Given slow drip inflation, a worrisome jobs market, and student loan repayments, we were pleasantly surprised that trends for both Lux and mass beauty have recently improved after a soft ’24 and 1H’25 per the Q3 results from L’Oréal, LVMH, Estée Lauder, and Procter & Gamble. Encouragingly, we also see the improvement in observed traffic and spend at Ulta. What’s going on? And what does it mean for the category’s big season ahead?

Well, the beauty category was disrupted in ’23 and ’24 by the brands opening up to Amazon, the rapid expansion of Sephora at Kohl’s, the fallout in drug retail, as well as the bad macro for the younger and aspirational consumer. While Amazon and Kohl’s were initially a benefit to the suppliers from sell-in, it also meant that there was excess inventory at retailers that lost traffic. As such, for those retailers hurt, there was a loss of sell-out, leading to a decline of sell-in. For Ulta, all of these disruptors hurt (save drug retail). However, the disruptors are now in the base periods and no longer “incremental.” As such, Ulta is now comp-ing the “new normal.” Additionally, Ulta is undergoing a “makeover” program by a new leadership team.

The makeover, called Ulta Beauty Unleashed, includes:

- A new leadership team

- Sharpen the execution and get back to the basics of running excellent stores that are easy to navigate, fully stocked, appropriately staffed, clean, and inviting (i.e. this is really a back-to-basics move like what Lowe’s went through in 2018 and what’s underway at the dollar stores)

- Optimize ways of working and streamline our cost structure

- Further investments in brand building with a particular focus on exclusive, emerging and established brands

- Deepen guest engagement through accelerated personalization, increasing automation, and real-time content across digital channels

- Accelerating our focus on wellness, and

- Launching a new marketplace for 3rd party sellers and brands.

In September, head of stores Amiee Thomas updated investors on the progress of Beauty Unleashed, “We’ve launched new brands, several new brands, 43 new brands, many of which are exclusive brands to Ulta Beauty. Our in-stock levels are better than they have ever been, and that has really been driven by process changes upstream and collaboration that’s happening within our corporate teams within merchandising, marketing, and retail operations… We’ve launched and we executed 30,000 events in our stores this last quarter and are tracking to do over 70,000 events this year, which is 40% more than we executed against last year. And our guests are telling us they’re noticing. Our NPS scores are growing year-over-year, and our guests are taking notice and loving what we’re doing. Within the accretive business category, we launched an expanded wellness… We’re also seeing lift in conversion in our loyalty member growth as well as our NPS scores. So we are doubling down on our Ulta Beauty Unleashed program because we know that, coupled with our unique model, it is going to deliver success and growth for not just this year in 2026 but for years to come.” And so, lots of positives there. We also see progress in Advan’s data for Ulta.

In reference to the Sephora at Kohl’s disruption, Thomas said, “We saw in the last couple of years, quite a bit of competition… surged into the market, and we have started to see that slow. When we look at our stores, we are seeing consistent and solid performance across our entire fleet. 90% of our stores experienced a point of competitive distribution. One or more show up in close proximity to them in the last two years; that means 10% did not. When we look at the 90% versus the 10%, we are seeing an equal amount of strength in the performance of that 10% as we are to the 90%, which tells us that the Ulta Beauty Unleashed strategy and all of the things that we’re doing are working.”

