Growth in all of Amazon’s reported revenue lines accelerated for Q2, save AWS, which held at +17% growth (its 2-year rate improved by +230 bps QoQ). Focusing on just US eCommerce, paid units increased around +12% with sales a couple points less due to lowered prices on general merchandise and a shift in the sales mix to consumables, which generally have a lower average price as well as a lower merchandise margin rate. Reflecting those factors, merchandise margin was -76 bps worse. But despite that headwind, segment operating margin improved from 6.1% to 8.2%, with leverage on every expense line (save merchandise). Management and forward guidance indicated no pause in consumer demand. As such, the US segment should again produce double-digit growth in Q3, along with higher margins.

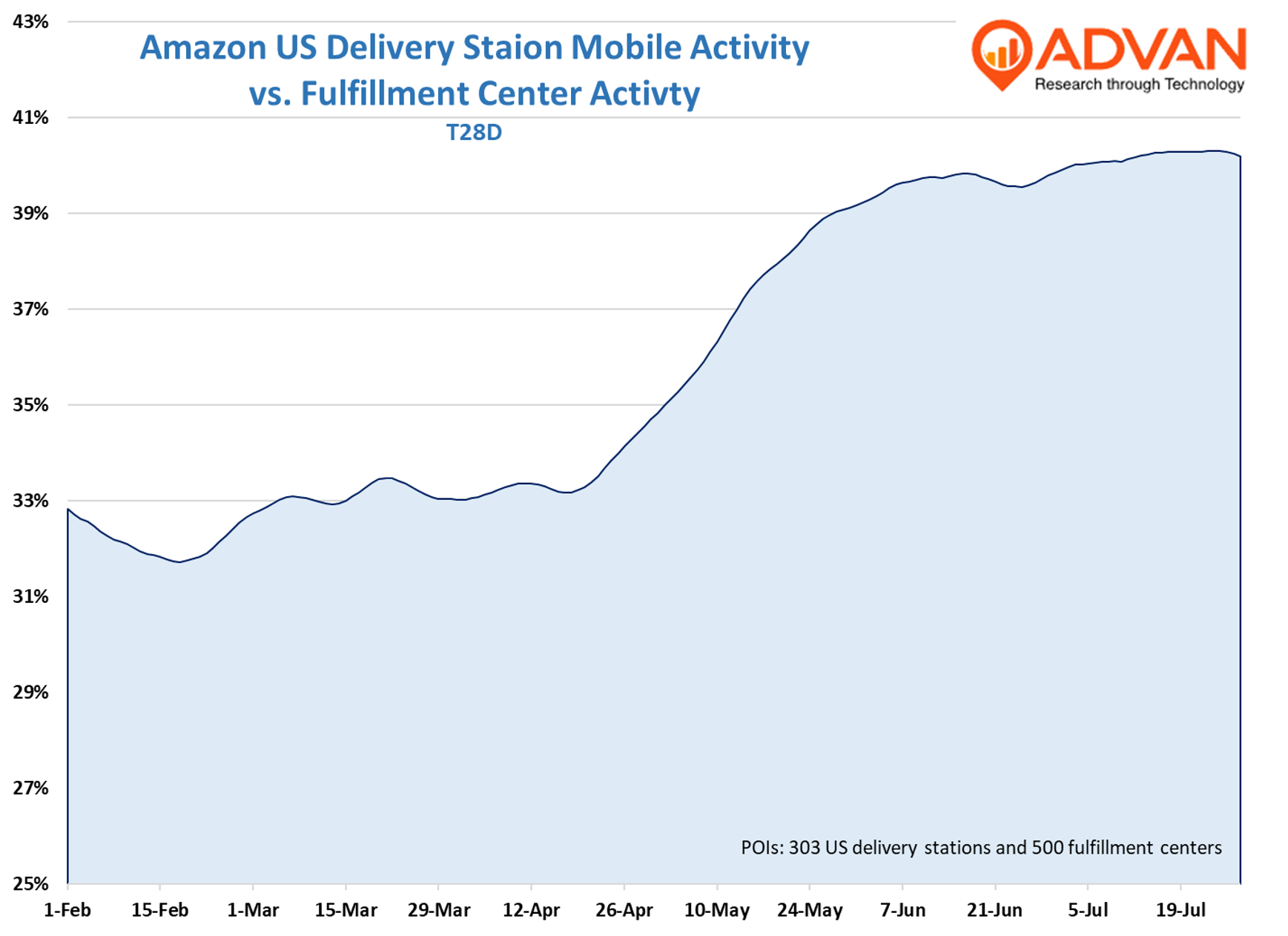

If the US business segment wasn’t burdened with “moonshot” start-up businesses like Project Kuiper, as well as all of the G&A functions for Amazon Inc., the US segment margins would be mid-teens. Two of the largest expense lines are fulfillment and shipping. Shipping expenses increased only 6% YoY, much lower than the unit growth of 12%, leading to a rate improvement of 103 bps (vs. retail sales revenue, or 1P+3P). Fulfillment expense improved by 22 bps. Automation, route optimization, order frequency, etc. all help drive improvement in these figures. Additionally, inventory placement through using more regional delivery / sortation stations to get closer to the customer continues to be a large contributor, and is shown most clearly in the improvement in shipping expense. Below, we show how this looks in our data, with delivery station geolocation data over fulfillment center data. More automation at the fulfillment centers is also a contributor to reducing the denominator and increasing the ratio.

CEO Andy Jassy shared, “Further improving delivery speed remains a key focus, and we continue to make progress. We’ve previously shared how we rearchitect our U.S. inbound network into a regional structure, allowing us to place inventory and ship from locations closer to customers, improving speed and low run costs. That work is delivering tangible results. In Q2, we increased the share of orders moving through direct lanes where packages go straight from fulfillment to delivery without extra stops by over 40% year-over-year. We’ve also reduced the average distance packages traveled by -12% and lowered handling touches per unit by nearly -15%. We’ve made progress on order consolidation with more products positioned locally, we’re able to pack more items into each box and send fewer packages per order. That has helped drive higher units per box and improved overall cost to serve. Taken together, these improvements are making the network faster and structurally more efficient.”

