With fiscal Q2 earnings, Target announced that Chief Operating Officer Michael Fiddelke will succeed Brian Cornell as CEO, effective February 1st, 2026. When asked what they were seeing as evidence that the business was improving, Fiddelke said that they were seeing “pockets of green shoots,” but “we need to turn those into a field of green shoots. And that’s where the teams are focused. We need to make sure the experience pays off the expectations that our guests have.“ Fiddelke’s plans for planting that field center on, “Three key priorities to help us reinforce what will continue to set us apart for years to come. I strongly believe in our differentiated place in retail. At our core, we are a style and design-led company were merchants at heart who love product and win through offering a unique assortment. So first, we must reestablish our merchandising authority in a way that is distinctly target. Second, we’re a retailer that believes that an elevated experience is every bit as important as product. We want guests to find a sense of joy from every trip to target and we must do that more consistently and frequently. And third, we must more fully use technology to improve our speed, guest experience and efficiency throughout the business.”

Many other retailers and companies have cited WFH as an inhibitor to collaboration and success, and so, it perked our ears to hear Fiddelke say, “We started redesigning large cross-functional processes like how our teams build our merchandising and inventory plans to clarify roles and access the right data to make more effective decisions. And while we still believe in the flexibility of a hybrid workplace, we’ve set the expectation that our team should be working in person more often so they can collaborate more effectively across team lines and solve problems more quickly. We’re also improving and embedding more technology and data within our team to get that work done and moving quickly to evaluate every one of our tech initiatives determining which have the highest return and are most mission-critical so we can realign resources accordingly.” (The Mayor of Minneapolis and the stakeholders of its downtown will rejoice in that “expectation” change given how activity downtown is still far below its pre-pandemic level; 2024 was only at 81% of 2019’s level per Advan data)

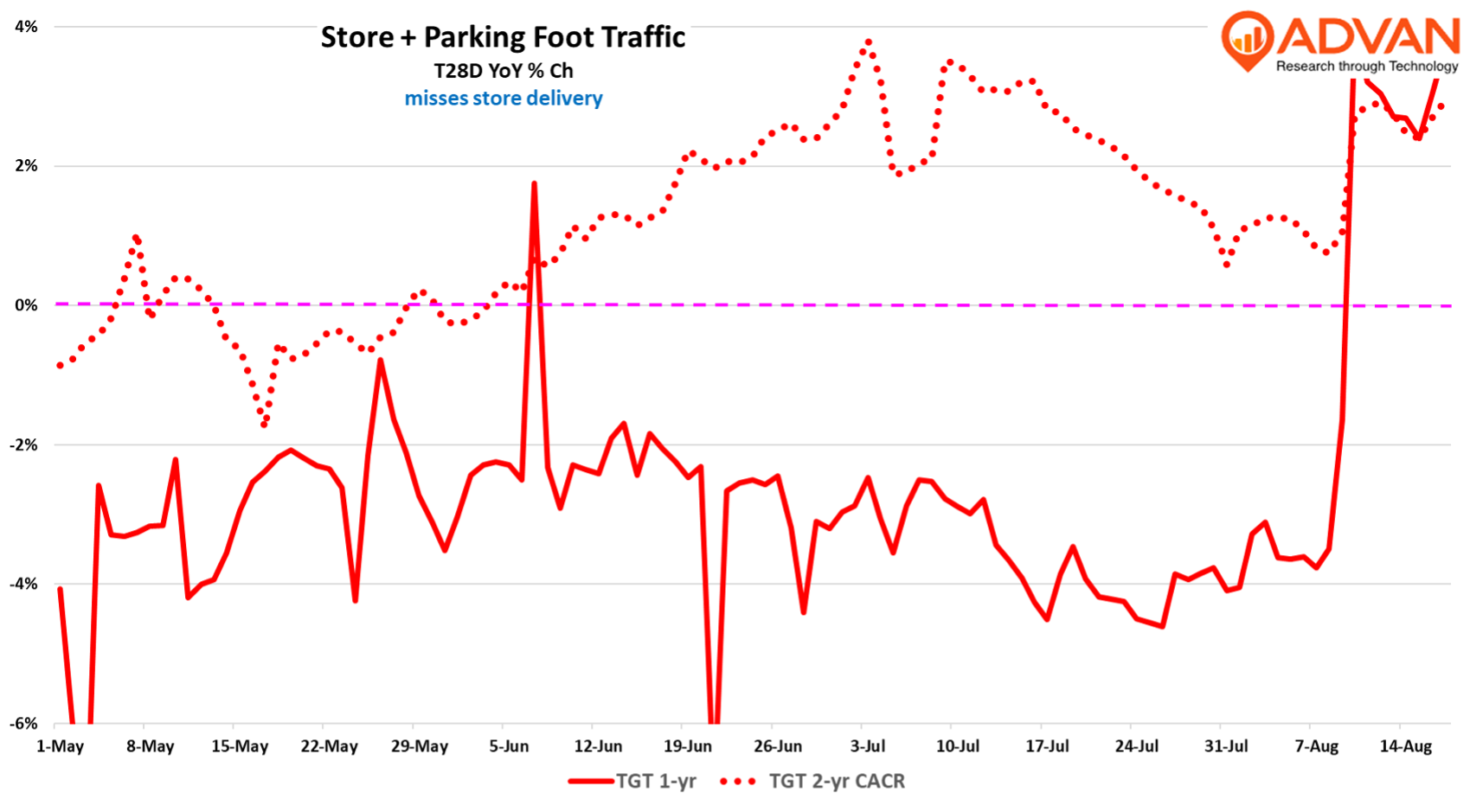

In terms of the quarter, total revenue declined -0.8% with advertising revenue up and merchandise sales down -1.2%. The -1.2% decline came from total comp-sales declining -1.9%, offset by strong new store performance and a 4.3% increase in curbside and store-delivery (+25%). The -1.9% decline came from a -3.2% decline in “inside the store” comp-sales. Less the decline in average transaction amount (-0.6%), store comp-transactions declined -2.6%. Observed store traffic (by Advan) was down -3.1%, implying some improvement in the conversion rate. As shown in the chart below, observed traffic improved throughout the quarter, especially the 2-year trend. Management shared that June+July were stronger than May, which suggests that’s where the conversion rate stepped up. If true, that is the most important green shoot in the results, as an improvement here typically precedes an improvement in traffic. Observed traffic in August is up +2.8%, i.e. much improved – management also said that back-to-school and -college were going well. Cornell also said, “We’re continuing to see improvements in quality measures surrounding the store experience, including on-shelf availability. And we continue to see particular strength in our business with guests on newness and innovation in our assortment…” However, as management didn’t increase guidance for the 2H, that implies “caution” and uncertainty as to how much of the improvement is back-to-school season and more amenable weather vs. an underlying upturn in the business to sustained transaction and sales growth. (Find our Q1 analysis here .)

LOGIN

LOGIN