- The club channel continues to thrive in today’s thrifty K-shaped economy, with the channel and its strong private brands taking meaningful share-of-stomach.

- The club channel is widening its price gaps to conventional grocers by not increasing retail prices despite commodity cost inflation, implying that the share capture is likely to accelerate.

- That share capture will lead to further volume and margin pressure on national CPG brands.

In yesterday’s note on Walmart’s results and its strategic actions, we highlighted how it was leaning into providing greater value to its shoppers by not passing through cost inflation onto its shoppers and increasing price rollbacks. (Target is doing the same.) However, where giving greater value is especially apparent is at Sam’s Club. Despite food-at-home CPI averaging +2.7% during the fiscal period, Sam’s US comp-ticket declined by -0.1%, a stark deceleration from FQ2’s +2.0% increase. Moreover, comp-sales decelerated a similar amount for every merchandise category, save home & apparel. As gross margin rate held firm at 11.7%, it implies that Sam’s leverage over suppliers is increasing, and it is the suppliers that are eating the cost inflation. Sam’s is also drawing on its growing high-margin advertising business to fund member savings. Competitor BJ’s Wholesale **Club **reported a similar deceleration in comp-sales, +2.3% in FQ2 vs. +1.8% in FQ3, and FQ3 merchandise margin was flat. Additionally, like Sam’s, BJ’s grocery comps were less than CPI. Industry leader, Costco, same story. That these three are gaining so much market share in grocery, pressuring suppliers for greater value, and moving share-of-stomach to their private-label brands is brutal for the national CPG brands, and brutal from a competitive perspective on regional conventional grocers (the segment where national CPG brands make outsized margin).

On the topic of price, BJ’s CEO Bob Eddy said, “We certainly have invested – we widened our price gaps in Q3 considerably with those investments versus competition. So I’d like to say thanks to our merchandising team for making those moves. It’s important to our company, important to our members, for sure. And we have many different levers to offset that throughout the business, not just within the margin construct. We will try and be as efficient as possible throughout the business to fund investments in member value. Certainly, some of the offsets that you might think about within the merchandising world would be being more efficient in the distribution centers, trying to be more efficient from a trends perspective, growing our retail media program, which has been growing very, very nicely, the team is doing a great job there.”

On the topic of private label, BJ’s CEO Bob Eddy said, “We are launching many new owned brands products, which are aimed at improving the member experience by offering excellent quality at an unbeatable price… Owned-brands products have a multitude of benefits as they are typically priced at about 30% below national brands while offering comparable quality of national branded items. This gives our members even more compelling value for their hard-earned dollars, which in turn drives loyalty and higher lifetime value. Owned-brands products also deliver higher penny profit for us, which we can use to invest back into the member experience, further propelling the flywheel that drives our business. We’re excited to see how our customers respond to our improved offerings.”

