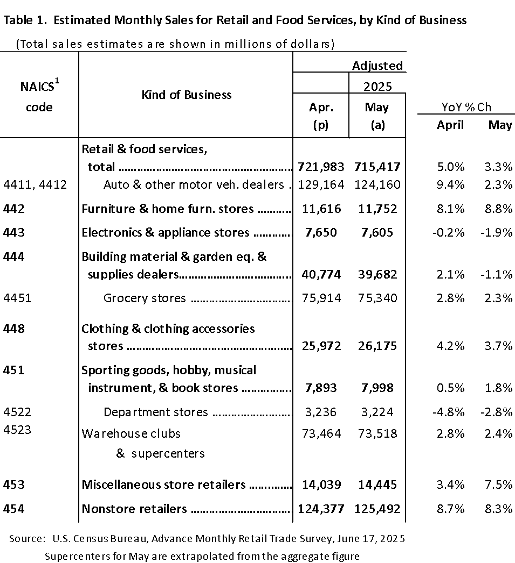

As we previewed in our story about Costco, May retail sales (as measured by the Census Bureau-adjusted) slowed from April’s pace as the tariff pull-forward lapsed and leisure activity quickened (again taking share from spending on goods). Additionally, weather for most of the month and country was absolutely horrid for seasonal sales. Building materials & garden supplies fell -1.1% in May from April +2.1% increase. Advan’s measure for NAICs #44422, which is 11K nursery, garden centers, and farm supply stores around the country, declined a similar amount. The “air pocket” following the pull-forward is clearly visible, with auto sales slowing to +2.3% YoY growth from +9.4% and most other categories gently slowing. However, “Gently” is far better than we, and others, were expecting, and so we take this report as “better-than-feared.”

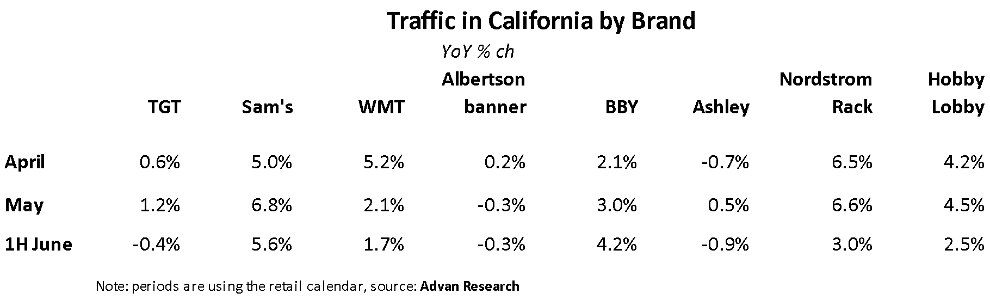

Some notable exceptions to the deceleration include “miscellaneous store retailers,” which posted +7.5% growth, up from April’s +3.4% and “department stores,” which includes off-price, declining only -2.8% from April’s -4.8% – or “less bad” by 200bps. Those improvements likely reflect “less Temu” – similar to our story on **Five Below **and the better quarter for the dollar stores. Significantly less advertising spending by Temu, and less China-direct merchandise, has led to a sharp bounce in traffic for secondhand stores and crafter stores. Saver Value Village traffic improved by +450 bps MoM and Goodwill by +120 bps. **Michael’s **and Hobby Lobby each improved by +150 bps. Similarly, traditional department stores are likely benefiting from less Shein. To isolate the underlying consumer trend from the horrid weather, we looked at traffic in California for Target, Walmart, etc. as shown below. What sticks out to us is the deceleration by Walmart (which roughly matches the sector’s -250bps MoM deceleration in the Census report). The pull-forward benefit to Walmart was very clear as the February – April average trend was +1.9%, before a mid-April spike that took the level up to +8.2% (on a trailing-14-day basis). That Best Buy accelerated is surprising; the further improvement in June likely reflects the release of the Nintendo Switch. In our opinion, the robust trend for Rack and Hobby Lobby reflects “less Temu.” By contrast, the worsening trend for Albertson’s likely reflects share-of-stomach loss to club, mass, and value. The loss is an industry trend, as we see similar trends for Ralphs and Safeway. (See our report on the topic here .)

Looking forward, given that the 4th of July lands on Friday, we expect the celebrations to be festive and long, requiring lots of stocking up ahead. The retail month for June doesn’t end until July 5th and so those celebrations will be captured in the June reporting and hopefully produce a better month.

LOGIN

LOGIN