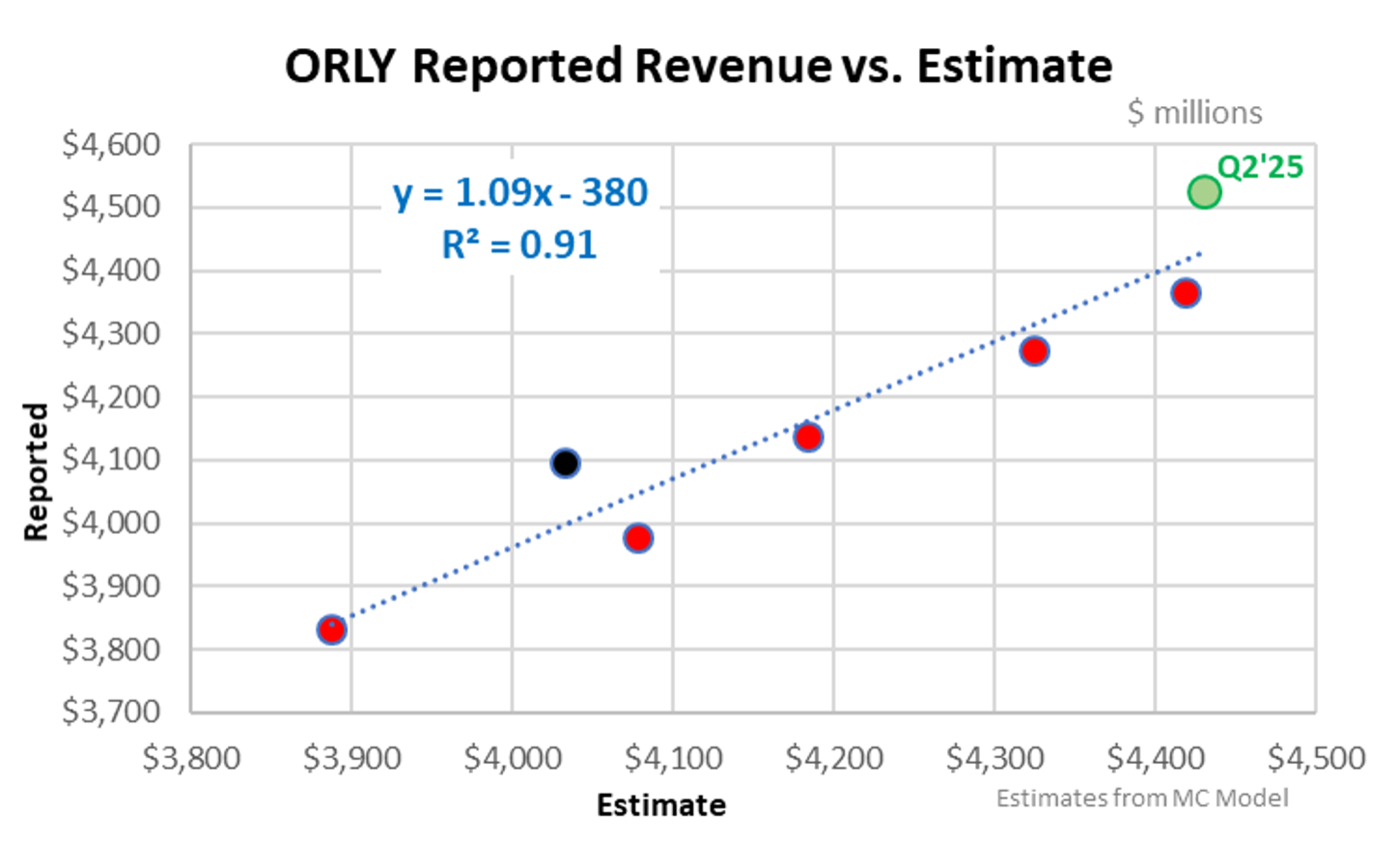

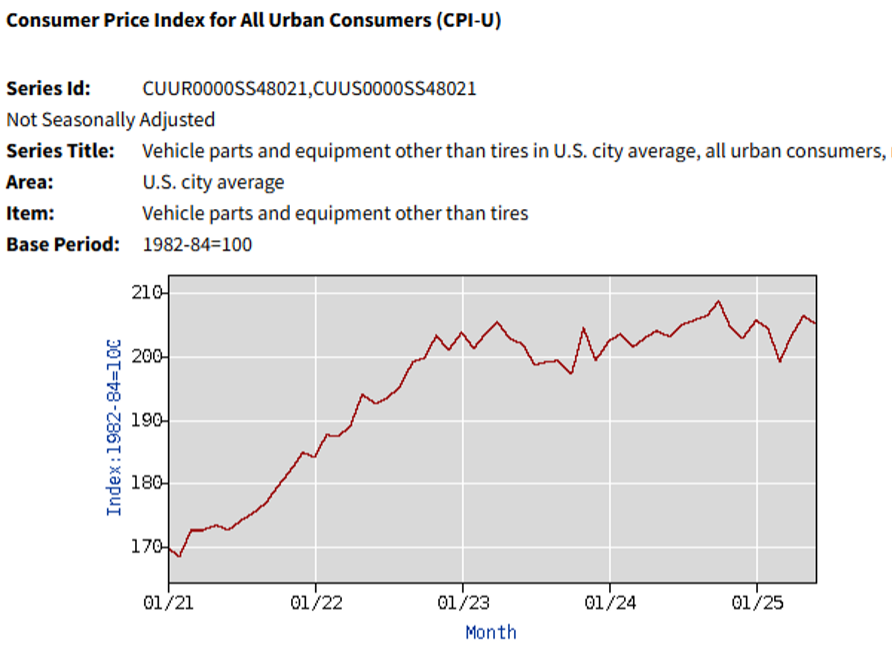

Auto part retail, and specifically, O’Reilly (ORLY), Advance (AAP), and NAPA (GPC), are interesting businesses from an alternative data estimate perspective given that commercial (or DIFM) is half of the industry’s revenue and that’s billed business vs. POS / credit card. (For NAPA it’s nearly 80%.) Mobility data captures both – the DIY visit to the store and the store’s delivery truck leaving the store to deliver parts to a repair shops. That said, there are discrepancies / error in the estimate that stem from spurts in inflation and much stronger DIFM sales relative to DIY. Abnormal weather can also increase the error. The chart below shows ORLY reported revenue to estimated* revenue; the average error over the past 8 quarters is +/-1.6%, i.e. pretty darn good. For Q2, reported revenue was 2.1% above our estimate with the overage stemming from the above factors. Specifically, same-SKU ticket inflation accelerated from +0.5% to +1.5% due to tariff cost pass-through, thus explaining 100 bps of the 2.1%. Additionally, DIFM comp-sales were over +7%, vastly stronger than DIY comps of +1%. As the DIFM comp-ticket is far larger than the DIY comp-ticket, this mix impact increases the overall comp-ticket and revenue, thus explaining the remaining 110 bps under estimate. The chart’s red dots… Generally, these were quarters where the weather was disruptive and the inflationary surge of 2022 rapidly mellowed in ’23, then picked up again, as shown in the second chart below. The black dot was Q4’24 – a very strong quarter on both the DIY- and DIFM-side.

