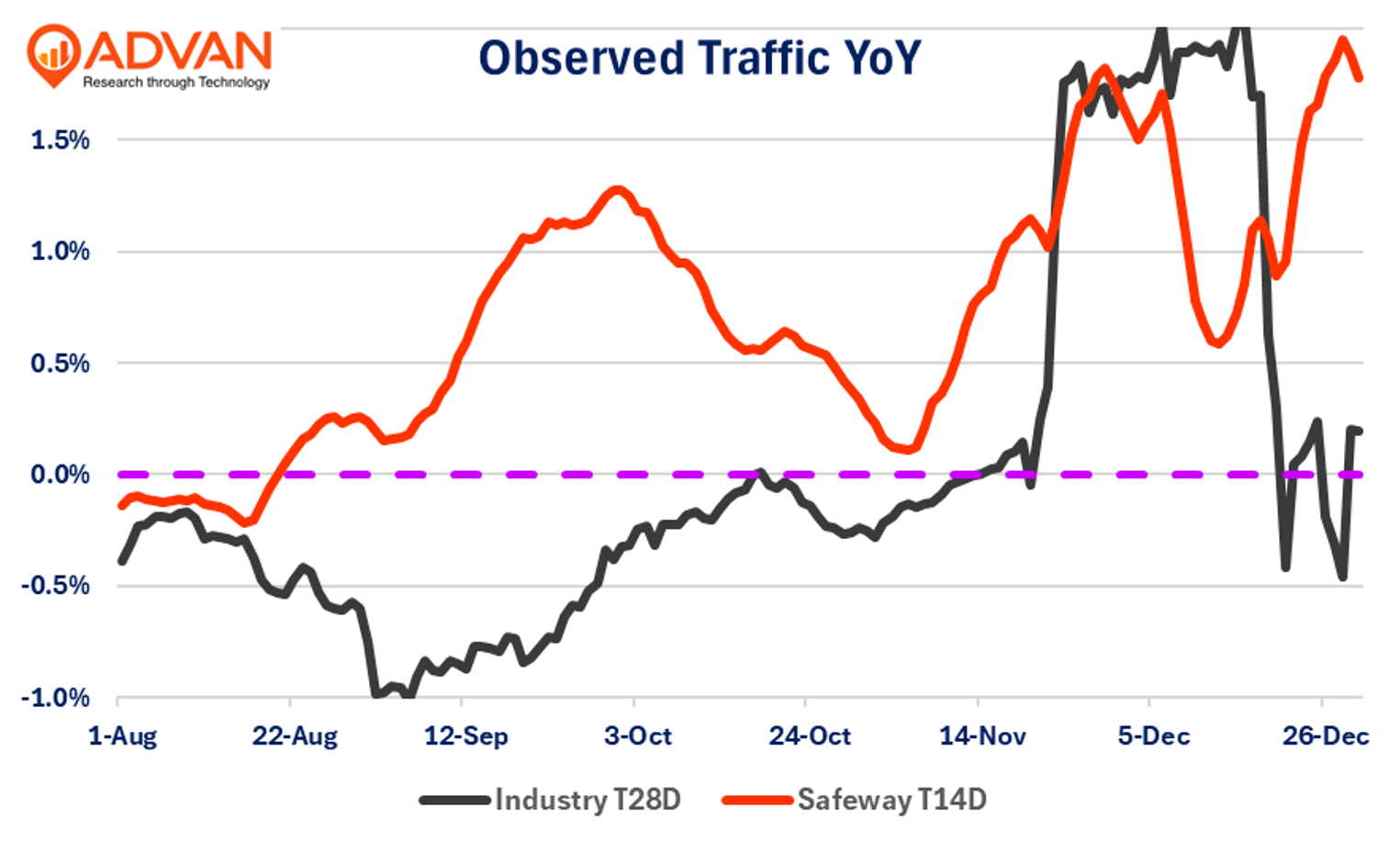

Albertsons fiscal Q3 sales (November-end) comp-sales (+2.4%) were driven by thin margin categories, which combined with price-investments resulted in a -55bps decline in the gross margin rate. The +2.4% represents +$430M in $-sales; the largest drivers were growth in pharmacy sales (+$465M), which was principally GLP-1 drugs, and 3P store delivery + curbside (+$257M). Said differently, inside-the-store grocery $-sales fell -1.9%, -90bps worse QoQ. (Management pegged an impact of -15bps from the government shutdown and delayed SNAP.) For reference, the industry grew at a +3% rate (CB MRTS) during September / October, i.e. Albertsons lost $-share. That said, Safeway (ACI’s largest banner) outperformed the industry in traffic, and so why not also $-s, what gives?

CFO Sharon McCollam, “CPI was up 2% in Q3. We did not pass through 2% and we passed through less than our cost inflation. That’s what you see in the margins.” Observed foot traffic at Safeway was (+0.9%), but observed transaction $-size declined -0.6% (which excludes RX); these figures imply that basket units / volume declined (UPT). The volume decline is due to fewer calories consumed (GLPs), the loss of share in center-store / pantry-load categories to mass / club / value / Amazon, and a more pronounced paycheck cycle. The decline in transaction $-size and gross margin reflect deeper loyalty offers. CEO Susan Morris said, “YoY unit trends improved sequentially versus [last] quarter, reflecting the impact of our surgical price investments… [And] in the divisions where we’ve launched our new lower price campaign, we continue to see fundamentally better unit trends and growth in unit share… Our personalized promotions, our targeted price investments, our own brands innovation, all of these are designed to support unit recovery over time.” i.e. Albertsons views the current environment as a long slog, including for 2026.

On shopper behavior, Morris said, “The environment remains mixed and continues to reflect pressure across income segments. At the low end, the shopper is clearly stretched, putting fewer items in the basket each trip and prioritizing essentials while visiting more frequently as they manage their cash flow. Middle-income households, which have been relatively resilient, are showing some signs of softening with increased price sensitivity and trade-down behavior emerging in certain categories. At the high-end, spending patterns remain largely stable, but even these customers are becoming more conscious of price and value, reflecting a broader shift towards cautious discretionary spending.” (ACI’s pressures from the mid- to high-end is also the shift to club, Walmart, and likely Amazon.)

Loyalty members increased by 1.1M QoQ (+12% YoY); however, that puts grocery sales per member at $1,221 (annualized), representing a -11% YoY decline. However, the loyalty program is more than just offering shoppers more value; it’s also about offering vendors more ways to pay Albertsons. Morris,” Our media collective continues to gain traction as a high-margin growth engine. In Q3, on-site media delivered double-digit growth year-over-year. We also strengthened performance by adding transaction capability to off-site ad units… While the retail media space remains highly competitive, our advantage lies in the depth of our loyalty data and omnichannel reach, which enable targeted measurable campaigns that improve both partner outcomes and the customer experience…” See our last write-up on category trends here and ACI’s prior earnings report .

LOGIN

LOGIN