- Dollar store results for the 2H are coming in strong despite pressure on the lower-end consumer. The outperformance is the result of strong execution on Retail 101 fundamentals by new management teams.

- Tariff cost pass-throughs, better in-stocks, and better assortments are driving the comp-ticket. Improved store standards, consumer trade down, and increased social media marketing are driving comp-traffic.

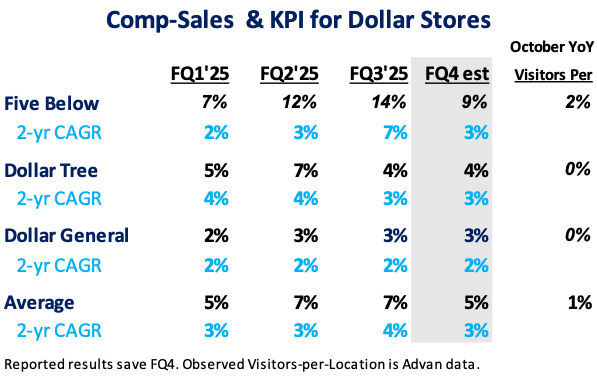

Despite the widely reported pull-back in spending by the less-affluent during the September – November period, for FQ3, the dollar stores reported comps in line with expectations, resulting in consistent 2-year trends, save Five Below, which again, reported blow out results; that stems from selling purely discretionary merchandise driven by a rocket-fueled toy / merchandise trend of Lilo & Stitch, K-Pop Demons, and SpongeBob. (This has happened several times in the past – Fidget Spinners, Squishmallows, etc.) No competition from Temu also helped (as they would have been very involved in the collectables / toy category). Additionally, all three retailers have new management and “back-to-basics” / Retail 101 initiatives. Back-in-the-office has also improved execution and coordination on delivering exciting merchandise. The better top- and bottom-line financial results demonstrate that all three are connecting on the 101 initiatives. Five Below’s growth in visitors-per-location is also very impressive, especially as the increase would be higher on a comp-basis. The same applies to Dollar Tree and Dollar General; but the gains that they are making in higher-income households are masked by softness in lower-income households.

Five Below CEO Winnie Park shared, “The second [growth] pillar is delivering a connected customer journey, acknowledging that awareness begins on digital channels and social media and ends with an amazing in-store experience. By curating compelling stories in social that lead our customers to pre-shop on our website, culminating in a trip to our stores… In terms of the marketing change, what we’ve done is actually redirect the spend into channels that we think are most relevant with young customers. And so while we were doing social, for instance, before, we’ve distorted the spend in social and really gone after better-curated storytelling in conjunction with our merchandising team. So it’s really merchandising and marketing working in unison.” For context, Temu spent around $2B on social advertising in the US in 2024; Five Below’s entire advertising budget was $64M in 2024. While Temu didn’t directly compete with Five Below on like-for-like merchandise, they did compete with Five Below for impressions on TikTok, Instagram, etc. Temu was willing to pay more per user engagement / action than anyone else, be it Five Below, Party City, Etsy, or Walmart Marketplace. Park also said, “The key to our execution is the way we work cross-functionally with tight coordination between merchandising, supply chain distribution, marketing, and stores.” (The back-in-the-office driver of better results.)

Five Below’s CFO Dan Sullivan said, “Largely, over the course of the quarter, the monthly year-over-year growth is fairly consistent, if you think about it relative to our guide range and our midpoint. You don’t see month-over-month spikes. A lot of that, obviously, is what we’re cycling from a year ago, but it’s a fairly consistent growth pattern… If go backwards to the start of your question on Q3, you would see actually a very – very similar trend in terms of comp growth. And I think what excites us the most is that our performance, and I’ll define that particularly as I think about traffic growth, actually strengthened as the quarter went on. So we exited the quarter with traffic growth month-over-month at the highest level we had seen. So all in all, we’re in a really good place, and we think we’ve got a really good view on fourth quarter.”

