This week, concerns rose on consumer “health” given weaker results from packaged food, weak results from Chipotle, and very low guidance for Q4 from Sprouts Farmers Market. Sprouts has knocked it out of the ballpark for the past six quarters, and so, to guide to comps of only 0-2% for Q4 is to suggest a sharp downshift in consumer spending. As it relates to Sprouts, along with incremental paycheck behaviour, perhaps weaker execution and new competition may be at work as well. In terms of the consumer, based upon the results and commentary from **Visa, Mastercard, **and American Express, we do not think there is deterioration in the aggregate picture (also review our story on the beauty category’s strengthening); however, there is incremental caution by the lower-income consumer (see PayPal’s results). That consumer is intensifying its effort to stretch their dollars further, be it tradedown to private label, scrimping on detergent and dish soap, or getting their fill from grocery and club vs. restaurants. (This is the same story that we presented two weeks ago to the National Association for Business Economics Annual.)

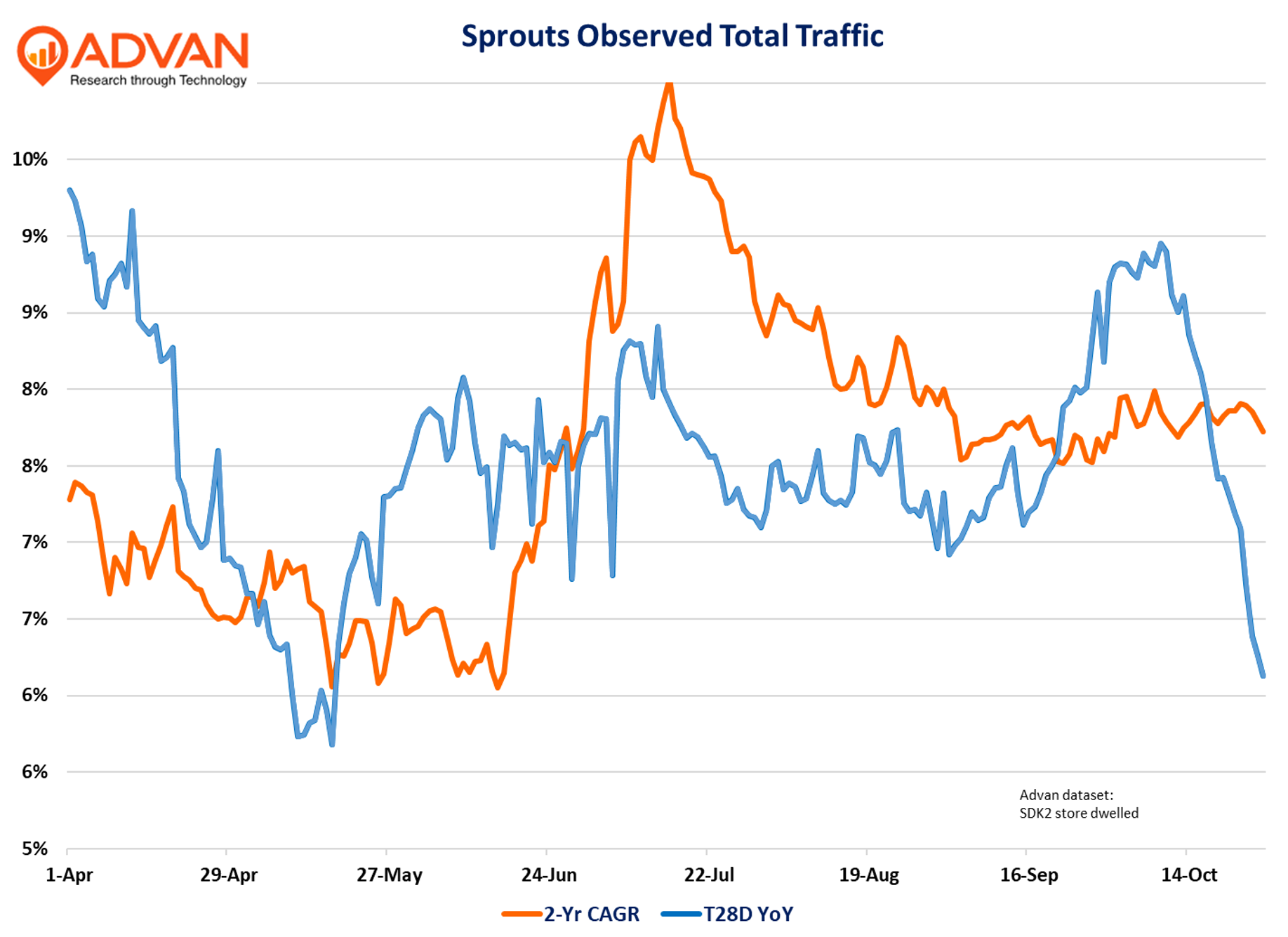

As it relates to Sprouts, we suspect execution because of a divergence between observed foot traffic and transactions (Advan data), with a slower rate of transaction growth due to in-stock deficiencies. Additionally, the trend in basket size suggests fewer items in the cart (UPT). A decline in UPT can imply in-stock deficiencies as well. A decline in UPT is often a precursor to softer traffic, which is apparent in the October traffic and the Q4 guidance. October of ’24 is also a more difficult compare (+13%) and November and December are also difficult at +10.5% each. As such, it won’t be until Q1 is underway that the business’ steady-state go-forward run rate becomes discernible.

From the earnings call on in-stocks and deficiencies:

- Analyst “How do you guys size the opportunity in in-stock? **Because what we keep hearing that natural and organic fill rates are not anywhere near where they need to be. **How can you fix that?

- CFO Curtis Valentine, “With regard to the supply chain and the in-stock… Natural and organic is a very long tail, John, as you know. And that does create a challenge in terms of being as in-stock as people with less SKU count in the middle of their kind of assortment. We will be looking at expanding some other areas potentially on self-distribution, which we’ve talked about in the past. We would like to be better on Sprouts’ brands in terms of how we can get more in-stock on that. We