Well, Starbucks’ US comp-sales were not down -1% as investors feared, but flat for the quarter, which was a +200bps QoQ improvement. Additionally, the comp was not driven by more pricing as average check decelerated -100bps QoQ to only contribute +100bps YoY. Comp-traffic/transaction was the driver, improving from -4% to -1%, or around +300bps QoQ. That 300bps increase was ahead of observed traffic (Advan), which strengthened by +80bps. (Others were suggesting a -160bps QoQ deterioration.) Of note, Advan doesn’t see locations in “urban canyons,” and a lot of the company’s focus is on these markets (and especially NYC). That suggests that the traffic improvement is stronger in the urban canyon locations than in suburban and open locations. These improvements demonstrate that Brian Niccol’s initiatives are moving the ball forward in what is a difficult macro and competitive environment for coffee retail. However, the initiatives to improve the café experience, such as higher wages, more hours, and upgraded environs, do have a cost, and store operating expenses for the North American business segment rose +12%, far outpacing the +3% revenue increase.

We’ve written several times about how the “coffee-led limited-service industry” was bifurcating into two subsegments – brands whose locations are meant to draw consumers in for a crafted, cozy, and lingering experience, and brands whose locations / brands that were principally drive-through and highly transactional – Dutch Bros Coffee, 7 Brew Coffee, and Scooter’s Coffee. Niccol calls this “back to Starbucks” which we’ve cheekily called it “Reclaiming the 3rd Place.” For locations observable by Advan, September ‘25 vs. Sep ‘24, Starbuck’s average visits per location was up just slightly. Observed visits between 15 minutes and 2 hours were also flat YoY. However, the length of stay for those lingering visitors increased by 1%. For perspective, that’s a relatively large increase as it’s hard to move the number. This data also demonstrates that Niccol’s initiatives are hitting.

