This week brought a lot of news about Aldi’s expansion, including 200 new locations by year-end, half from new openings and half from converting the acquired Winn-Dixie stores. Next year is to bring another round of new openings and around 120 Winn-Dixie / Harvey conversions. Florida is winning / experiencing the most with 50 (mostly conversions), giving residents a greater selection of strong grocers to choose from. As of August, Aldi had 268 locations in Florida, with Orlando its biggest market at 70 locations. Aldi’s largest incumbents in Florida are Walmart and Publix. Given that we’ve recently written positive stories about these two (Walmar t and Publix ), we thought to explore how they are doing in Orlando. Walmart has 81 locations in the region and a $5.0B business (per Advan data); Publix has 186 locations and a $5.4B business (Advan). Instinctively, we guessed that Aldi would be taking share from both Walmart and Publix due to its strong combination of low prices and shopping convenience; however, that instinct was wrong. Based upon our data and analysis, in Orlando, both brands are holding up well and slightly outperforming Aldi on a comp-sales basis. Moreover, both have a higher shopper frequency than Aldi; so much for the assumed convenience advantage, especially as it relates to Walmart.

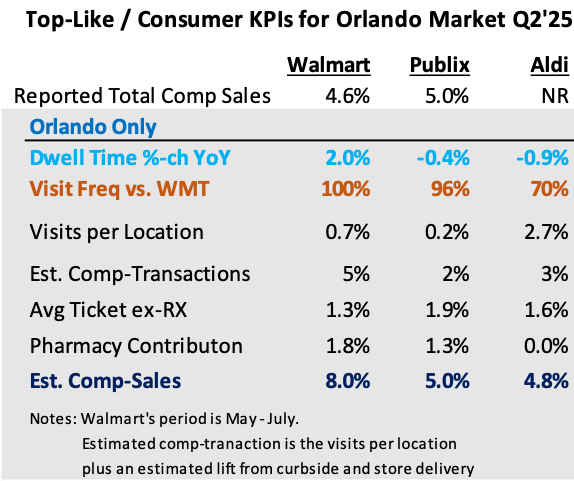

As shown in the table, all three brands are growing traffic in Orlando; however, Walmart leads in comp-transactions, which stems from store-delivery, curbside, and its recently contemporized offering (always a topic of our reports on the brand). Interestingly, Publix’s Orlando visits per location is 150bps better than the chainwide average. (Why? Is for another story.) Advan’s transaction data for Publix points to a +1.9% increase in average ticket, which is right in line with the PCE. Added to these comp-drivers would be pharmacy, especially GLP-1 drugs, which add around 100 to 150bps to the comp, for a +5-5.5% comp-sales increase. We estimate that Aldi’s Orlando comp-store increase is in the range of +4.8%. Walmart’s increase in its Orlando dwell time is also impressive and that implies that units per transaction (UPT) increased a like amount. For fiscal Q2, Walmart reported an increase in average transaction amount of +3.1%, with pharmacy / GLP-1 being roughly +180bs of the increase. Applying the transaction contribution to the Orlando business takes Walmart’s comp-sales figure to +8%, well above Aldi’s.

