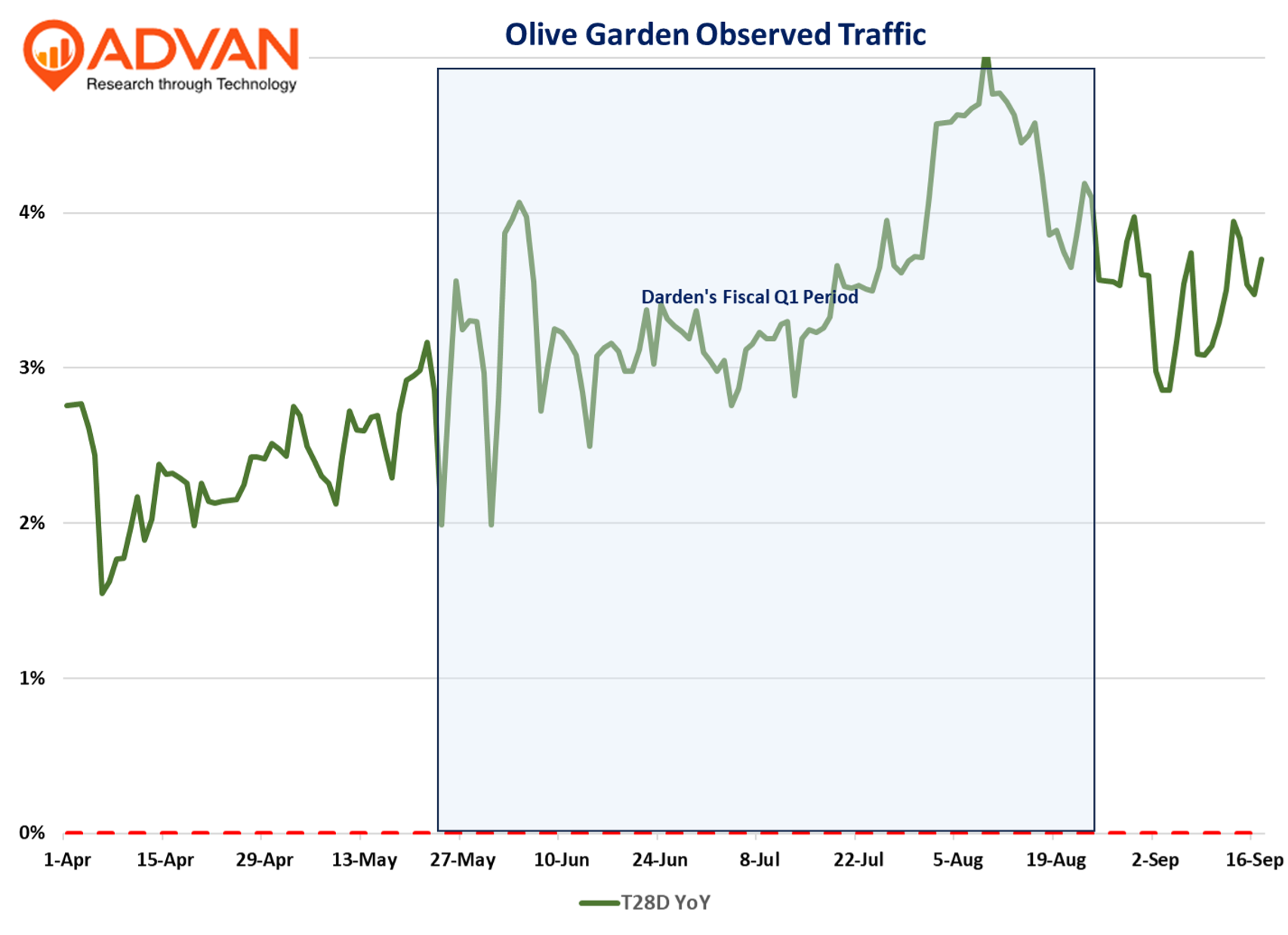

Darden’s fiscal Q1 results were solid, observed traffic (Advan) increased +3.7% at Olive Garden and reported comp-traffic was +3.6% (with catering). Focusing on just Olive Garden, delivery (both the meals and the fees) added around +140bps to comp-sales, and price / mix another +90bps, to make up the +5.9% reported comp-sales increase. Excluding delivery, average check was lifted by pricing, but offset by mix to value offers / portions and less alcohol. Curbside and delivery orders grew strongly, but no figure was shared; it was +20% in the prior quarter. The delivery business was fueled by nationwide availability for the entire quarter (first initiated late 2024).

Traffic slightly built into quarter-end, and has remained at a high level thus far in September. The ongoing strength likely emboldened management to raise its full-year comp-sales outlook by +50bps to approximately 3%. For CQ2, Advan also shows Olive Garden’s dwell time and visit frequency increasing YoY. Olive Garden’s profits at 20.5% were roughly even YoY, despite investments in affordability (pricing less than expense inflation) – more on that in a minute. That favorable margin dynamic in a difficult cost environment reflects its strong top-line growth. On its success in gaining share-of-spend and -stomach, CEO Rick Cardenes said, “[Our] restaurant teams remain focused on being brilliant with the basics through culinary innovation and execution, attentive service and an engaging atmosphere…”

Cardenes – “Delivery through our partnership with Uber Direct is helping capture younger, more affluent guests who value convenience and crave Olive Garden. This represents a significant incremental opportunity for the brand as these guests have a higher check average and typically do not use Olive Garden for an in-restaurant dining occasion. Olive Garden’s advertising featuring one million free deliveries concluded in the first quarter with all the free deliveries being redeemed. Average weekly deliveries doubled throughout the campaign. Following the campaign, delivery order volume has remained approximately 40% above the pre-campaign average…

