To say the least, the dollar stores had a difficult 2023 and ’24, and best signified by 99C Only going away and new leadership being appointed at Dollar General, Dollar Tree, Family Dollar, and Five Below. With the new leadership teams, each pivoted to a “back-to-basics” strategy, or as we like to say, “retail is detail.” Well the details are being done right given the strengthening traffic and even better comp-sales results. Comp-sales and comp-transactions are growing faster than comp-traffic due to improved merchandise mix, higher UPT, and improving conversion rate. The macro environment is also improving – back-to-school was especially strong this year, and on the margin, the less-affluent consumer appears to be spending a bit more (part of that is the shift in spending from fast food to food-at-home.) Lastly, the group’s sequential improvement is the result of: one, an easy comparison, and two, “less Temu,” which was a disruptive competitor from late 2023 until 2025.

While we flagged Five Below two weeks ago as having a strong back-to-school season, we are blown away by their fiscal Q2 financial performance; comp-sales increased +12.4%, gross margin rate improved +60bps, and operating income increased +41%. Unfortunately, the outlook was less brilliant due to tariff costs significantly hitting 2H gross margin, especially Q4 (around -240bps). The outsized hit stems from management’s decision to pass little of the costs onto the customer so that Five Below can demonstrate greater relative value. We suspect that they desire to continue fueling the top-line momentum. Added to the profit margin pressure, is the roll-over effect from the increased investments in store service earlier in the year. Underlying SG&A is running about +300 bps faster than revenue growth; however, as we describe below, that investment is creating a lot of top-line lift.

On Five Below’s better the top-line results, recently appointed CEO Winnie Park said, “A few strategies that bolstered our Q2 results were: one, curating relevant WOW! newness in our assortment; two, simplifying our pricing to whole price points, highlighting value; three, improving in-stocks and flow of product throughout our network of stores; and four, initiating marketing campaigns fueled by creator content… The second quarter was about summer fun, be it staycations, or road trips to the beach and lake, we delighted our customers with products to play, live, give, and celebrate. We were pleased to deliver broad-based performance across our world. Our merchant source an amazing assortment of products, including licensed must-haves with exclusive collaborations like the Stitch surf shop. From toys and games to loungewear, handy beauty products, including travel necessities and more, we offer trend-right products that resonate with our customers. In tech, we continue to benefit from better in-stock positions in cables, chargers, and phone cases, perfect at any time of year, but especially for back-to-school.”

Another big surprise in the results, to us, was the comp-transactions increase of +8.7%, +250bps better QoQ. Observed traffic on a comp-store basis (per Advan) appears to have been flat and unchanged from last quarter’s rate. Our analysis of Q2 suggests that there were two drivers to the outperformance – strong e-commerce transactions and a much improved store conversion rate. Reported total transactions, which include new stores, increased +20%, which was much higher than our data’s estimate of +15% – with the only reasonable explanation being strong digital sales, which were the result of a very large increase in social media spend and ROI. As a reminder, the high spending by Temu on TikTok, Instagram, and YouTube had priced Five Below, and others, out of the market. With Temu (and Shein) vacating these platforms, Five Below could now get a large bang for its buck on them, and that bang would preference Five Below’s digital shopping cart vs. its in-store visits. Moreover, given that these platforms’ content creators flock to whatever is trending hot (that’s how they make their money) and trading cards and collectibles were hot during the quarter, which means that creators’ attention and creativity were concentrated on Five Below’s sweet spot.

In Q1 and more so in Q2, Five Below moved a lot of ad spend to creators and social. We don’t have Five Below’s underlying ad campaign data, but the shift in spend would be the increased dollars allocated, but also added volume that resulted from a lower cost-per-action given the absence of Temu. Assuming that the $-spending on social increased by 50%, and the cost-per-action was 25% of last year’s figure, that could produce a 6-fold increase in leads from these social platforms. Estimates are that e-commerce was around 12% of Five Below’s total revenue in ’24, and so, it seems plausible that a 6-fold increase in relevant social leads could lift comp-transactions and comp-sales by 5 ppts.