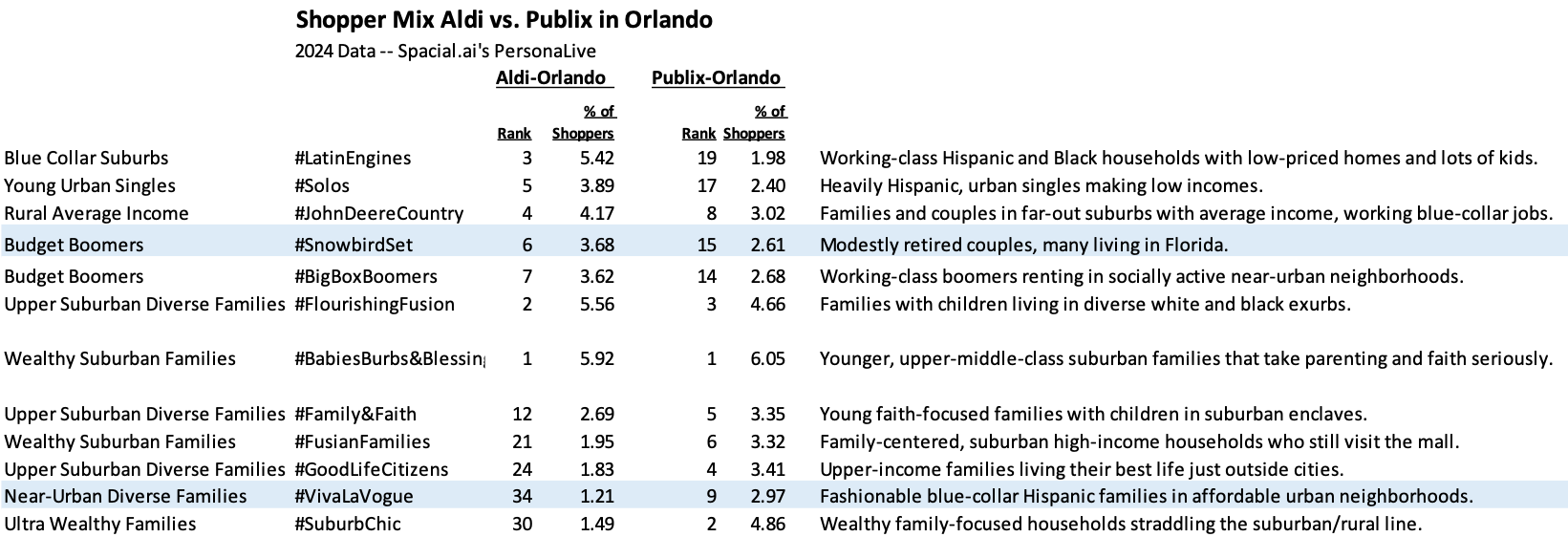

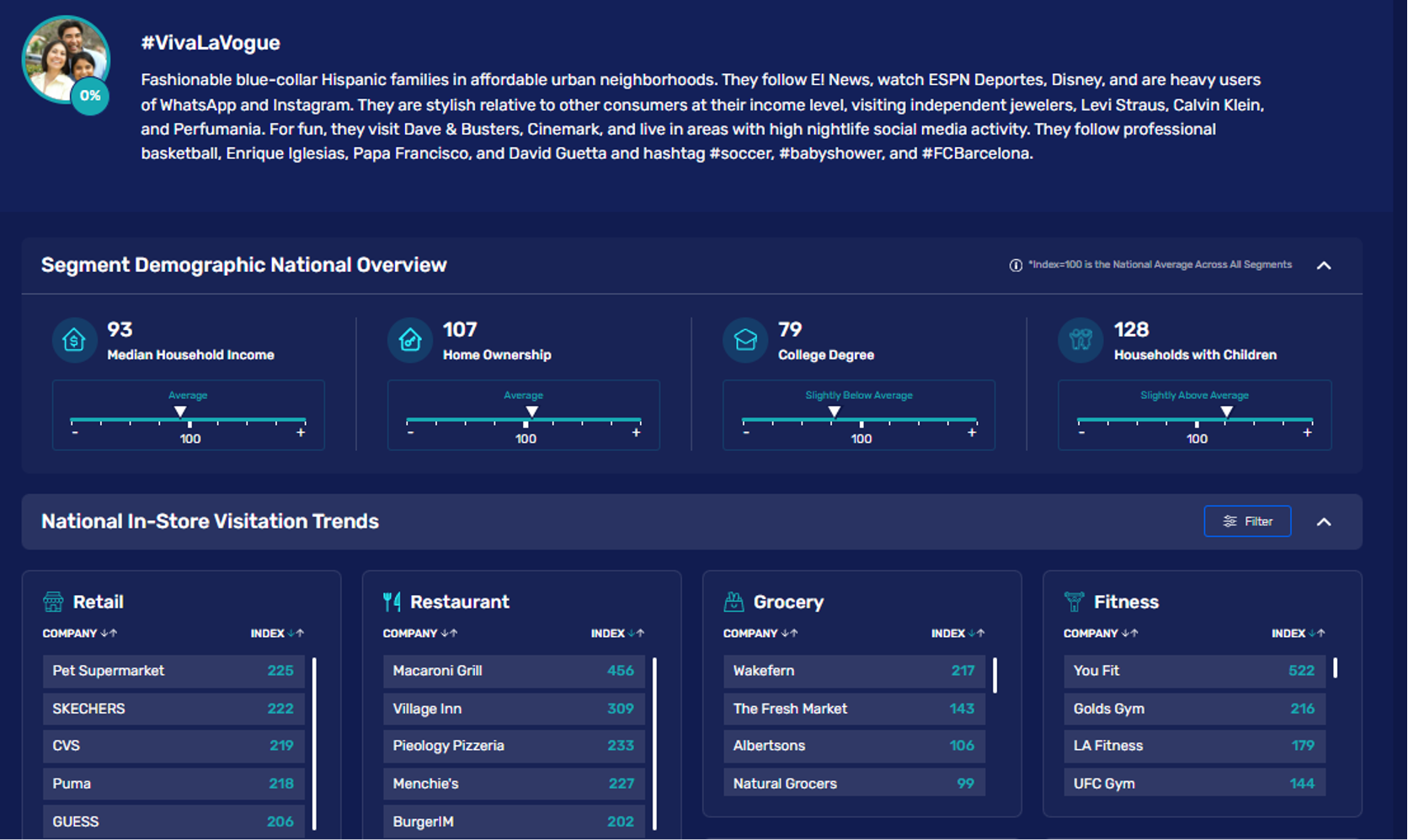

We next compare the Aldi Orlando customer to the Publix Orlando customer. (We are leaving Walmart out as there is a significant shift to store-delivery, which our data doesn’t capture.) Not unexpectedly, the Publix customer is more affluent than Aldi’s (nearly +20%) and they shop Publix more frequently. Aldi functions, on a relative basis, more as a stock-up trip. As a result, despite a less affluent shopper, its average transaction amount is only $1 less than Publix’s $49.50 (per Advan data). The table below shows the customer clusters. Unsurprisingly, the shopper mix for Aldi has a lot of moderate-income clusters and customers; whereas, Publix has a lot of affluent clusters. Interestingly, the number #1 cluster for both is BabiesBurbs&Blessings. PersonaLive’s full description of this cluster is displayed. That SnowbirdSet does so well for Aldi likely stems from these customers having shopped (ing) Aldi in their home markets and now bringing that loyalty to Orlando. Publix success with the VivaLaVogue cluster suggests that its stems from this segment being “foodies” with a strong desire to shop high-quality and organic fresh produce (our we read into their grocery preferences). To conclude, Yes!, Aldi is a significant competitive threat to incumbent grocers; however, here we’ve identified examples of established brands with large businesses that have outperformed Aldi in-market. As such, Orlando is a market to examine on the ground for the deeper and nuanced how. Relatedly, we’ve all read this week’s Kroger news that it’s restructuring its corporate layer (on top of two earlier layoffs) with the savings from -1K corporate job cuts (call it savings of $100M) to be reinvested into lower prices, added store labor hours / service levels, and new locations. Without question, the move is in response to the strong market share gains by the club channel, Amazon, Walmart, Publix, and value / specialty brands like Aldi, Trader Joe’s, and Sprouts .

LOGIN

LOGIN