Finally! Housing-related retail categories are experiencing some wind in their sales. Two weeks ago, we wrote about mattress and furniture retail reporting on better demand, which we took to be more of a backwards look than a forward look with the reasoning be that it was due to tariff pull forward; however, with Home Depot and **Lowe’s **reporting excellent sales results in July and observed traffic (Advan) in August looking especially robust (+5% YoY MTD), we are going to modify our earlier viewpoint to say that the macro and demand is now improving for housing-related retail. Additionally, last Friday we wrote a piece on July retail sales and back-to-school, where we noted that the Census Bureau’s monthly retail sales report showed a degradation in growth in July for home improvement & garden retailers (NAICS code 444). Census reported that this category deteriorated from a -0.3% sales decrease in June (seasonally adjusted) to a -2.6% in July, or 130bps worse. However, Home Depot reported a +3.3% US comp-sales increase for July, up +280bps MoM and Lowe’s a +4.7% increase, up +440bps. And so, the largest two retailers in the category (25% market share) reported meaningfully better results in July, not worse. Observed traffic (per Advan) improved +80bps MoM. Added to this is positive average ticket, especially for Lowe’s per Advan’s transaction data. The better ticket reflects better sales trends for better and best items, higher appliance sales, and more large home improvement projects. As such, Census’ statistics are not matching ground-truth measurements. Thus, the growing importance of high-fidelity and low-latency alternative data measurements.

Looking at larger ticket, Home Depot reported a comp-sales +2.6% increase (+230bps QoQ) in transactions above $1000 in size. Similarly, Lowe’s reported a +3.6% comp-sales increase (+230bps QoQ) in transactions above $500. Home Depot looks to have outperformed Lowes in storage, electrical, bath, and kitchen, the last two really aligned with big-ticket. Lowe’s outperformed Home Depot in paint and flooring, the last also aligned with big-ticket. Both companies spoke about a much better balance between categories, with more of them growing, and balance between Pro and DIY, and across geographies. Again, a better balance indicates the market is healing and the outlook has improved. Home Depot’s Chief Merchant Billy Bastek said, “We saw continued momentum in the underlying demand across home improvement-related projects, and outperformance was the strongest it has been in over 2 years.”

Home Depot and Lowe’s market are also expanding into adjacent markets via acquisitions to enhance their large Pro “ecosystem.” Following the earlier acquisitions of HD Supply and SRS, in June Home Depot announced the acquisition GMS, a leading distributor of specialty building products, including drywall, ceilings and steel framing related to remodeling and construction projects. The purchase price was $5.5B (11.6X ’24 EBITDA). With its earnings, Lowe’s announced its intent to acquire Foundation Building Materials (or FBM) – a premier distributor of interior building products, including drywall, metal framing, ceiling systems, insulation, commercial doors and hardware and other complementary products. The purchase price isn’t small at $8.8B ($13.4X ’24 EBITDA). (SRS is a specialty trade distributor focusing on materials for professionals in verticals such as roofing, landscaping, and pool supplies. HD Supply is HVAC, plumbing supplies, electrical components, lighting fixtures, etc.)

