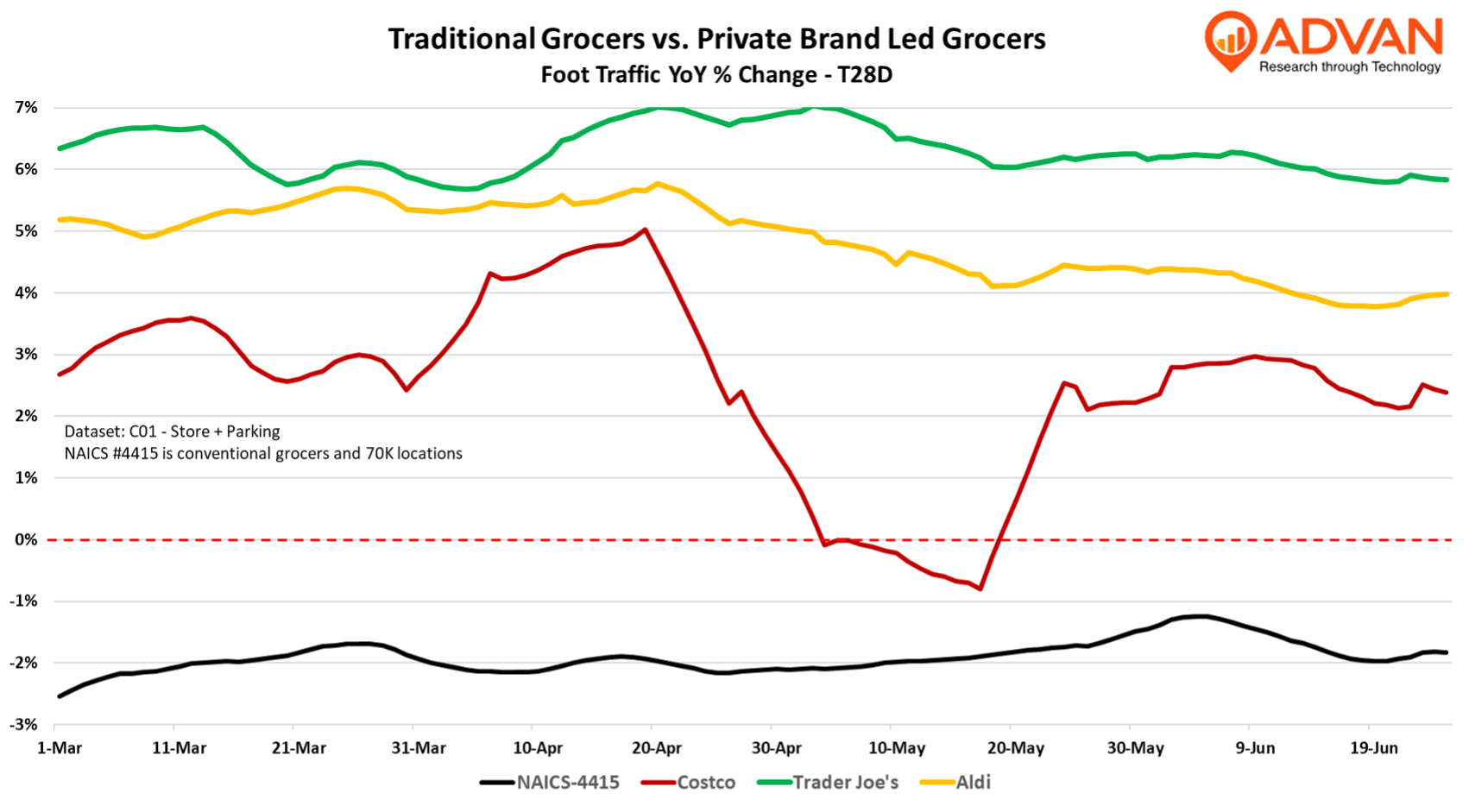

General Mills’ very soft quarterly results, once again, reinforced our viewpoint that category growth for the year, as was the case last year, will be driven by private label and the retailers that excel at it. And so, in addition to scanner data, we recommend watching the foot traffic at Trader Joe’s and Aldi. As the chart shows, traffic for the conventional grocery industry (NAICS-4415) remains in the dumps. By contrast, traffic for TJ’s and Aldi remains robust and very stable. The downswing at Costco is the air pocket following the pull forward ahead of tariffs.

What this means for General Mills, and its peers, is that volume and profits will continue to fall until foot traffic normalizes at conventional grocery. For the three-month period ending May 25th, General Mills’ North America Retail segment volumes fell -1%, price / mix fell -7%, margins declined -500 bps+, and profits declined -30%. Volume is now 9% below pre-pandemic levels. Guidance for the next twelve months was more of the same, with underlying profits expected to be down around -10%. Last quarter’s price / mix component of -7% is the result of lowering prices and given larger discounts to retailers that can move volume (i.e. Costco, Sam’s, and Walmart).