In terms of the impact from improved conversion rate and looking at just the stores, the 15% increase in store transactions less the lift from new stores (11%), implies a 400bps lift to comp-transactions. The 400bps figure, while large, also seems reasonable given the strong management commentary about the benefits from improved store service / in-stock levels and the overall consumer mood in discretionary. Chief Operating Officer Ken Bull said, “Inside that transaction number, conversions was a big driver this year on a year-over-year basis.”

Management implied that price and tariff flow-through was limited. As such, the +3.4% increase in comp-ticket was both UPT and AUR. The increase in UPT and corresponds to the +3.8% increase in dwell time (Advan data). The improvement in dwell time, likely benefitted the conversion rate as well. When describing the result, management strongly highlighted a better store experience – both service levels and in-stocks, and that shows up in a higher UPT. As we’ve stated before, improvements in UPTs and conversion rate typically precede improvements in comp-traffic, and so that’s what to look for in the next two quarters’ results.

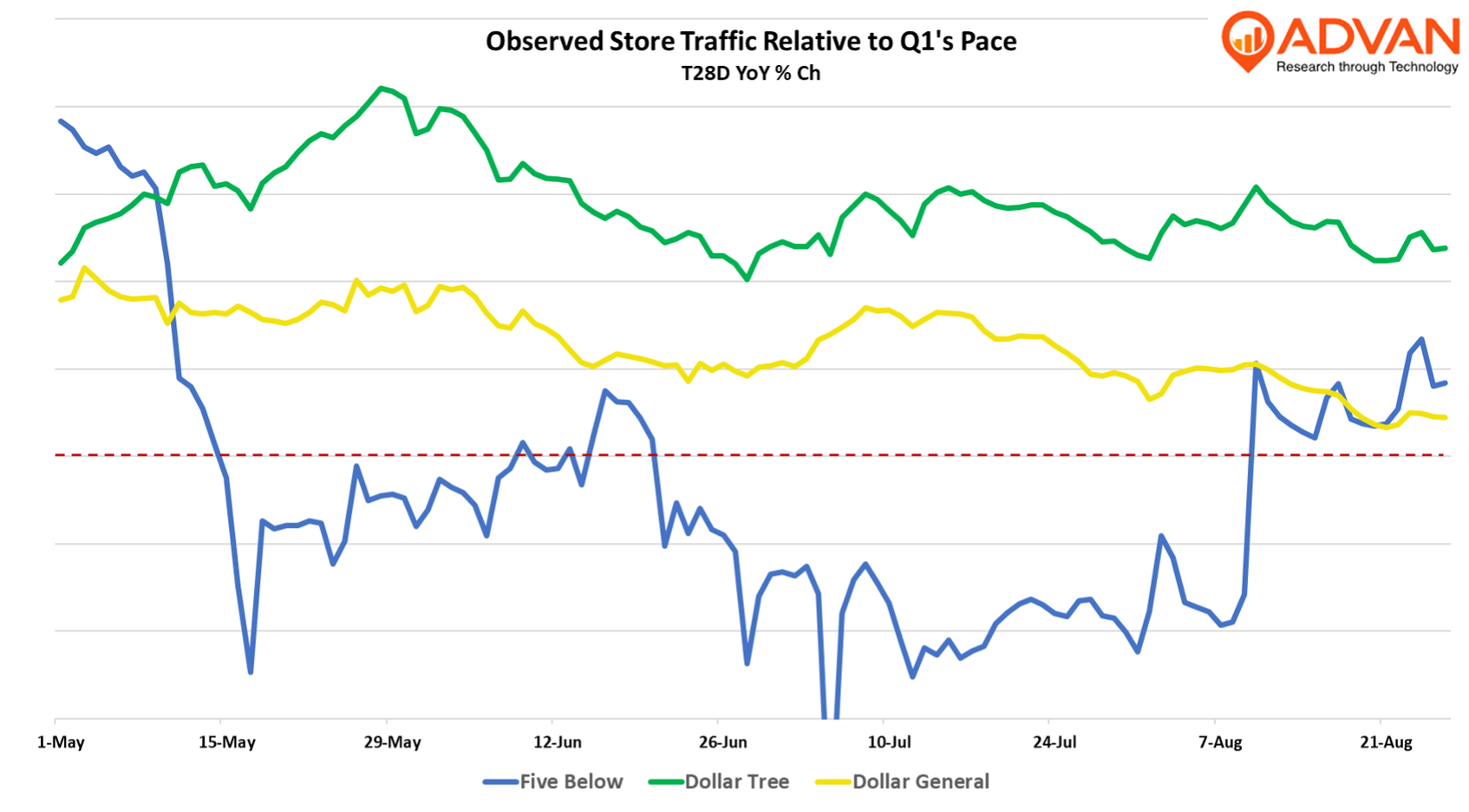

In terms of observed traffic and the quarterly cadence, as the chart below illustrates, the front of the quarter and back-to-school were the strongest for Five Below. However, by comparison, Dollar Tree and Dollar General drove a stronger improvement in observed store traffic relative to fiscal Q1. The sales mix for Dollar Tree and Dollar General is substantially more consumables and that drives traffic. As such, swings in conversion rate are minimal to store comp-transactions. That said, we think that improved digital results (vis-à-vis Uber and DoorDash) was material (+50bps) to Dollar General’s improved comp-transactions (+180bps), a larger lift than Dollar General’s observed transactions of +130bps QoQ.

Many of the drivers to Five Below’s strong comp were idiosyncratic and large, which on a relative basis is why Dollar General reported only a +2.8% increase in comp-sales, which was only marginally above last quarter’s +2.4%. Moreover, the 2- and 3-year comp CAGRs deteriorated (vs. a 200bps QoQ improvement for Five Below). That said, all four of Dollar General’s merchandise comp-ed above +2.5% – the best breadth seen in some time. Where Dollar General really outperformed was in gross margin rate; on a total sales increase of +5.1%, cost of sales increased only +3.0%, yielding 137bps of gross margin expansion (108bps resulting from less shrink). CEO Todd Vasos, was quoted in the release saying, “Our improved execution, along with our progress advancing key initiatives, is resonating with both existing and new customers as we further enhance our value and convenience proposition…To that end, we’re pleased to see growth with customers across all income brackets during the quarter. This includes our core customer who increased spending despite worsening sentiment. In addition, we continue to see trade-in growth with middle- and higher-income customers during the quarter, which we believe is contributing to the nice performance we’ve seen in our non-consumable categories.”

