Given our recent analysis on how extended store hours were driving additional visits to **Sam’s **and Costco, we were interested in what Costco had to say about it on yesterday’s earnings call. CEO Ron Vachris said, “We estimate these incremental hours have added about 1% to weekly U.S. sales since implementation. This has been very well received by our members.” CFO Gary Millerchip shared, “Excluding the membership fee increase and FX, membership income grew 7% year-over-year. This was driven by continued growth in our membership base and increased upgrades from Gold Star to executive membership. At Q4 end, we had 38.7 million paid executive memberships, up 9.3% versus last year… We have recently seen a lift in upgrades in the U.S. after we announced our executive member exclusive ours and other benefits… Almost half of our new member sign-ups are now under the age of 40.“ Given Costco’s large size, that’s a lot of membership growth. With that comes a large amount of market share given that these are more affluent households. As we’ve previously highlighted , the substantial gains by the warehouse clubs over the past three years is one of the largest challenges to **Target **as they are after the same household spending, especially the under-40 households.

Over the past three years, we’ve highlighted that the grocery industry’s (food-at-home in economics’ lingo) would be driven by fresh, private label, and the retailers that excel at it, which obviously includes Costco. For the quarter, shelf-stable food & sundries increased at around +7% (on a comp-sales basis), with Kirkland Signature above that, and fresh categories increased slightly more. We’ve seen no diminution in the trend and expect it to power on into 2026.

What’s changed vs. pre-pandemic is the high rate of inflation and absolute high price level, which is what’s driving new membership and trips into the warehouse channel. Costco (and its peers) turn inventory at a very high rate, as such, they don’t hold inventory for long on the balance sheet / in warehouses and so tariff pass-through will show up first in the warehouse channel. Costco said that for non-foods, it went from deflation to +2%-ish in recent months. Given that dynamic, Costco is changing assortments and leaning into more Kirkland Signature items in non-food. As other retailers sell through their stock-up of pre-tariffed goods, they will likely pass the higher costs through. That, in turn, should drive more households and spending to the warehouse clubs.

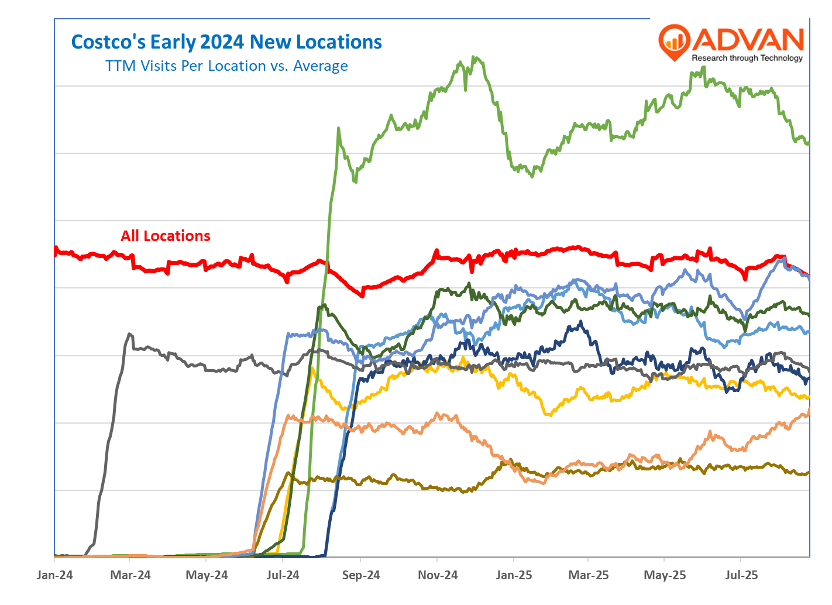

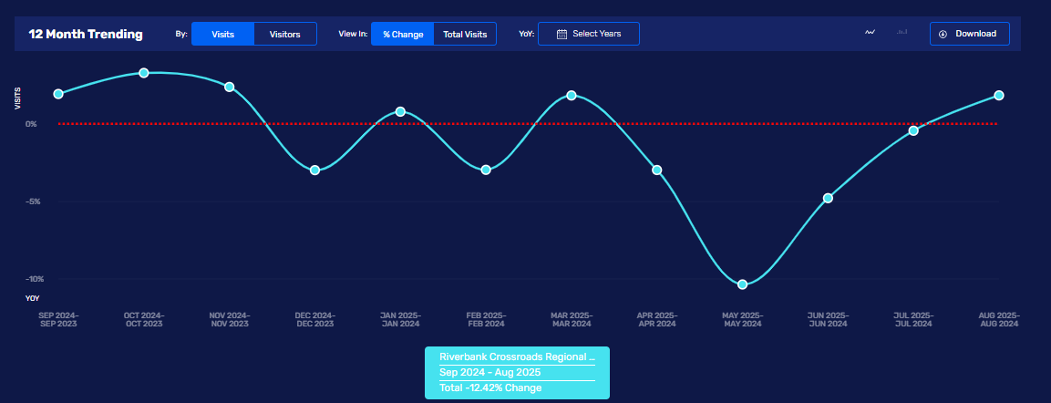

Given the favourable membership and macro trends, management indicated that they will continue to open a consistent number of new clubs, remember that Sam’s is newly expanding in the US. As shown below, new locations open explosively, but they take a number of years to mature. Sometimes, there are very strong new locations like the one at Tomball, TX that opened in July ’24, and Riverbank, CA – June ’24. As the second panel shows, the new Tomball location has put the hurt on the neighbouring Walmart. By contrast, the Target in Riverbank has seen its traffic undiminished.

Walmart

Target

LOGIN

LOGIN