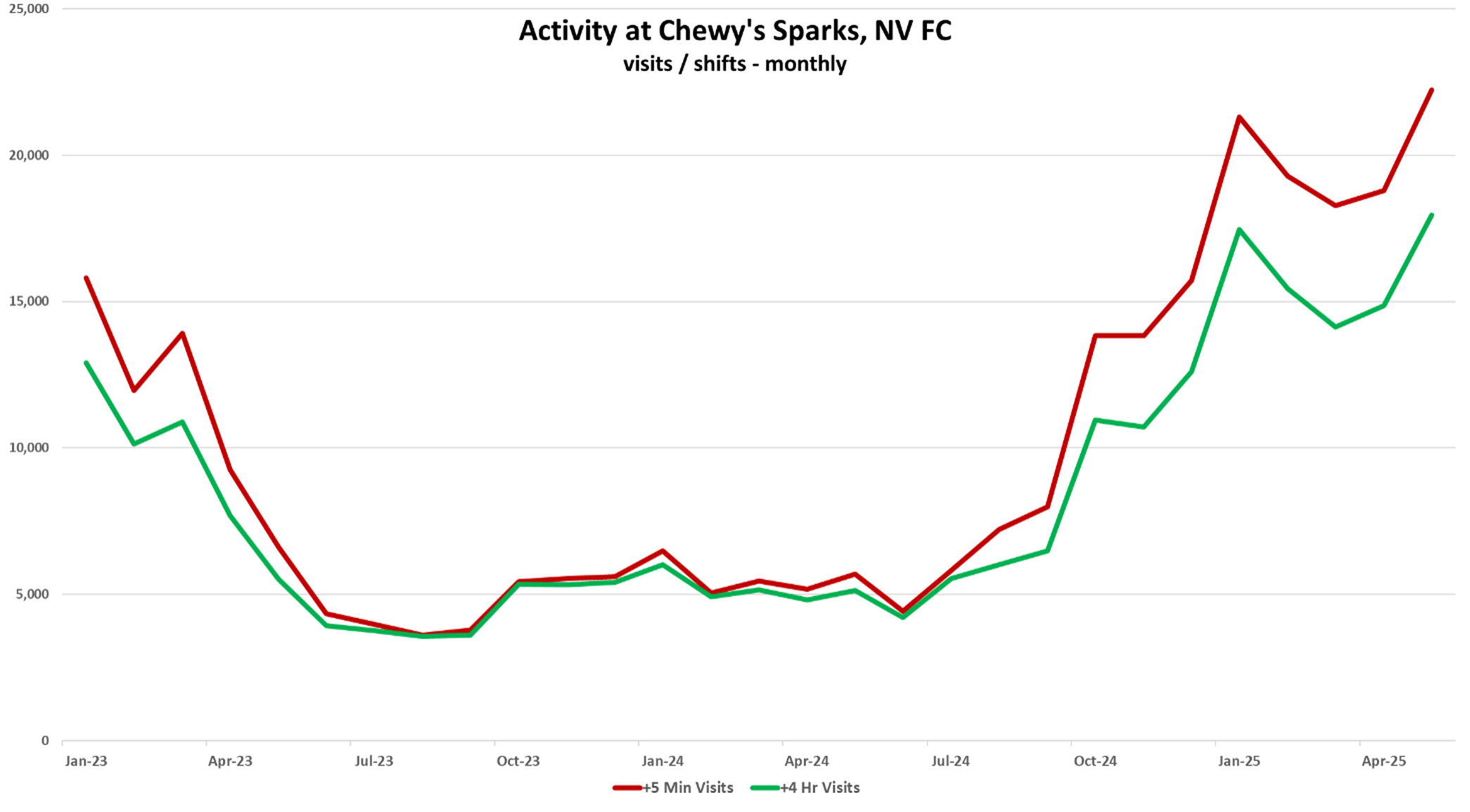

Last week, one of our Advan Buysider names, Chewy , reported fiscal Q1 results, which once again demonstrated improving business momentum and unit economics. As a reminder, Chewy’s market share growth is accelerating due to the accruing benefit of more and more Autoship customers. (That share gain, plus Amazon’s, is further depressing foot traffic to pet specialty retailers.) Chewy’s higher volume in turn is allowing it to improve its fulfillment center (FC) utilization; this is key to improving its unit economics as they stood up too much capacity during the 2020 / ’21 pet boom, which became a drag on profits when the boom, busted. Chewy reported +8.3% underlying revenue growth, ahead of last quarter’s +7.4% growth and Advan’s forecast* of +8.1% growth. Autoship sales rose +15% to reach (+200 bps QoQ) to reach 82.2% of sales. Sales-per-active-customer increased +4%. Active customers increased +240K QoQ to reach 20.8M. High-margin hardgood sales grew +12%, +300 bps QoQ. That improvement reflects an increased focus on the category’s merchandise and value, the growth in Autoship, and also potentially less competition from Temu . (We also see evidence of less Temu in Chewy’s +30 bps leverage on ad expense in the quarter.) The Chewy+ membership program ($49/year) just launched nationwide, and if successful, customer counts and spend-per-active should accelerate. Leverage on fixed cost (+20bps) pushed EBITDA (ex. SBC) +18% higher, to $193M. For perspective, EBITDA for the year will likely exceed $750M vs. $300M in ’22. Chewy has 16 FCs. Two remain essentially mothballed. It’s FC in Sparks, Nevada was similarly mothballed in mid-’23; however, as shown below, since last fall it has ramped up mightily. As shown, +5-minute visits lead +4-hour visits. Advan takes the +4 hour visit to represent an employee shift worked. As such, the +4 hours is more of a steady underlying indicator that better represents orders packed and shipped relative to the shorter +5-minute visit. (+4-hour visits make up 80%+ of the total visits.) Sparks ramping means that it is being used to service the western region, which means lower shipping expense overall as the region was previously serviced by other distant FCs. Additionally, there is another high-volume FC in Reno, NV. Activity there is steadier (+5%). Sparks, sharing the burden, likely allowed Chewy to add to Reno’s.

On utilization, CEO Sumit Singh said, “Our teams internally are very closely aligned with our partners, both activating more partners as well as more dollars from pocket to be able to apply to these – to the supply that we’re opening up on the website to drive higher utilization rates, right? We’re super pleased with the utilization. And between our partners and us, we’re super transparent and having a really good high-quality conversation on the ROI expected. And so far, we’ve continued to exceed ROI expectations, therefore, pretty nicely balancing the demand and supply side. And then on top of that, you want to put the 1P platform that essentially allows us to flow through a greater portion to our bottom line and improve experience for our suppliers, including greater analytic capability that we didn’t have or may not have had at the same level in the past.” ‘*Maiden Century model

LOGIN

LOGIN