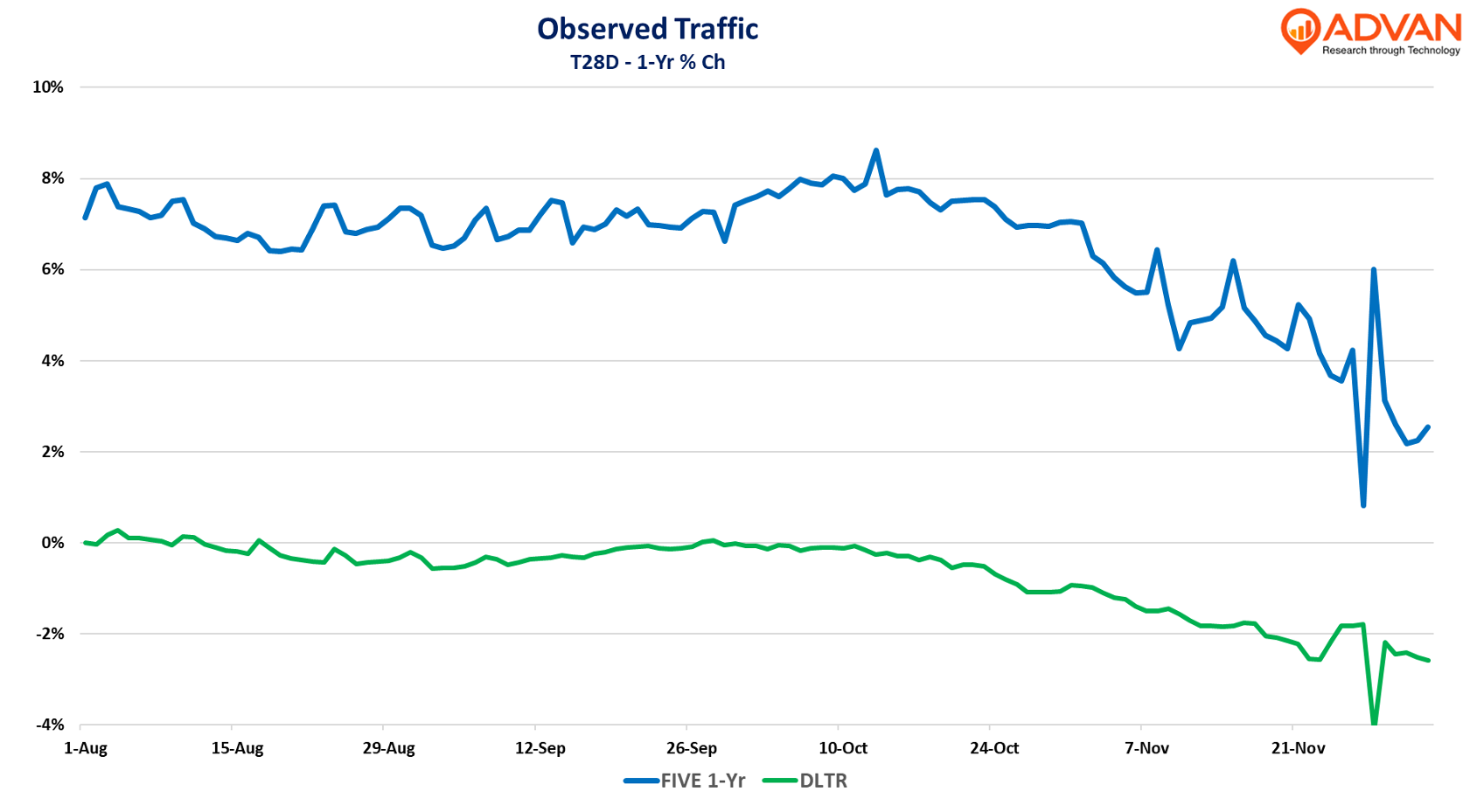

As shown in the chart, Advan’s data supports Sullivan’s characterization; however, November has decelerated. Comp-ticket was +7% for FQ3. Should the remainder of FQ4 run at a +4% comp-transaction level and the FQ3 +7% comp-ticket repeat, combined, that would deliver a +11% comp-sales increase – well above management’s +6-8% guidance range.

Turning briefly to Dollar General and trade-down, DG’s CEO Todd Vasos said, “We’re pleased to see growth once again in our total customer count with disproportionate growth coming from higher income households.” Notice he said “disproportionate,” implying that it’s down elsewhere; Advan data suggests that more than 40% of Dollar General visitors have HHI above $100K. That general merchandise categories (+4%) outperformed consumables (+2.5%) also likely reflects this change in customer mix, with “higher” willing to put discretionary items into their shopping baskets. DG’s partnerships with DoorDash and UberEats are likely contributing to this outcome, with the “higher” willing to pay the 3P delivery fee. Turning to Dollar Tree and merchandise mix / trade-down, CEO Mike Creeden said, “Let me start by framing the quarter at a high level… First, I’d like to highlight the strength of our discretionary business which showed its first positive year-over-year mix shift since Q1 of 2022. We believe this strength illustrates how our exceptional value proposition, including our growing multi-price assortment, is resonating with our shoppers by helping them meet their needs and desires in the budget-constrained environment that many consumers find themselves today… Dollar Tree continues to gain share and attract new shoppers while continuing to serve its large and loyal base of core customers… We had 3 million more households shop with us in Q3 this year compared to Q3 last year. Approximately 60% of these incremental shoppers came from higher-income households, those earning over $100,000, 30% from middle-income households, those earning between $60,000 to $100,000, with the rest from lower-income households, those earning under $60,000.“

Creeden went on to say, “While the average per household spend for our higher income customers is currently lower, even given their higher income, larger average basket size and ability to spend more, this is a simple function of trip frequency. Because many of our higher-income customers are still early in their relationship with Dollar Tree, their purchase frequency has significant room to grow. Over time, we believe that growing trip frequency among these higher-income customers, given their propensity to build bigger baskets, will be a powerful growth driver for Dollar Tree. This is why our brand promise matters so much right now. We make it easier for customers to do more with less without trading down on quality or experience and that is what keeps our traffic and baskets healthy in a cautious consumer environment.” Looking at Advan data for October, we see a modest increase in trip frequency. However, looking at shopper income and visitors in Q3, Advan data shows a slight decline in visitors as a % of the total above $100K HHI and a modest decline in median HHI on a YoY basis and a QoQ sequential basis. Should Creeden be right of the potential, these figures should move higher in the quarters ahead.

In terms of the quarterly cadence, Creeden said, “Comparable sales increased 4.2%, a nice acceleration from the quarter-to-date trend of 3.8% we shared in mid-October. As the results suggest, October finished strong, driven by momentum in our multi-price assortment and a great Halloween. Our Q3 comp was all ticket-driven as traffic was slightly negative.“ Advan’s observed visits for Dollar Tree match this pattern. We suspect that the lull following Halloween is just the normal seasonal lull before the Christmas Holidays get moving. Moreover, we are not concerned about the Dollar Tree’s softer Black Friday Weekend. That weekend is less of a thing for dollar stores than other retail brands / categories. For Dollar Tree, daily traffic for Friday – Monday averages only 7% more than earlier in the month; by contrast, Best Buy’s Weekend average is 72% higher and Dick’s Sporting Goods is 60% higher. Five Below is in the middle at 30%.

LOGIN

LOGIN