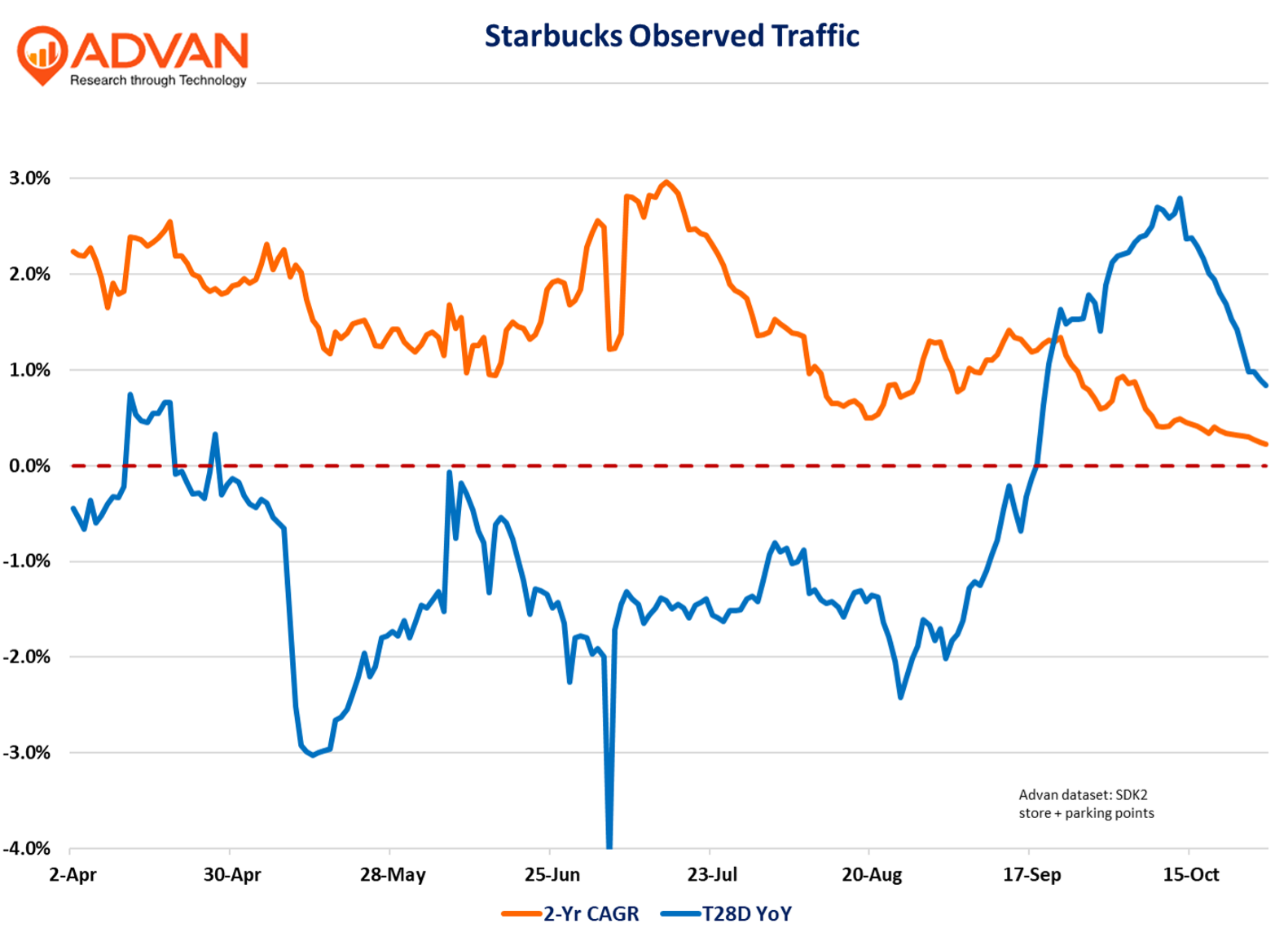

Lastly in terms of what Advan data shows in the above chart, comp-traffic in the 1H declined as Starbucks curtailed “rich discounts” that drove “quick grab” visits, but as the company transitioned into September, there’s been a substantial improvement in the trend. Some of that improvement is an easy comparative, but also due to the reemerging crafted and cozy Starbucks, i.e. reclaiming that 3rd place. Looking at the Los Angeles markets, which has gotten more of the plan’s attention, visits for the past three months have outperformed the nationwide average by +83bps in terms of visits per location. Again, more evidence that the ball has been moved forward.

On the progress, Niccol said, “A year ago, we launched our Back to Starbucks strategy to get us back to the exceptional craft, connection, and welcoming coffee houses that define the Starbucks Experience and set us apart. Since then, we’ve been focused on executing our plan and accelerating it where we’ve seen opportunity. We took the significant step of scaling several key pieces of work during the quarter, and it’s clear from our results that our plan is working, and our turnaround is taking hold…Our North America company-operated comps improved to flat year-over-year, driven by flat U.S. comp… Across our U.S. company-operated portfolio, we more than tripled the percentage of coffee houses with positive transaction comps from a year ago, with year-over-year transactions improving across all regions and dayparts…. Notably, our U.S. company-operated sales comp turned positive in September, driven by transactions, and it’s remained positive through October, reflecting the momentum taking shape in our business.” (A pattern aligned with the chart’s.)

Niccol, “When we launched the Green Apron Service standard in the middle of August, we saw the business respond so much so that in September was the first month where we actually had comps – positive comps driven by transactions, a point of transaction comp growth. So Back to Starbucks is a reference around the whole brand proposition. And it gets us, I think, centered on providing a great customer service experience, which separates this brand from everybody else. The foundation is this customer connection… With the Green Apron Service model, we’ve actually freed our partners up to get back to focusing on moving towards customers, providing that connection, and providing that customization in the beverage that people want, whether it’s hot, cold, coffee, refreshers, and you’re going to continue to see us innovate across matcha. So it’s holistic. And what I love about it is I see it really playing out nicely in transactions right now.”

LOGIN

LOGIN