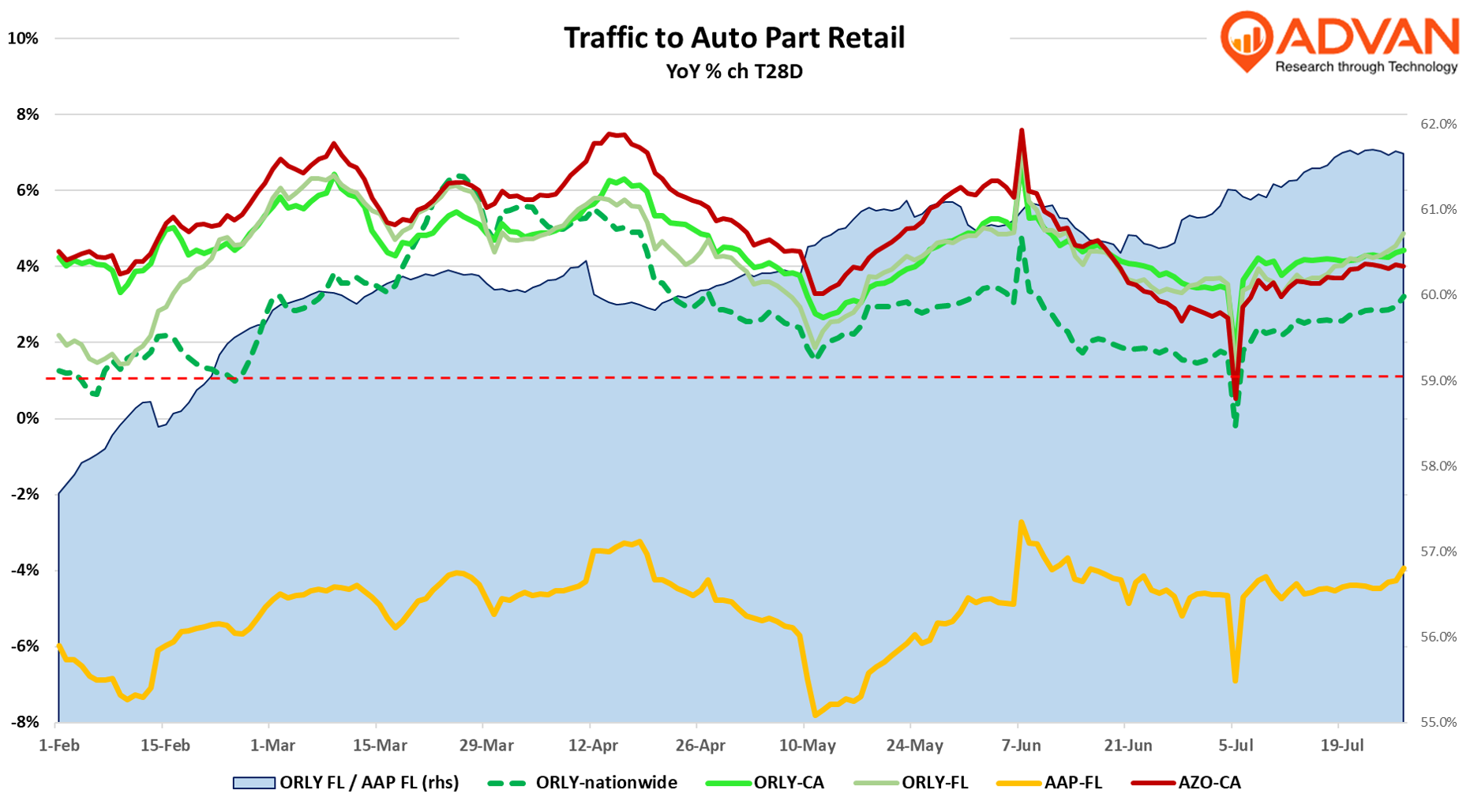

Back to ORLY’s Q2 results, the DIFM comp of +7% was spectacular and that reflects a healthy overall market (i.e. more miles driven and an ageing vehicle population, including of high value / well-maintained vehicles). It also reflects ample market share capture. Recall that Advance Auto exited the West in order to solidify its hold on the Southeast and northward. Florida is Advance’s largest state with 526 stores. O’Reilly is much smaller in Florida at only 313 stores. However, as shown in the below chart, O’Reilly is getting larger in Florida, whereas Advance is getting smaller. The blue patch in the chart is O’Reilly’s T28D visits relative to Advance in Florida. At the end of January, the ratio was 57.7% and by mid-July, the ratio has risen to 61.7%, i.e. Advance is getting swamped. Over the past year, O’Reilly has added 30 net new locations in Florida. Assuming company-average new store productivity, that implies that O’Reilly’s Florida business is up both on a comp-basis and from new locations.

The other news that O’Reilly shared on its earnings call was that it had acquired a new DC in Fort Worth, Texas to support 350 stores in the South Central region. (Texas is O’Reilly’s largest state with 860 locations.) O’Reilly President Brent Kirby said, “These market areas represent some of our most mature markets, while also being strong contributors of highly profitable growth for many years. Even with the relatively high store counts we have in Texas and surrounding markets, we still see tremendous opportunity to continue growing in this part of the country in the future but are running up against constraints with our distribution capacity. The backfill addition of this facility will not only give us additional capacity and enhanced service capabilities in the important Fort Worth metro market but will also free up much needed capacity in surrounding DCs to support growth across the South Central region of the country. We are still in the early innings of development for this new DC, having just acquired the facility with substantial infill work still ahead of us.” In other words, Texas is somewhat maxed out at the moment for O’Reilly, but that is only temporarily.