On automation, Jassy, “Automation and robotics are also important contributors to improving cost efficiencies and driving better customer experiences over time. We deployed our one millionth robot across our global fulfillment network and unveiled innovations in our last-mile innovation center, such as automated package sorting and a transformative technology that brings packages directly to employees in an ergonomic height.”

As it relates to sales mix and its push into consumables, Jassy stated, “And we started expanding our very successful perishables pilot, where we offer customers perishables as a point of purchase when they’re ordering other items that will be delivered same day from our same-day fulfillment nodes. We’re seeing strong customer adoption as 75% of customers who viewed as service this year are first-time shoppers for perishables on Amazon, with 20% of customers who use the service returning multiple times within their first month. Our prices continue to be low and sharp for customers. It’s one of the reasons our everyday essentials growth outpaced the rest of the business globally and representing one out of every three units sold. (We’ve previously shared how this expansion into everyday essentials is a large headwind for Target and the drug channel. This is such a large channel shift that it’s frequently called out in quarterly results as a material impact to businesses as large as Procter & Gamble and L’Oréal.)

Success in everyday essentials demands faster delivery, Jassy, “We’ve also set another global speed record in Q2 delivering to prime members at our fastest speeds ever. In the U.S., we delivered 30% more items same day or next day than during the same period of last year. Items customers used to pick up locally and nearby physical stores are now arriving at their door often within hours. And we’re working to further improve delivery speeds no matter where customers live, we’ve recently announced plans to expand our same-day and next-day delivery to tens of millions of U.S. customers and more than 4,000 smaller cities, towns and rural communities by the end of the year. Today, it’s already available in more than 1,000 of these communities across the U.S. The early response from customers in these areas have been very positive. They’re shopping more frequently and purchasing household essentials and meaningfully higher rates.”

LOGIN

LOGIN