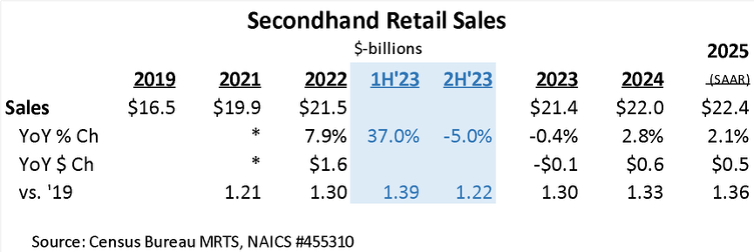

Better-than-expected quarterly results from Savers Value Village and ThredUp, plus the threat of inflation from tariffs, motivated us to take a look at foot traffic for the secondhand retail sector and its major players. As a reminder, the fiscal stimulus of ’21 and the bout of inflation in ’22 produced very strong years for the sector. So much so that those good times compelled ThredUp to IPO in ’21 and Savers in ’23. However, in the 2H ‘23 industry growth meaningfully slowed because: (1) the compounding high inflation hit discretionary spending, and (2) Temu took meaningful share of Halloween customs and decorations and Christmas decorations and furnishings. (Temu’s rise was also very detrimental to crafters and the craft retailers, so much so that JOANN’s business failed.) For those readers who haven’t recently visited a secondhand / thrift store, the industry has taken a lot of pricing since 2019. And so, while the price points at these stores may be lower than new-goods stores, they are in many cases far from “cheap” and essentially “premium vintage.” To our knowledge, there is no CPI measurement for secondhand; the best measure is Savers’ “sales yield” figure which is the retail sales generated per pound processed (i.e. the processing of donated goods). This is a currency-neutral and comparable-store based metric. For Q1 ‘25, it was $1.38/lb and meaningfully higher than 2019’s $1.08, meaning that Savers raised prices around +28% during the period (better sorting, merchandising, and inventory turns were also contributors).

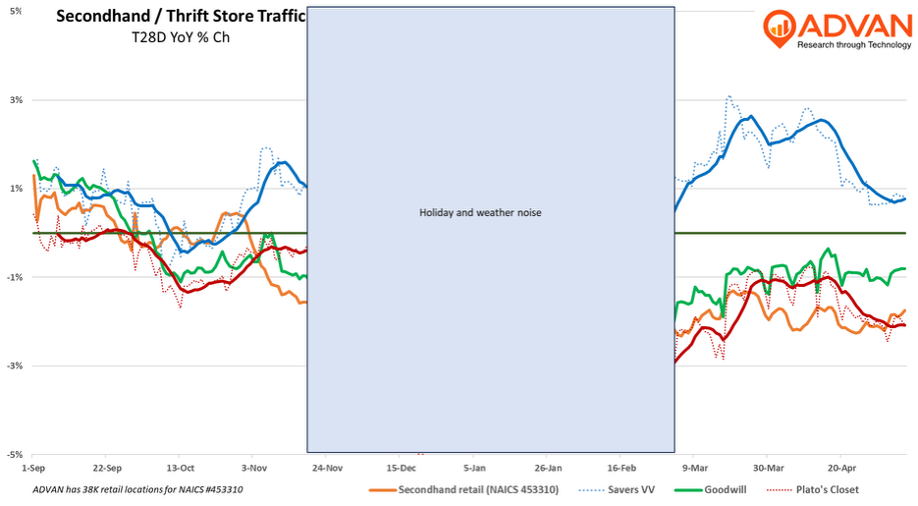

Looking forward, the secondhand retail industry doesn’t buy inventory; as such, it isn’t directly impacted by tariffs. Should the prices for new shoes, apparel, and home décor significantly increase due to tariffs, the gap to the prices at secondhand will expand and market share will move towards secondhand. Additionally, secondhand will also raise its prices because it can give higher prices for new goods. Separately, Temu has just pulled out of the US as the removal of the de minimis exemption destroyed its unit economics. High inflation on goods (if it happens) and no Temu should foster a strong 2H for secondhand retail. Per the 1H’25, traffic for the industry (NAICS #453310) is trending about -300bps lower than pre-Q4’24, which we suspect is the result of the extreme budgetary stresses on low-income consumers. We also see signs of that pressure in weak CPG sales volumes and fast-food industry traffic . Plato’s Closet is down slightly less, Goodwill is less bad, and Savers has outperformed.

For Q1, Savers produced at +9.4% sales increase for its US business. The increase was the product of more locations and a +4.2% comp-sales increase (vs. +4.7% in Q4). The comp-increase was driven by higher average unit retails (i.e. price) and comp-transactions (which we suspect is the result of recent store cohorts maturing). Those two were partially offset by fewer items in the basket (UPTs). Over the past year in the US, Savers added 17 new locations to reach 172 (it’s only a third the size of Plato’s and far less than Goodwill at 3,300). The new stores produced about 47% of the sales of a comp-store. Assuming that new stores mature at a pretty rapid clip, that maturation is driving a lot of the comp-transaction growth, rather than the mature stores. Advan’s REI data also shows a +3.9% increase in visitors per store, with an offsetting decrease in frequency of visits and dwell time. Dwell time is correlated with basket size. These metrics suggest that Savers (and the secondhand industry) is recruiting new consumers, but its loyalists (especially on the lower-end) are being more choiceful and careful in their visits (frequency down) and purchases (i.e. UPTs down). Looking at Savers’ peer Plato’s Closet, there were 521 locations at quarter-end, up from 515 in the prior year. Winmark’s holding company only reports “royalty revenue” and not retail location sales; however, that royalty revenue is closely aligned with comp-sales, and it increased +2.9%. The increase is above the traffic trend shown above, which suggests that the increase was driven by higher prices (like Savers) and potentially a boost in the conversion rate. Additionally, the +2.9% increase was just slightly above last year’s +2.8% annual increase. ThredUp reported a +10% sales increase, which was marginally higher than Q4’s +9% increase. Like with Savers, ThredUp’s growth was driven by more buyers, which inflected to +6% growth (1.27M) from a -6% decline in Q4; unlike Savers, frequency of ordering improved by +10% YoY, which lifted orders to +16% YoY growth. ThredUp has a younger shopper than Savers and Plato’s. And so, we suspect that it may be benefiting more, and potentially earlier, from a trade-down effect. Worth consideration is that Savers and Plato’s have a surprisingly high median household income for its visitors ($88K - $90K per Advan). Our conclusion from all of this is that the secondhand industry should benefit if inflation spikes and the economy sours. So far this year, most of the improvement in the industry’s sales is trade-down with more households shopping the channel, and price. Those benefits have been offset, to a degree, by less frequent visitation and spending by their lower-income households.

LOGIN

LOGIN