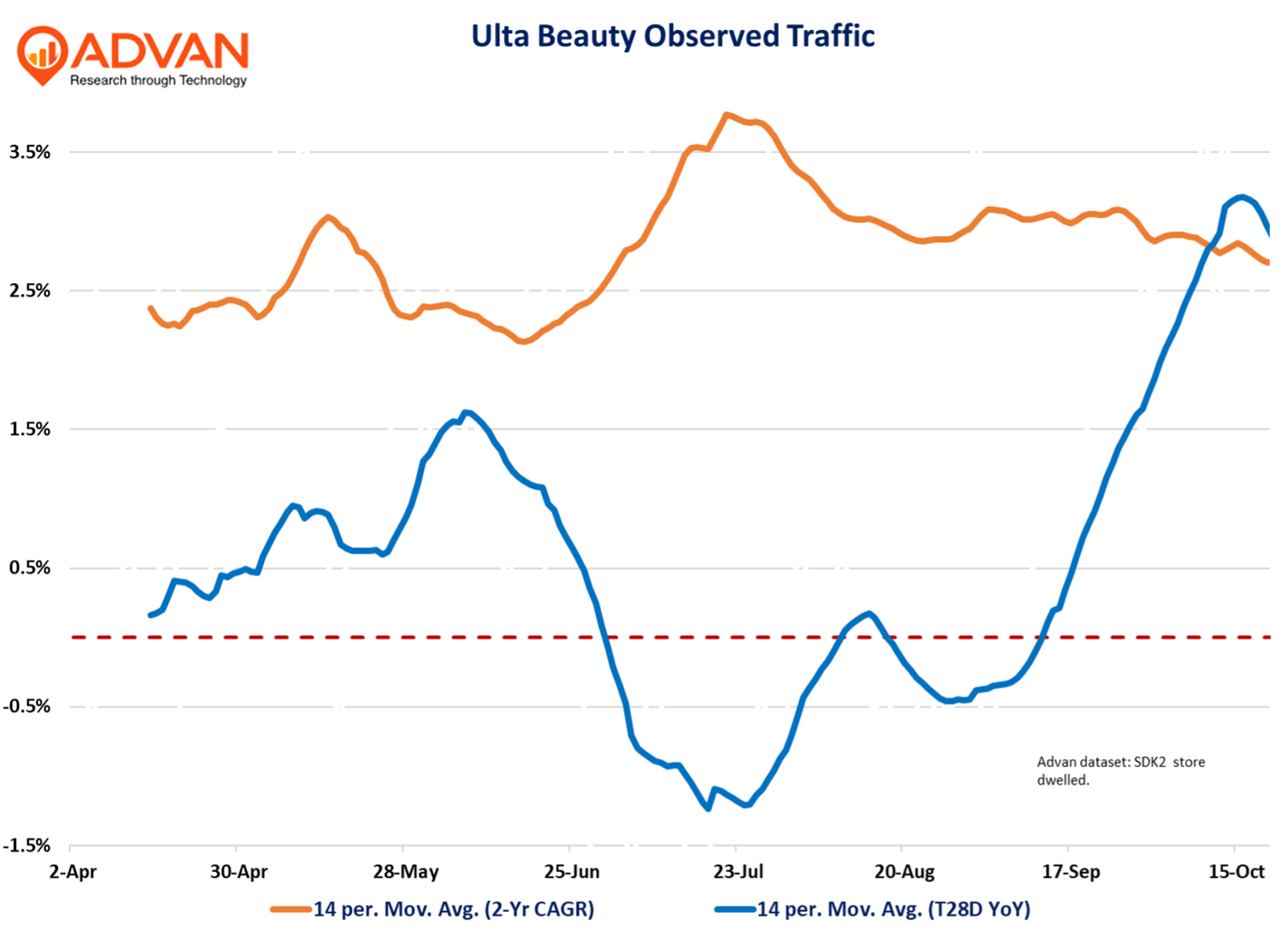

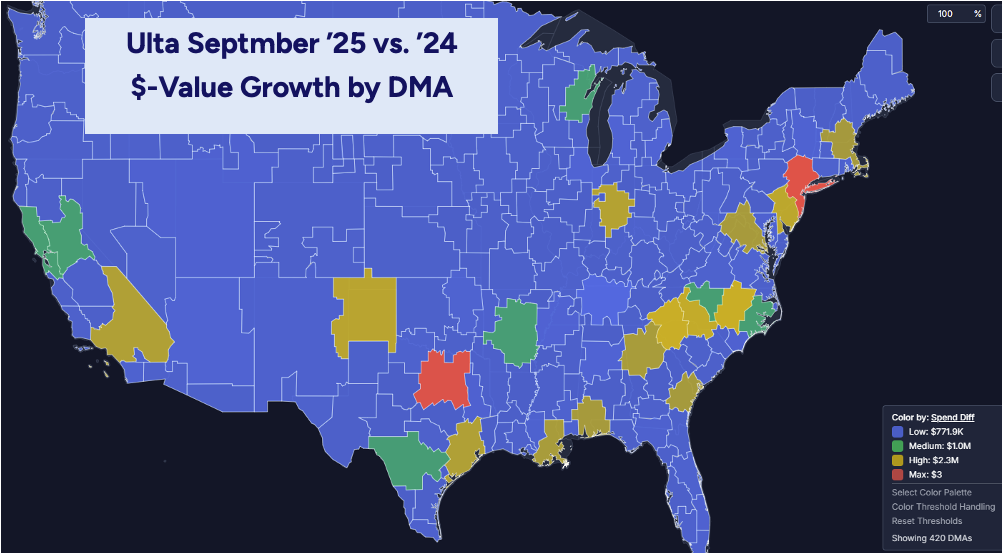

Per Advan, observed traffic is improving on a 2-year basis as shown below. We also see a slight improvement in dwell time and visitors per location for CQ3. An increase in dwell time is typically aligned with improvements in conversion rate and basket size (UPT). Advan’s observed transactions show a slight improvement in conversion and a very nice increase in average transaction size. The second figure shows that Ulta produced outsized growth in key markets like New York, Atlanta, Jacksonville, Austin, Houston, the Bay Area, Los Angeles, and North Carolina. As such, the Beauty Unleashed makeover is contributing to solid improvements in Ulta’s key business metrics, as Andreeva stated.