On our last call, we talked about putting a greater emphasis on sales growth and reinvesting to drive long-term growth. One of the ways we’re doing this at Olive Garden is by strengthening affordability on the menu to give guests more variety at approachable price points. During the quarter, Olive Garden began testing a lighter portion section of the menu, featuring seven of their existing entrees with reduced portions and a reduced price. These items available at dinner and all day during the weekend still offer abundant portions and come with Olive Garden’s Never Ending first course of unlimited breadsticks and unlimited soup or salad.”

The increase in frequency that Advan shows indicates that the value campaign is showing success in repeat visits and frequency counts. Cardenes, “It’s still pretty early. We do believe in the long-run, this is a traffic driver. It will dilute our check a little bit if people trade from a higher portion size item to a lower portion size item. But we believe that’s the portion that those guests want… [E]arly indications are that we’re seeing a little bit more frequency.”

On our focus topic of GLP-1 usage impacting the industry (particularly fast food), Cardenes said, “There are some people on GLP-1s that when you do the research on them, they eat smaller portions or they eat out a little less, but when they eat out, they actually eat out more in casual dining. And so, there is a little bit of that. But I think it’s maybe even a consumer that says, “I’m just trying to be healthier or eat a little less”…” – or exactly in line with our narrative of why it’s more of a headwind to fast food vs. full-service.

For those not closely watching the GLP-1 new product pipeline, Novo Nordisk just released strong drug trial results for an oral format that is expected to see regulatory approval by year’s end. The Wegovy pill (taken daily) helped patients drop 20%+ of their weight. Novo’s chief scientific officer was quoted in the WSJ’s article on the development saying, “Pending FDA approval, ample supply will be available to meet the expected U.S. demand as we hope to set a new treatment benchmark for oral weight loss medications.” The use of the word “ample” is important as the injectables were short in supply when they were first released, a limitation now remedied. The expectation for the oral pill is that it will more than double the market take up from under 2% of obese individuals that meet the conditions for GLP treatment for weight loss. That sets up 2026 as another potentially challenging year for the fast food, snacking, and BevAlc companies.

LOGIN

LOGIN