One year ago, Brian Niccol stepped into the CEO role at Starbucks, pledging to return the company “back to Starbucks” with a particular focus on reclaiming the 3rd Place through making the locations less busy (imagine that), better serviced, better maintained, and comfy. The wage ($500M) and location remodel investments ($150K each) are substantial. The location makeovers (1000) include sound insulation, rugs, dimmer lighting, more seating, more charging points, cozy dark wood paneling, and more. This week, CNBC did a nice piece on the makeovers. A contemporization of its food offering is still on the come. (We’ve penned a couple of stories this year following its earnings results and progress on the 3th Place, here and here .)

What does Advan data show in terms of one year’s worth of progress? Well for August, visits per location were down a very moderate -1.2% (vs. -3.2% last September); that decline stems from Starbucks’ cutting back on traffic-generating promotions (see the “less busy”), which created too much havoc for the Green Aprons. Longer dwell time (ascribed to folks lingering longer) is a measure of success on the 3rd Place. Dwell time in August increased modestly YoY, which is an improvement from the prior declines. Additionally, visits that lasted between 30 to 120 minutes increased 1% YoY. As such, this data provides support that the 3rd Place initiative is working, but with a lot more improvement to come given that the makeovers have just started. In a few months’ time, we will come back to it and focus on Los Angeles, which is the second makeover market following New York.

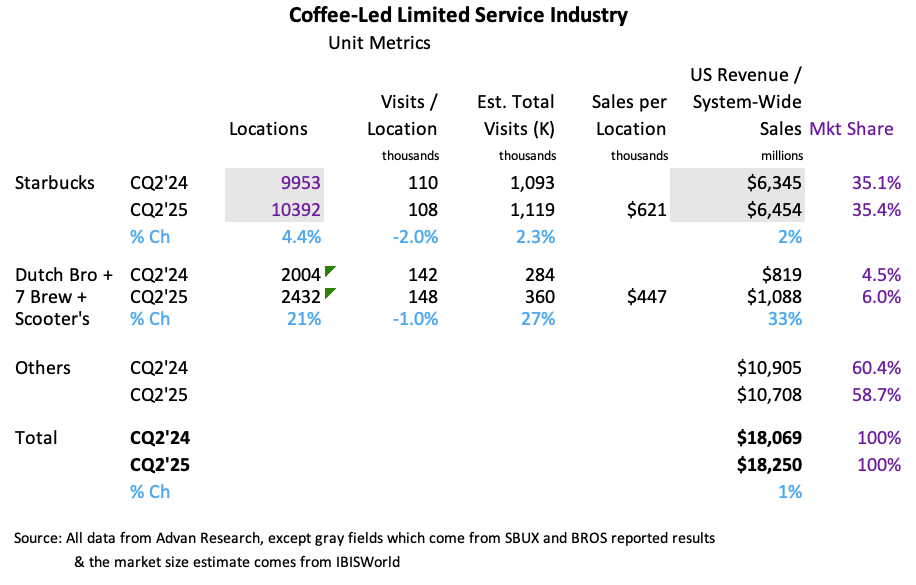

In our prior stories, along with our conversation with the Financial Times, we posited that the “coffee-led limited-service industry” was bifurcating into two subsegments – locations that were meant to draw consumers in for a crafted, cozy, and lingering experience, and locations / brands that were principally drive-through and highly transactional – Dutch Bros Coffee, 7 Brew Coffee, and Scooter’s Coffee. We wrote “coffee-led…” because the industry also competes with McDonald’s and other non-coffee-led brands for consumption occasions, especially the morning daypart. Of note, this is also the daypart that McDonald’s has said to be particularly challenged. Moreover, it’s also a consumption occasion that gas & convenience is also aggressively competing in. As such, in the table below, the market share of coffee-led limited-service significantly overstates Starbucks’ market share when you include these alternatives. Moreover, is the challenge to McDonald’s (and others) for the morning daypart just not the growing encroachment of the drive-through segment, as well as C&G’s offering refinement / contemporization?

We believe that “back to Starbucks” is a strategic repositioning to steer Starbucks away from this increasingly competitive drive-through / transaction-heavy scrum; Niccol and the Board likely believe that the scrum doesn’t offer the margins and returns that warrant SBUX’s current premium valuation multiple (33X NTM P/E). In the mid-2010s, SBUX generated a mid-twenties return on invested capital (ROIC). Given the reinvestment to get “back to Starbucks,” its ROIC has declined to 15.3%. Returning to mid-twenties is dependent on an idiosyncratic strategy, one that is uniquely differentiated from the near and far competition.

LOGIN

LOGIN