Turning to the brands, not only are the organic sales results better, but we read between the lines a more constructive tone as it relates to brick-and-mortar. Moreover, L’Oréal, LVMH, Estée, and e.l.f. are all ramping up innovation, investing more in top-of-the-funnel marketing, and expanding brands in brick & mortar, which aligns seamlessly with the Ulta Beauty Unleashed strategies. Taken together, we wouldn’t be surprised if Ulta printed a blowout holiday quarter (Q4’s comparison base is also easier). On the upcoming holiday, Amiee Thomas said, “So as we think about what we have, we have a very exciting lineup of newness coming… You’re going to see us show up in really big and bold ways in the fourth quarter connected to holiday. And then, of course, with holiday, we always have really the great uniqueness, the exclusives that we have that you can only find at Ulta Beauty… We feel very confident that although the consumers might feel a little uncertain, we’re doubling down on the areas that make us different. And we’re the place to shop from low deluxe, and we have that because of our model, we’re going to be able to take care of any guest and whatever it is that they need and the pressures that they’re feeling from a gifting or self-care perspective… We are low to Lux and we can flex with the wallet of our consumer.”

L’Oréal’s CEO Nicolas Hieronimus shared, “We’ve indeed seen the real acceleration of the North American and particularly the U.S. market… over the summer, and our outperformance has increased, particularly in Consumer Products where we were below market for the beginning of the year, and we have accelerated. So if I look at the total beauty market… the Q1 was flat. Q2 was at plus 2%. And Q3, which was around 3.9% or close to 4%. So it’s a real acceleration of the market. And we’ve been indeed outperforming the market in North America, thanks to an acceleration in mass, a continued stellar performance in… the Professional Division (salon products)… [A]s you can hear, I’m pretty bullish for the U.S., and I’m very happy with the performance of our CPD teams, which is, of course, helped by a fantastic comeback of L’Oréal in makeup, continuous performance in hair care…”

Hieronimus went on to say, “Beauty has to play its role of bringing a smile on people’s faces and we have to do our job in tempting consumers with exciting stuff. And – we hadn’t been doing it enough in the prior year because probably there was tailwinds that we’re carrying the market. Now we have to carry the market, and we do it. We do it both through the launches that are being launched now and that will – most of them being successful carryover for next year. And we, of course, that’s what I’ve spent my days right now in the meeting is reviewing the plans. We have strong plans for 2026. So we want to keep that pace very clearly… So beauty is a category where you need the brick-and-mortar experience. To smell, to touch the textures, to discover the brand and have the full experience, but it’s also a category where when you fall in love with a given product, whether it’s a new mascara, which is whether it’s a fragrance you love, the capacity to replenish and sometimes to discover for categories that are a bit less sensorial, there’s a perfect complementarity… And that’s how we grow our brands, making sure, of course, that their equity is absolutely well served and protected in every channel we operate in.”

To the point on brick-and-mortar, LVMH CFO Cecile Cabanis on Sephora said, “On Sephora U.S., Sephora U.S. performance was very strong (twice the market). You have to keep in mind that Sephora is everything, Amazon is not, because Sephora – the model of Sephora is really it’s a destination. It’s where you can find brands 1 or 2 only at Sephora. And it’s where you have beauty consultants and where you have brands. People that don’t say, I will buy some Amazon, but they will say, I go to Sephora. So it’s a very different model. And again, we have a Q3 where – and also in the U.S., both the traffic and the average basket have increased… So today, for us, it’s very simplistic to compare us to Amazon because we are very different. We are very different, and we are overperforming in all our stores. It’s all about stores and a destination for us.”

Estée is also undergoing a makeover with a new management team, led by CEO Stephane de la Faverie. On its CQ3 improved performance in the US, he said, “Our retail sales growth accelerated sequentially. In the quarter, we grew 8% in Skin Care versus the category up 6%. The Ordinary drove our share gain in skin care, while we also gained share in Hair Care led by Aveda… In the US, the most significant part for us was actually the market share gain in units that is showing that we are bringing new consumers to the company and to our brand. And if you remember, that’s part of Beauty Reimagined, it was really important for us that we are investing in the demand generation at the top of the funnel to just bring new consumers to our brands. So I think we’re seeing the momentum from a unit standpoint going on. Obviously, it’s driven by also macroeconomic trends that’s where we see a lot more demand at the entry of Prestige, and we’ve seen a strong acceleration with The Ordinary… Looking ahead, for the balance of the fiscal year, we continue executing on our action plan priorities, including investing in exciting holiday activation and expanding consumer coverage. As announced yesterday, this includes M·A·C entering U.S. Sephora spanning select stores…, which allows us to better connect with younger consumers and accelerate M·A·C turnaround in the US.”

Our conclusion from all of these comments – we expect the category and its retailers are going to have a strong holiday season based upon the increased newness, marketing, merchandising, and clientelling noted above and renewed “back to the basics / details” approach by its leading retailers, and certainly stronger than the 1H’s +3%.

LOGIN

LOGIN