With Medtronic’s fiscal Q1 quarterly results came the news that two new independent directors had been added to the Board and after Elliott Investment Management became one of its largest shareholders. The WSJ reported , “The activist investor and the medical-device maker have been holding friendly talks around how to boost the company’s valuation and build on ongoing plans to focus on core assets.” Notable from the earnings call, was management’s aim to accelerate top-line growth for the remainder of the fiscal year and beyond, which was one of the “asks” by Elliot per CNBC.

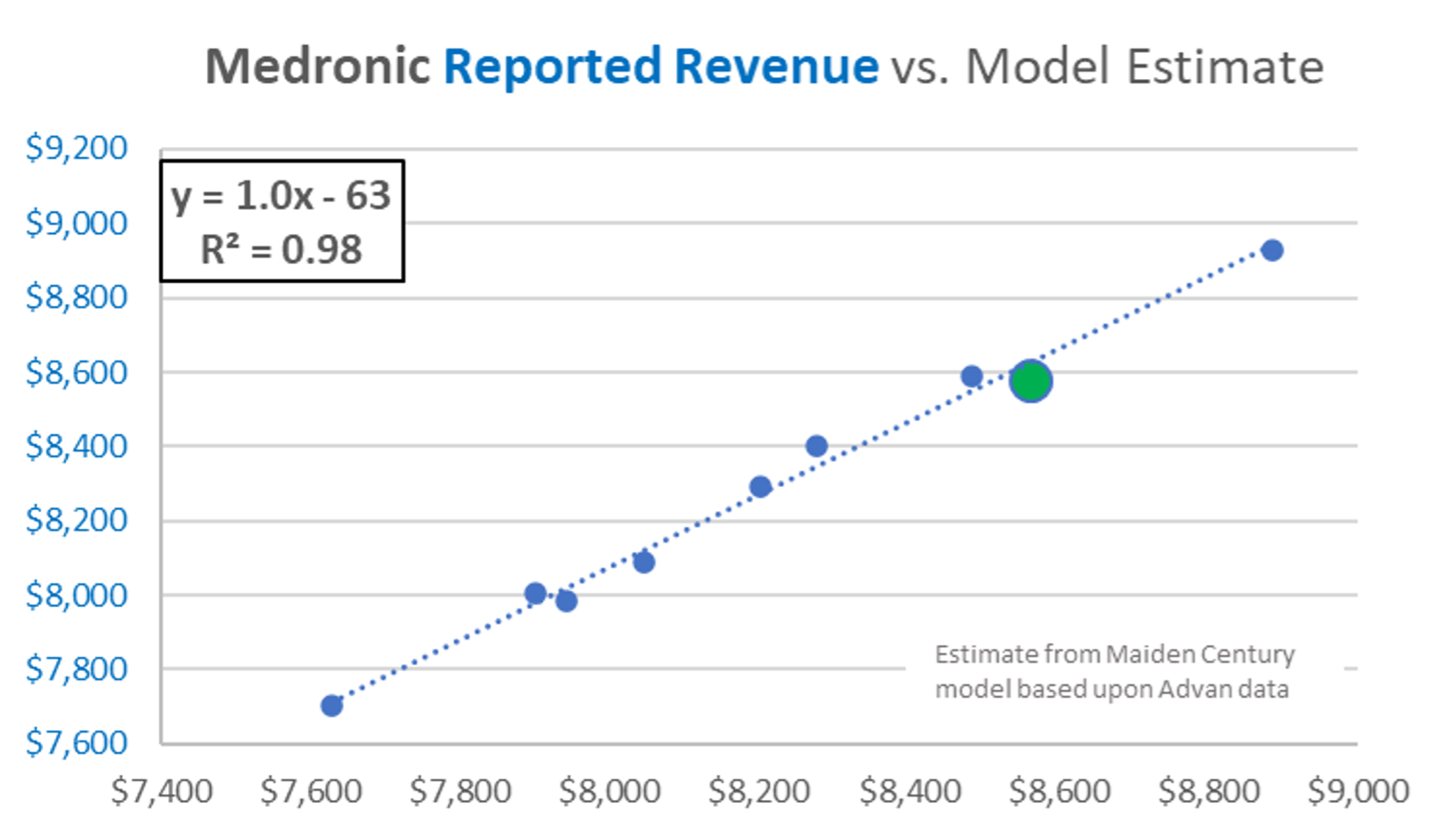

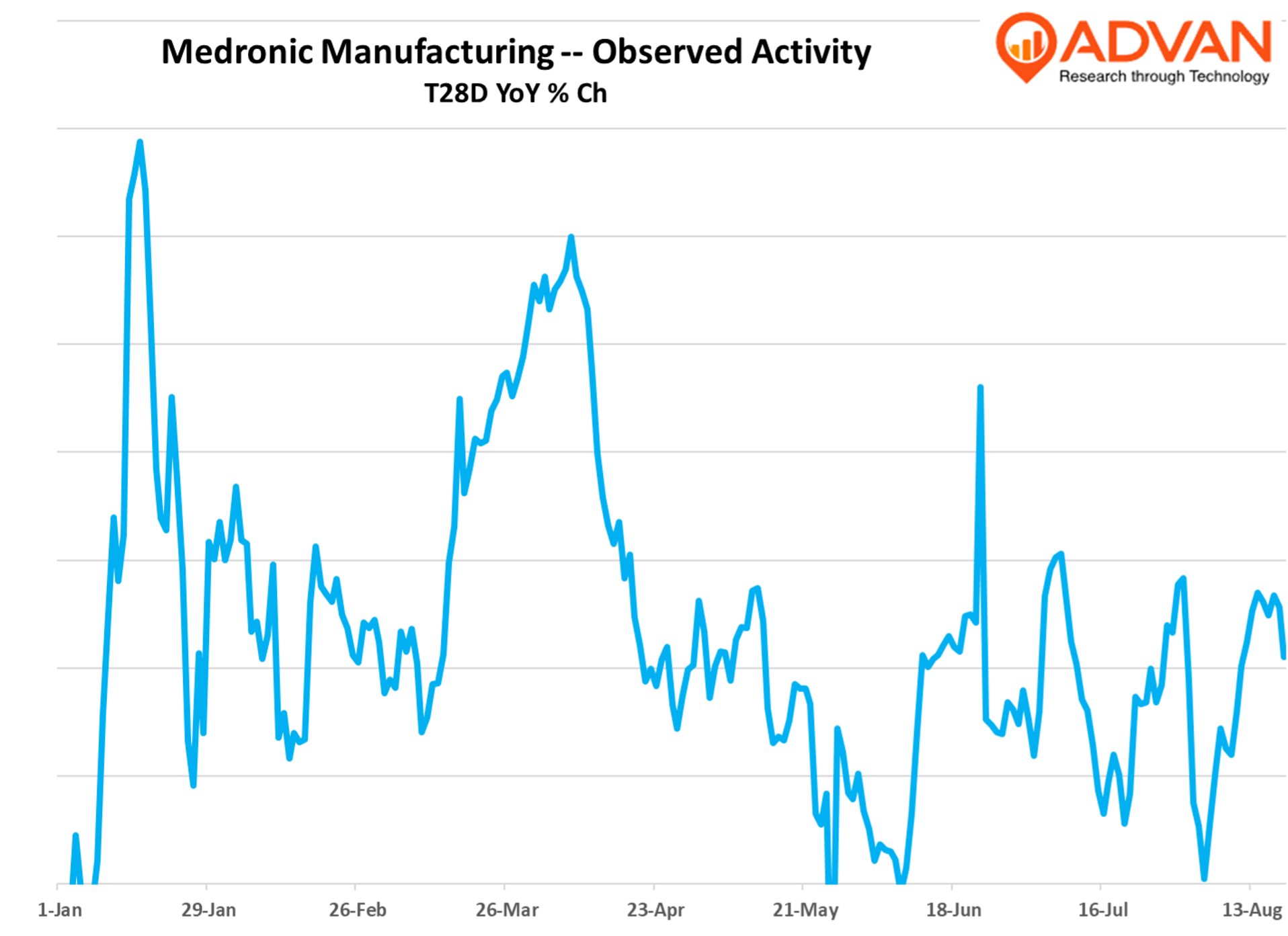

Q1 organic sales growth (+4.8%) was less that last quarter’s rate (+5.4%); the US region increased +3.5%, also less than quarter’s rate (+4.9%). These figures align with Advan’s observed activity at Medtronic’s US manufacturing locations where activity was -20bps softer than last quarter. However, reported revenue was much stronger (+$231M) than our forecast, which is typically quite close as implied by the scatter chart below. (Pre-Q1, T8Q error of +/-$78M) And so, what drove the upside to the forecast? Well, FX was a +$255M benefit QoQ, which isn’t captured in the model. Additionally, there was a $39M reduction in reported revenue due to an accrual. If we adjust our forecast for these, the estimate becomes $8,563, or -$15M / 0.17% less than the reported $8,578M, i.e. pretty darn close. (FQ1 is shown in the green dot.)

The quarter’s organic sales growth was driven by the Cardiovascular Portfolio (+7.0%) and the Diabetes Business (+7.9%). Cardiac Ablation remains the most dynamic for Cardiovascular, up +50%; but the core cardiac rhythm management continues to be a horse, up +9.1% on an organic basis. (We’re looking to identify where Cardiac Ablation is manufactured, in order to get an intra-quarter read on production volume and demand.) Looking at fiscal Q2 (below), activity at all of Medtronic’s domestic plants has yet to accelerate from Q1’s pace. As such, we (and others) will be watching carefully for an acceleration to see if management can deliver on that commitment.

LOGIN

LOGIN