Thomas Paulson

Thomas has been Head of Market Insights for Advan Research

since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at AllianceBernstein, Cornerstone, and others.

Walmart’s FQ4 – A different business now (and a new sheriff)

Walmart again reported strong results for Walmart US and Sam’s Club, with the business model rapidly changing with fast delivery / upgraded merchandise offerings attracting more affluent households and that / retail evolution producing a large profit pool of alternative revenue streams (advertising, etc.) that allows Walmart to lean into EDLP, e and drive more separation from incumbent retail. FQ4 contained a lot of external noise, hurricane comps, government shutdown, a more choiceful lower-end consumer, and yet, Walmart delivered +4.

7 minutes

The Advan Buysider Issue8

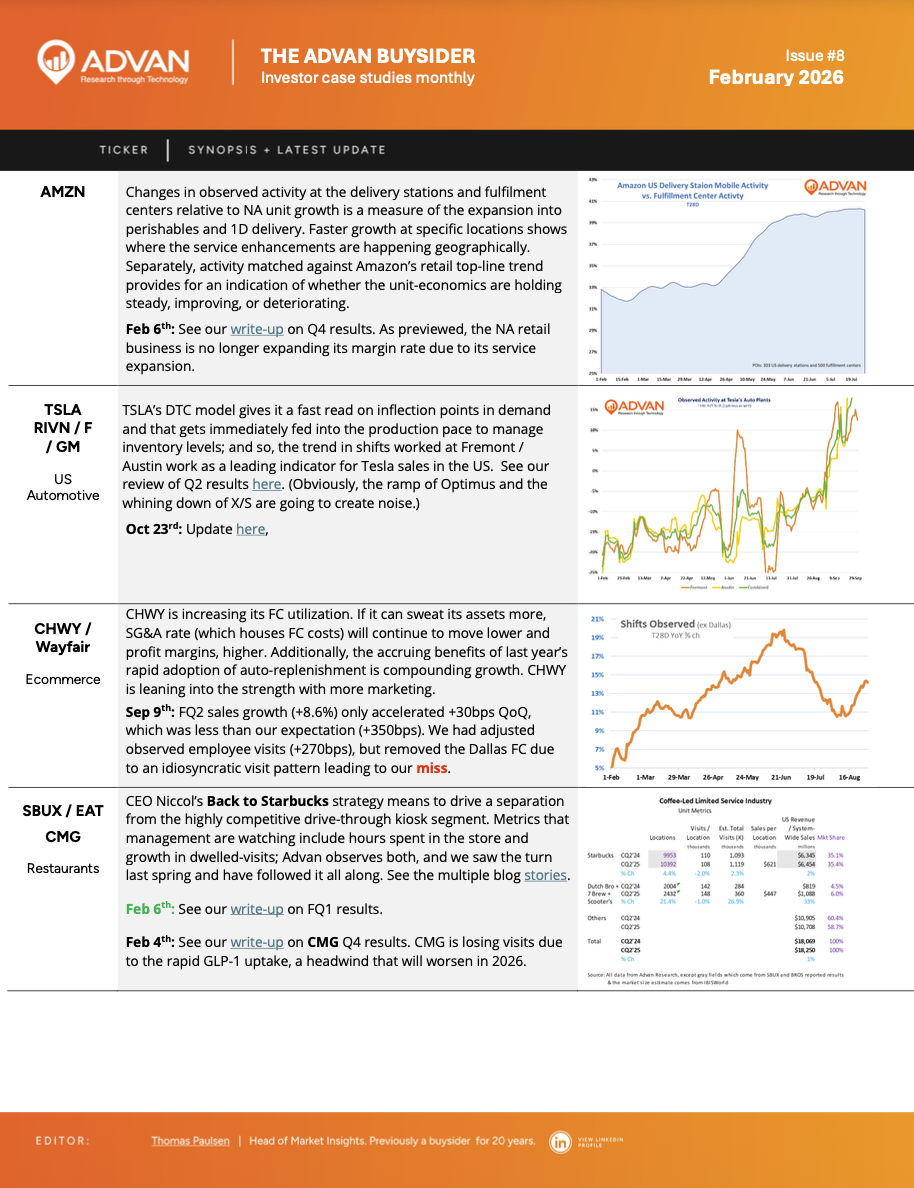

The 8th issue of The Advan Buysider is now available. As a reminder, The Buysider is designed to provide timely, novel, and impactful insights on specific names and topics using Advan’s data. I welcome your feedback. Should you not see names / sectors that are of high interest today, reach out to me. The takeaways from #8:

1) You’ll have noticed that we’ve begun to update on names (some previews, some post-views) between full issues.

One minute

O’Reilly Automotive: A Smooth-Running Machine and Driving Up the East Coast

O’Reilly Auto reported sales trends largely consistent with Q3 trends. Its market share capture in Commercial was again very strong. The DIY side of the business is still soft, reflecting that consumer. That said, vehicles need to be repaired when they break down, and so the volume decline in DIY is reasonably benign. Competition appears rational, given O’Reilly’s strong gross margin performance and despite O’Reilly moving into new East Coast markets; they win durable market share by out-serving the competition.

5 minutes

Amazon’s Q4: If you build it, will they come? Maybe if you deliver it

Amazon’s in-line results were marked by management signaling that the company was entering another large multi-faceted investment cycle and that the P&L efficiencies that the retail business has enjoyed over the past two years has come to a close. Amazon’s grocery business gained meaningful market share in 2025. Share gains will continue in 2026 and Amazon expects to open 100 new Whole Foods locations in the coming years. This added competitive intensity will further pressure conventional grocers and survival will be dependent on the incumbents delivering exceptional store locations, standards, and service levels, and differentiated on-target merchandise assortments.

6 minutes

Chipotle’s Sales Deterioration – Increased GLP-1 adoption to blame? Seems so

· Chipotle once again reported soft comp-store sales and guided for more of that in 2026.

· While consumer aversion to Chipotle’s higher menu prices may be one factor for the deterioration in sales growth, Advan’s data and Chipotle’s actions (in terms of menu innovation) suggest that the rapid update of GLP-1 drugs by more affluent households (which Chipotle’s out-indexes in) looks to be the larger driver, i.e. changing consumer needs in how much and what they want to eat.

3 minutes

Previewing January Retail Sales (and FQ4 Results): Walmart, Target, Ross, Dick’s, and US Luxury all stronger

January retail sales should be strong when they are reported. Broadly speaking, the retailers that were strong in FQ3 and for the holidays, continued to do well in January. Target is an exception with stronger observed results for FQ4 vs. FQ3, by contrast, Best Buy is worse. Within the context that January is a light month for retail, and often a payback period following ebullient holiday periods (see our review here ), we often make light of the month.

3 minutes

LOGIN

LOGIN