And it’s just not Texas, O’Reilly also shared that its new distribution center in Stafford, VA will open before the end of the year. O’Reilly has 105 locations in Virginia, but only 10 in Baltimore, none in DC, and only 49 in Pennsylvania. Kirby described the market as, “the largely untapped Mid-Atlantic region… . We’ve been a little strained with our distribution capacity in the Southeast and that Eastern Mid-Atlantic for several years now as we’ve grown our store count and grown our volumes there. So getting that DC online is something we’re really excited about. If you think about that I-95 corridor and you think about number of vehicles, the number of people that are along that corridor and really kind of a last frontier a little bit for us in terms of our domestic expansion… So certainly something our real estate teams are focused on and looking at and our operational teams are focused as well. So we see that as a big growth opportunity for us.” CEO Brad Beckham said, “As we continue to look at kind of that upper Northern Virginia, getting into DC, Baltimore, eventually Philly and New York City, depending on where you draw the line in some of those regions, you can almost come up with 1/3 of the population of the U.S. to Brent’s point, on population, car park, vehicle registrations, et cetera. And so it’s going to be a big opportunity to take a little bit of pressure off some existing DCs, but also more importantly, to really get after that part of the country where we have a lot of opportunity.” (O’Reilly only has 55 stores in New York and none in New Jersey).

California is O’Reilly’s second-largest state at 610 locations. Over the past year, O’Reilly has added 13 new locations. As shown above, California has performed strongly in visits for O’Reilly this past year. However, AutoZone has the most locations in the state at 686 and it has grown visits at an even faster pace. We suspect that the strong gains by both reflect both the favorable industry macro drivers and the exit by Advance (March). (See our last report on AutoZone.)

‘*Maiden Century Model

LOGIN

LOGIN