On the results, CEO Jeff Harmening said, “On our first priority of accelerating organic growth, our full year sales trends did not meet our expectations, driven in part by continued value-seeking orientation and weaker consumer sentiment. This was particularly true in our North America Retail segment. As a result, we’ve made important changes to adapt to the evolving consumer environment and put our business on a path back to growth. We reassessed our strategy at the midpoint of the year, pivoting our plans and making the decision to invest in greater value for consumers, narrowing price gaps, and moving below price cliffs on several North America retail businesses. (This is the Costco, etc. comment in the prior paragraph.) We believe that getting our value into the right zone would allow for our product news, innovation and marketing to resonate more clearly for consumers, leading to improved volume and household penetration. Importantly, we expected volume trends to improve first with dollars lagging until we lap the investment in price. And that’s what we saw play out with a significant improvement in North America Retail’s competitiveness in the fourth quarter… And we stabilized household penetration across North America retail for the first time in 3 years.”

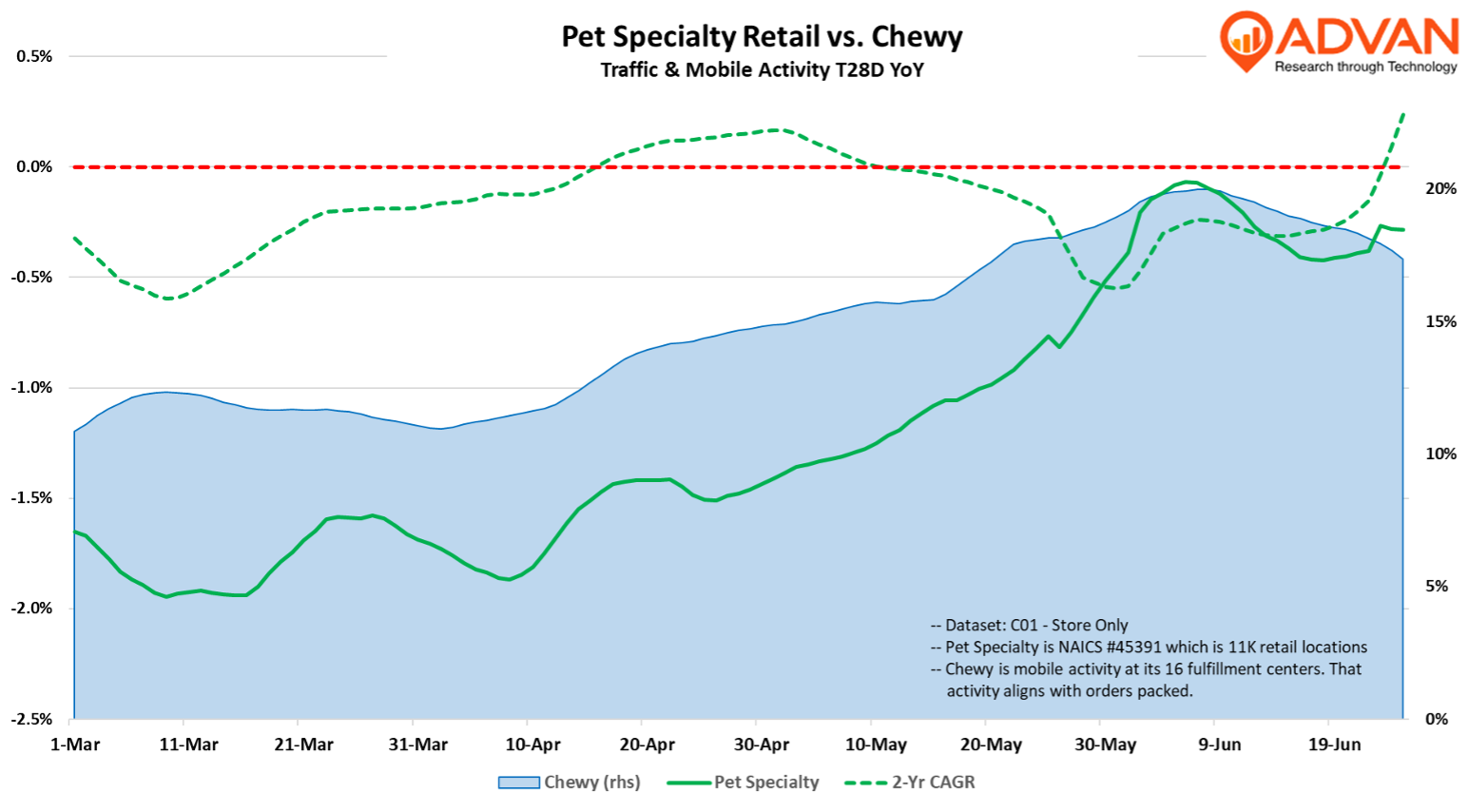

General Mills isn’t just sitting still in the face of persistent traffic and volume declines at traditional grocers. They are adjusting the product portfolio (i.e., divesting Yoplait, expanding the lineup of Cheerios Protein flavors, etc.); they are also leaning more into pet, including launching a fresh version of Blue Buffalo across in the US, which is to be shelved in retailers’ own coolers (vs. Freshpet which installs its own dedicated coolers at retailers). This is a large launch, with a large media plan, and that investment is one of the drivers of next year’s expected company-wide profit decline. Obviously, that investment will be good for spurring traffic to offline pet specialty retailers. (Chewy sells Freshpet, but as it is shipped in dry ice, its prices on fresh are substantially higher than offline retailers.) New product introduction backed by large marketing campaigns that are essentially focused on offline retail is critically needed as Chewy is gaining a lot of share at the moment given the momentum of its AutoShip program, as the chart below demonstrates with orders fulfilled by Chewy up double-digits. That said, it’s nice to see that pet specialty’s trend has improved in May and June.

LOGIN

LOGIN