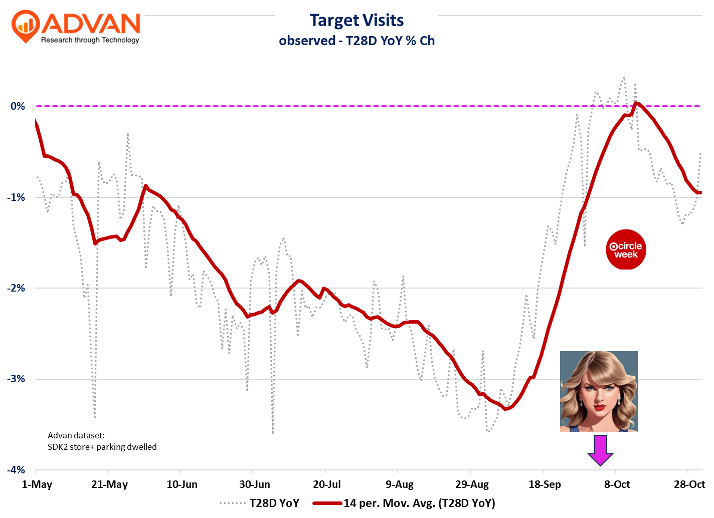

Since our last story on Target (FQ2 results), the company has had a successful Circle Week event, a Taylor Swift Exclusive, and a large layoff announcement. Given a new CEO, its weak financial performance this year, and the broadening trend of greater efficiency and “delayering” across corporate America, the layoff should have surprised no one. Also not unexpectedly, CEO Michael Fiddelke’s charge to spread the Tarjay across the store with greater urgency isn’t an overnight fix, and certainly not an easy fix. Finding authentic and inspired design and merchandise is an art, and art often takes time to imagine, design, and manufacture. In the meantime, Target is relying on coveted exclusives, such as Taylor Swift’s The Life of a Showgirl album release, and strong promotional events, like Circle Week. As shown below, these two took the observed traffic trend from down -2.5% up to around -0.5%. We’d also call out that the late September improvement is due to lapping Hurricane Helen’s large disruption last year. (Of note, others are suggesting significantly worse traffic for FQ3 than what our data indicates.)

Obviously, Target can’t continuously bring out Taylor Swift exclusives and recycled Circle Weeks. Additionally, the steep decline during the back-to-school season is troubling. In prior stories on Walmart and the B2S season , we shared that Walmart had a very strong one, and that Target was “less considered.” Additionally, in our data, we also see Target’s conversion rate slipping in September, average check slipping in September and October, and length of shop declining by -2.6% in September, which is a rather large drop, and which is typically aligned with a drop in basket size (UPT). A decline in UPT is concerning on two counts: (1) it lowers sales and (2) it typically precedes an erosion in traffic as it indicates that shoppers are getting those items elsewhere, and in time, they discontinue shopping at that lost retailer. (We also fear, for Target, that Amazon’s same-day delivery of perishables may be at play.)

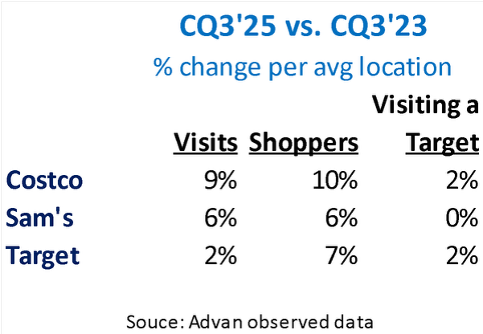

In our prior story on Target, we noted that while compelling and distinct merchandising (i.e. Tarjay) and store standards (out-of-stocks and service levels) may be inhibiting Target’s prior success, we believe their principle challenge is value perception in what we call our “extended thrifty K-shaped economy,” where (1) all consumers are fed up with the absolute level of prices, which is turning them to Costco, Sam’s Club, and Walmart, and (2) due to Target not having a full shop grocery offering. While Target does offer great value, its gross margin rate on merchandise is 27.1% (F2024), which is far above Costco’s 10.9% and Sam’s 8.6%. As such, by its business model, club offers greater value on a $ basis.

How this channel shifting looks in our data is shown in the table below. Over the past two years, the growth in visits and shoppers has been aligned for Costco and Sam’s ; by contrast, Target’s frequency-of-shop has declined. Over the period, while Costco and Sam’s have expanded their shopper base (membership), club members who also visited a Target is little changed, i.e. the incremental households, in aggregate, didn’t give Target consideration.

In our opinion, what this means in terms of what to watch and listen for when Target reports fiscal Q3 earnings on November 19th is: (1) what’s the progress in the “re-Tarjay-ification” of Target? (2) What is Target doing to grow UPTs? (3) What is Target doing incrementally to address the needs of households that hold a club membership that also shop Target, and what is Target doing to retain and increase the frequency-of-visit of these households. And (4) as it relates to its Target’s grocery business, how has market share held up post the Amazon perishables launch, our center story Amazon’s Q3 results, and how does Target plan to enhance its grocery offering.

LOGIN

LOGIN