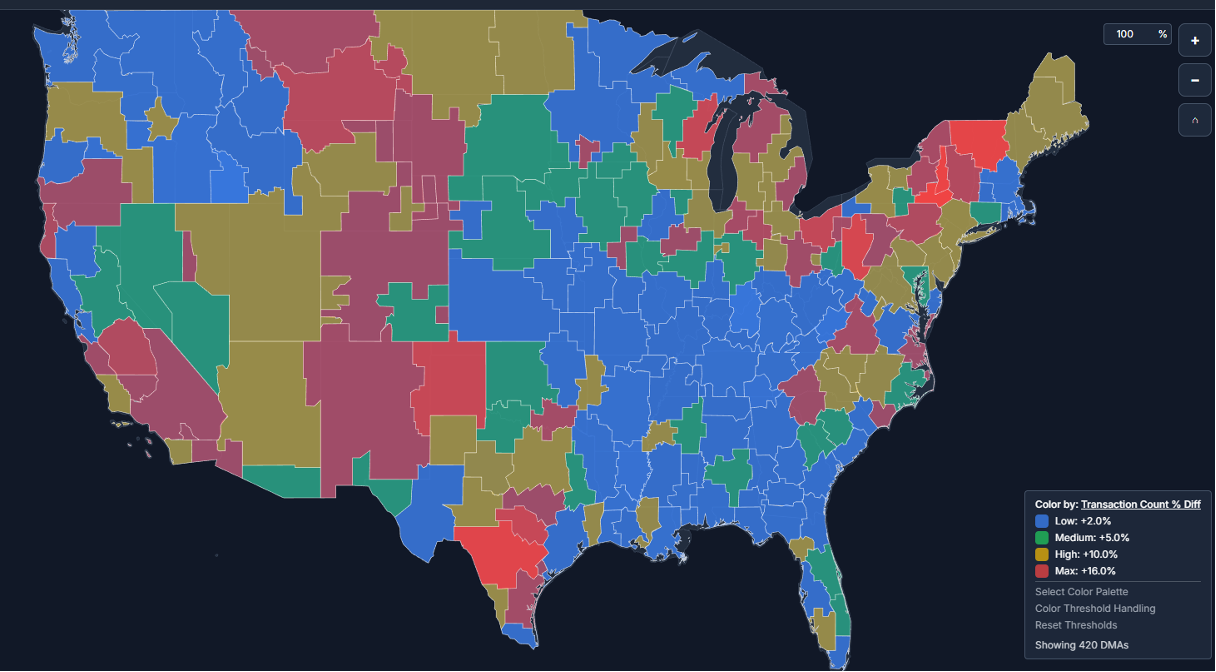

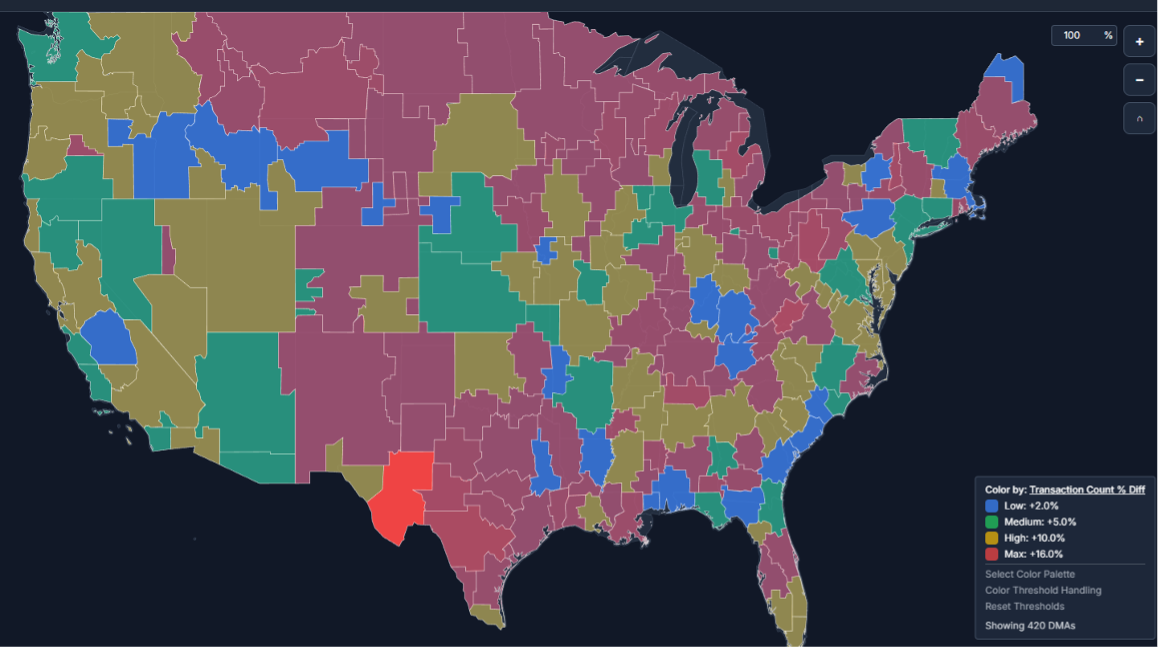

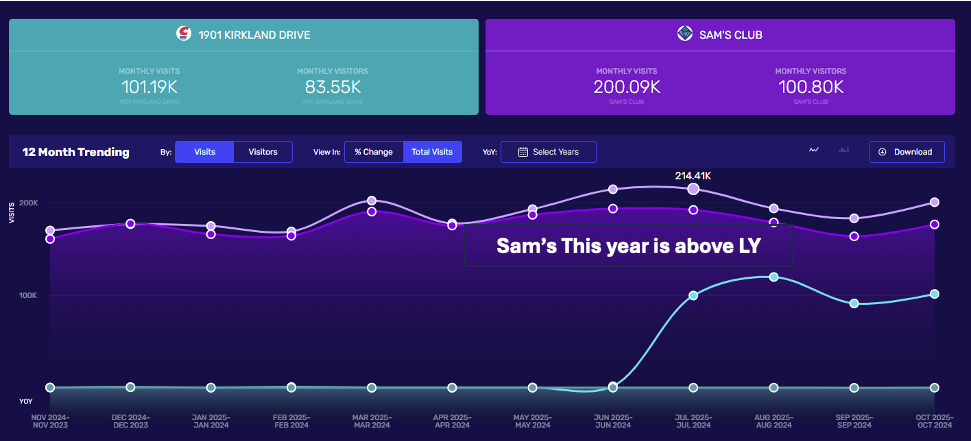

Focusing on Sam’s versus Costco, the following two panels show growth in spending by DMA around the country on a TTM basis, ending October 2025, with the rate of growth color-coded. (This is Advan’s SpendView data that’s derived from our credit card panel). Sam’s is outperforming in the Southwest and the Northeast. Costco is outperforming in Texas, Florida, and the Great Lakes region. Costco’s high growth in Odessa+Midland, Texas is because it added its first location to the market this past June. There is a nearby Sam’s Club, which we show in the third panel. Interestingly, there is nearly a 50% overlap (47.95%) in shared customers between the two, and since the opening, foot traffic for the Sam’s has increased, not decreased. The Sam’s location does twice the foot traffic (October) as the Costco, and a lot of that is frequency, with Sam’s monthly frequency at 1.98X vs. Costco’s 1.21X.

LOGIN

LOGIN