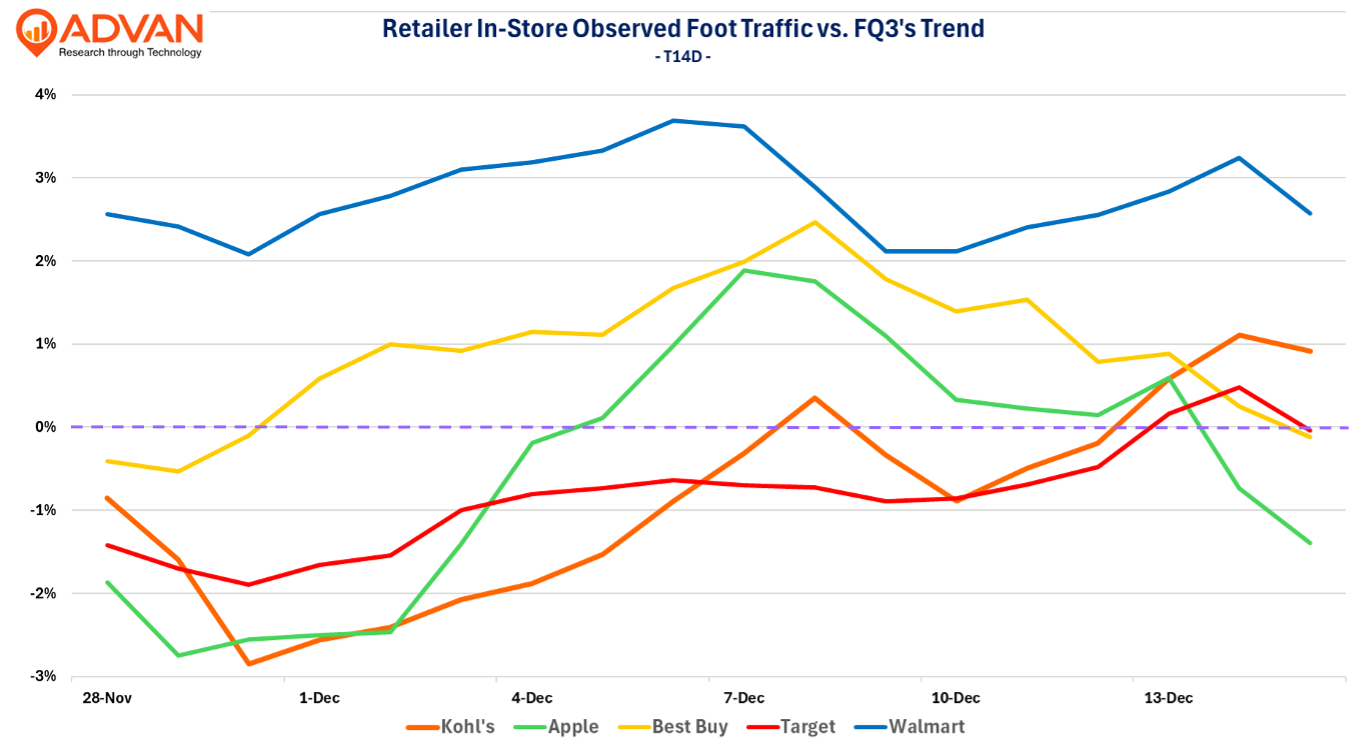

- The positive trend in foot traffic has held since Black Friday Weekend. Amazon, Walmart, Five Below, and Ross Stores have continued to outperform in traffic and spend. Best Buy, Target, and traditional department stores are trailing their FQ3 performance.

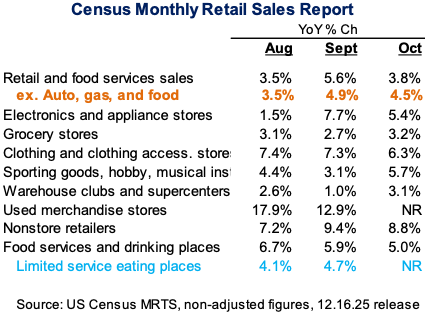

- The October monthly retail sales from Census report (today) reinforces that trends that have been underway all year continue, i.e. no new trends or inflections shown in the report.

The season-to-date pace of foot traffic and sales have been solid for Five Below, sporting goods, Walmart, Apple, but more neutral for Target and the department stores – including Dillard’s and Bloomingdale’s, both of which had strong FQ3 results. (See our review of Black Friday Weekend.). Amazon continues to produce double-digit sales volume growth. We see three patterns in the data:

- Excluding sporting goods and Five Below, observed the trend in foot traffic is stronger than spend – suggesting shoppers are hunting for deals, implying smaller $-basket sizes. Sporting goods is an exception to this with basket size is meaningfully outpacing traffic and FQ3’s trend. Five Below’s spend trend matches FQ3’s (see our review ). The relative spend trend at Apple is healthy, but less than the prior three months given the significant excitement around its new product launches in September.

- Off-price’s traffic trend has modestly softened, but spending has not, suggesting a bit more improvement in $-basket size; a stronger basket size also drove FQ3 comp-sales.

- As we’ve seen in the past, when consumers are stressed, they shop for deals and closer to need. As such, we are not surprised by the trend slowing post Black Friday and we expect it to firm up over the next week.

The Census Bureau released its monthly retail sales report for October. Based upon the trends shared above, and on our blog stories , we expect November to show another strong month when its released in a few weeks. What stood out to us in October’s report was:

- Core retail sales (the orange figures) growth was once again robust at +4.5%. Some of the increase is from tariff cost pass-through; however, volume will still have been positive and in the +2-2.5% range.

- In electronic stores, September+October’s stronger growth is Apple’s new products.

- The growth in clothing & clothing accessories stores is remarkable; that stems from new wardrobes to fit newly slimmed down figures due to rapid uptake of weight loss (GLP-1s) drugs.

- The ongoing strength in used merchandise stores i.e. secondhand or thrift stores is even more remarkable and that reflects less-affluent households finding ways to get the goods that they need at cheaper prices. And,

- Limited-service growing slower than food service & drinking places, implies that full-service is outperforming in the category. That outperformance reflects households still valuing going out to celebrate special occasions, as well as the spending boom by the more-affluent (a frequent blog topic).

LOGIN

LOGIN