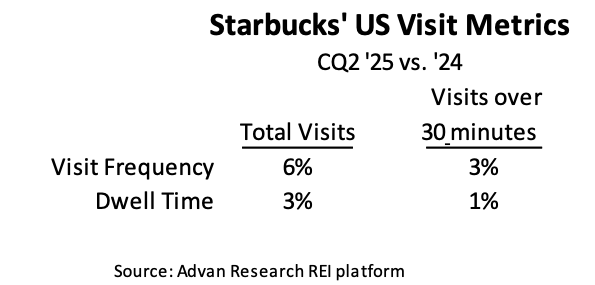

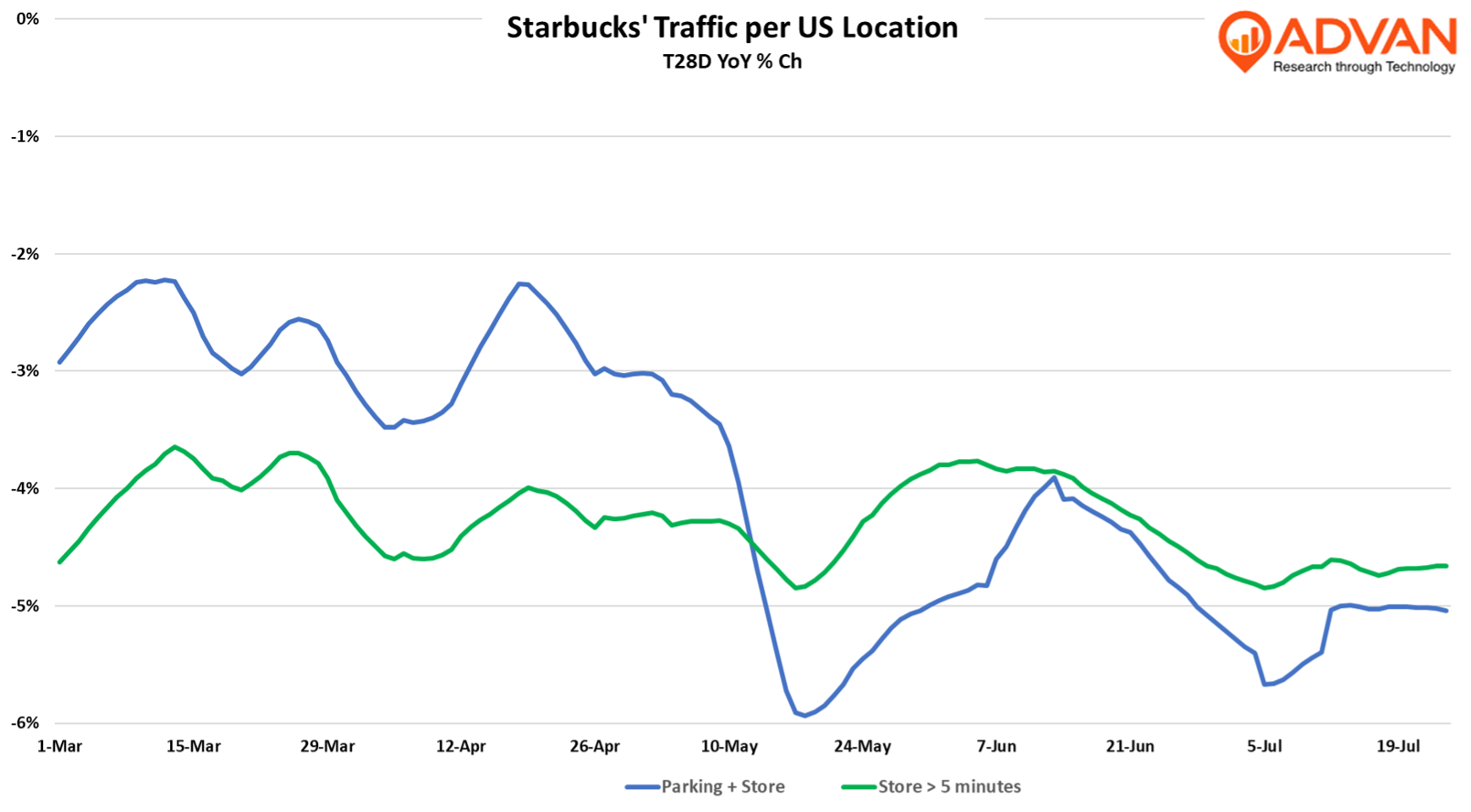

On the surface of Starbucks’ quarterly results, little improvement is visible for the US segment; US comp-transactions were again down -4% and profits fell -36%. However, as we highlighted in our last review of Starbucks’ results, it is succeeding in reclaiming the third place in people’s lives. We draw that conclusion as the dwell time and visit frequency improved once again, and especially for those visits exceeding 30 minutes – as shown in the table below. Additionally, the chart beneath that shows that the >5-minute store visits have outperformed the short visit trend since mid-May. On the earnings call, CEO Brian Niccol said, “It’s clear, Back to Starbucks is the right plan. It is grounded in feedback from our customers and partners, and it’s rooted in what has always set us apart, a welcoming coffeehouse where people gather and where we serve the finest coffee, handcrafted by our skilled baristas. This quarter, we’ve made meaningful progress, and we are ahead of our expectations. We’re moving quickly to transform both the business and our culture…. I’m confident that we’re not just getting Back to Starbucks. We are building a better Starbucks, where everyone can experience the best of Starbucks, one that is stronger, more resilient, and consistently growing, a Starbucks that is once again the gold standard in customer service, partner experience, the coffeehouse experience and financial performance.”