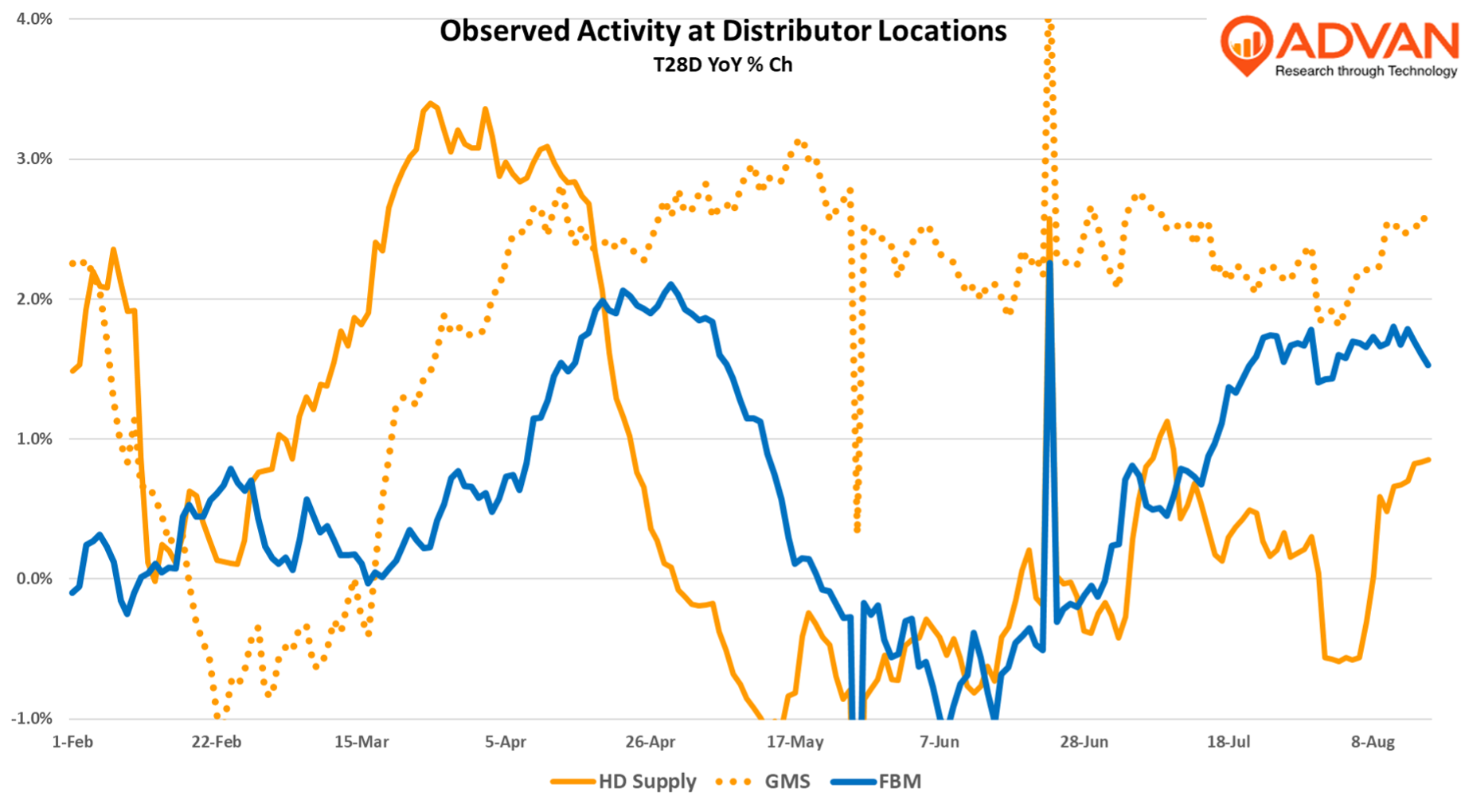

Overserved activity (Advan) at the distributor locations of the three, suggests that GMS has more business momentum this year and that HD Supply and FBM were more impacted by tariff inventory and order adjustments. That said GMS organic revenue was down -8.3% in CQ2 and so we know that revenue is more volatile than activity. In June, GMS’ CEO said, “We are cautiously optimistic that we are nearing the bottom of the cycle, although the intensity and duration of the downturn will vary by each market. [Q2] demand was down across both residential and commercial as economic uncertainty dominated the headlines.” However, as we demonstrated earlier, wallboard activity picked up over the summer as shown by producer Eagle Materials. And so, there is a turn up happening somewhere out there – Home Depot and Lowe’s both see it coming.

That Home Depot and Lowe’s are undertaking such large acquisitions also tells us that the managements and Boards are feeling more confident in the trajectory and stability of the base retail business, as well as the large Pro market. (They are also adding more retail locations; in Lowe’s case this is for the first time in many years.) Home Depot’s CFO Richard McPhail said, “And by the way, we think that the Home Depot store is one of the most rock-solid investments we can make, which is why we’ve leaned into that program. So SRS wholesale distribution, a capital-light model. Second, our DFCs. If you take our DFCs and you look at where they are on their maturity curve, they’re actually generating higher returns on invested capital than an equivalent Home Depot store would at this point in their life cycle. Again, if you’re using the benchmark, a Home Depot store to us is almost like buying treasuries. I mean that is as close to the most confident return we can drive in this business. And the incremental investments we’re making, I’ll argue, are positioned to drive higher returns on that capital.”

LOGIN

LOGIN