think there are certain categories that we need to double down on. Having said that, we are working very hard with our partners to get better forecasting and better anticipation of how demand could be – we could anticipate demand even better… We have in the meat category. But in other categories, we haven’t put a really clear number to it. But instinctively, there’s some upside for us in that if we can get better…” (Being able to get better implicitly means that there is a deficiency.)

As it relates to a more pronounced paycheck cycle, comp-traffic will exceed comp-transactions, which adds another level of confusion. Valentine shared, “We’re seeing a little bit of pressure at the end of the month on the basket… as the consumer pressure builds a bit, similar to what we saw during the inflationary period in ‘22 and ‘23, they’re really managing the end of the month, and it’s creating kind of a units-per-basket-type pressure that we’ve seen before.”

Sprouts’ Q3 sales were also below managements’ expectations; CEO Jack Sinclair said, “It happened through the quarter as opposed to in the quarter. And as we look forward, we’re anticipating a challenging environment. We know what we’ve got to lap going forward, and we’re anticipating a little bit of pressure on the consumer going forward. With regard to thinking about what should we do with – we’re not seeing a competitive dynamic changing dramatically in the marketplace in terms of pricing or activity. We’ve always promoted and we’re very comfortable with promoting going forward… So no, we’re not seeing anything dramatic in terms of the competitive dynamic in this space.” However**, Amazon** just launched same-day delivery of perishables (eggs, milk, etc) in 1000 cities in August, with plans for 2000 by year-end. We’re confident that Amazon would have interrogated Sprout’s selection for said launch, plus they have the data from Whole Foods. And so, maybe the traffic to the stores came along with phones in hand – the showrooming behaviour that has happened before in other categories. This, too, would erode the conversion rate and basket size. (Sprouts comp-ticket was similar QoQ despite incremental inflation in the period (+1%). And so, new competition may also be a factor for the slower sales, just as Temu was to thrift and dollar stores in the 2H’23. Listening to Amazon CEO Andy Jassy, on its Q3 call, discussing the strong success in perishables since launch, and the increase in the target for served cities to 2300 by year-end, built our confidence that we are onto something as to Sprouts’ October slowdown.

LOGIN

LOGIN