Dollar General’s average ticket increased +1.2% with approximately half of the gain attributable to UPT and half average unit retail (AUR). This is the second quarter in a row that Dollar General reported gains in UPT, and so, we were not surprised by the improvement in traffic this quarter. Given that over 80% of its sales mix is consumables and inflation in that category is 2.0%+, that AUR only increased by 0.6% demonstrates the extent that Dollar General is “enhancing” its value. On tariffs, Vasos said, “With the rates currently in place, we believe we will be able to mitigate the vast majority of the impact on our cost of goods. The proactive approach of our sourcing team, coupled with our relatively low direct import exposure has positioned us well to serve our customers with a quality assortment at tremendous value. While the landscape remains dynamic, tariffs have begun to result in some price increases, and we will continue to work to minimize them as much as possible.”

On back-to-basics, Vasos said, “A lot of the work that we did on Back to Basics has served us well and quite frankly, has set us up nicely for that trade in consumer, as that trading consumer came into the brand over the last few quarters, they’ve seen a better store, both from cleanliness in stock as well as friendly as well as having somebody at the front end to meet and greet them…. I would tell you that as I look at the composition, as I mentioned earlier, being pretty balanced between consumables and non-consumables that the work the team has done on the merchandising side on our non-consumable business has been phenomenal. All these brand partnerships that we’ve been talking about along with great execution at store level and the flow of freight from our distribution centers has all been very, very good to deliver that outsized comp that we saw in our non-consumable businesses… Right now, as we look at the back half of the year, our value proposition is as strong as ever. Matter of fact, we’ve got our $1 SKUs for the seasonal piece for the back half of the year. 25% of the offering is at $1 or less. So even in the face of tariffs, we’ve been able to maintain a $1 price point in our seasonal offering, which should resonate with the consumer. Matter of fact, 70% of the total offering is at $3 or less.” We expect Dollar Tree to have a similar message when it reports fiscal Q2 results next week, but as the above chart implies, we expect a stronger QoQ improvement in comp-transactions.

LOGIN

LOGIN