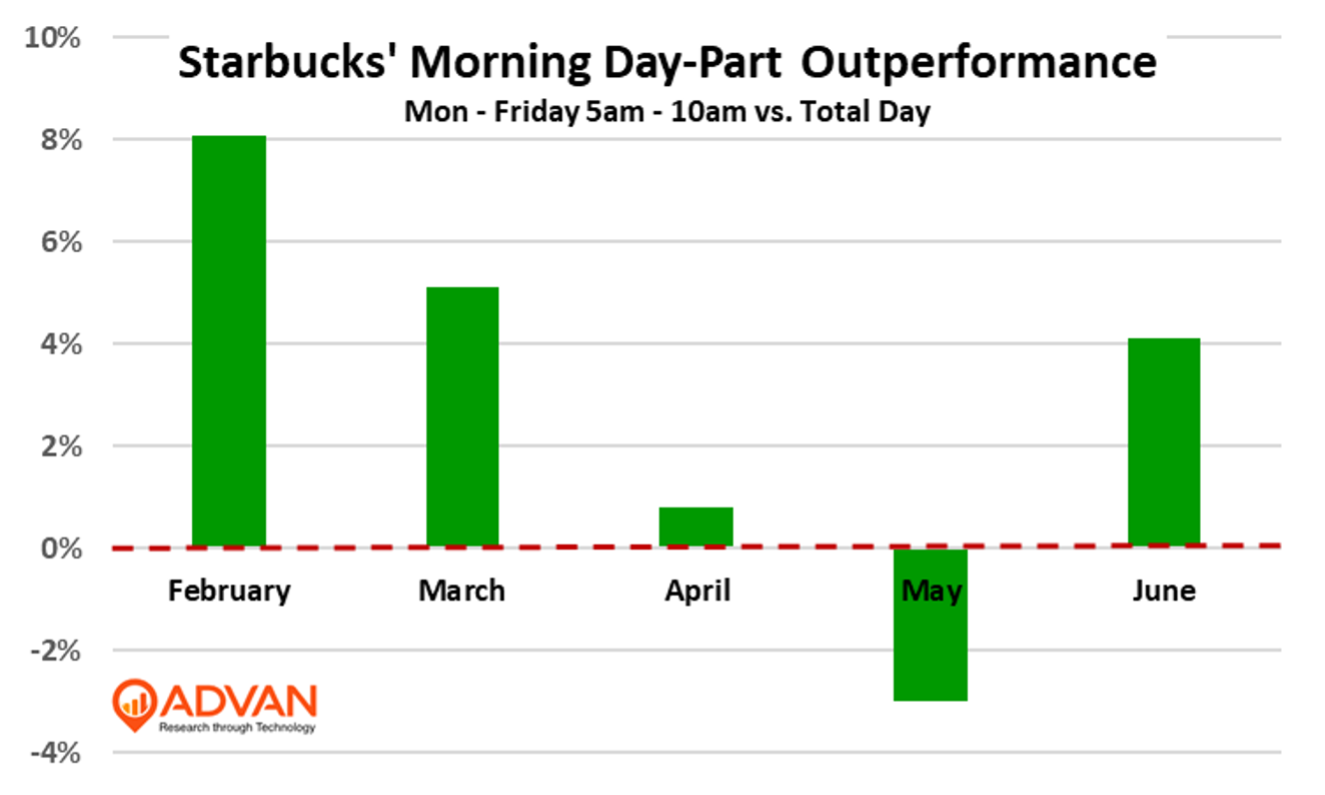

On to the comp-transaction decline, the company is still lapping a highly promotional period last year. That impact will fade in the 2H (Niccol started last September). CFO Cathy Smith said, “We’re also making progress with our Starbucks Rewards customers with quarter-over-quarter improvements in the number of transactions not on promotion. We’ll continue to drive growth and loyalty with our rewards customers through a reimagined loyalty program next year… We have reduced the percentage of discounted transactions by a third, putting us back to more normalized levels as we build back a healthier transaction base and focus on improving the overall value proposition for our customers.” Niccol went on to say about the qualitative and quantitative improvements for the US, “Customers are liking our marketing and noticing that our speed, hospitality, and accuracy are improving. Customer connection scores are up and customer complaints are down, both quarter-over-quarter and year-over-year. Customer value perceptions are near 2-year highs, driven by gains among Gen Z and millennials who make up over half our customer base. We saw the percentage of company-operated coffeehouses with positive full-day transaction comps and positive morning transactions improve for the third straight quarter…. (See the chart below.) The most significant change will come as we begin fully scaling Green Apron Service across all U.S. company-operated coffeehouses in mid-August. Green Apron Service is a new foundational operating model that establishes repeatable, consistent, and scalable standards. It is Starbucks’ biggest investment ever in operating standards and customer service. Green Apron Service starts with the five key moments, including craft and connection that define the experience we want every customer to have every time they visit. It is enabled by an evolved staffing model, which includes adjustments to roster size, labor hours, peak coverage, and deployment.” They will be investing an $500M in store labor for the US over the next year, or roughly $30K per location.

And lastly on the store itself, Niccol said, “We slowed new builds and major renovations to prioritize a new coffeehouse uplift program with a targeted investment of approximately $150,000 per store and minimal to no downtime. Uplifts are intended to quickly replace thousands of seats we removed and introduce greater texture, warmth and layer design.” They are doing New York City currently and will begin SoCal in September. We, at Advan, will be carefully watching how the SoCal market responds in CQ4.

LOGIN

LOGIN