McDonald’s reported a much-improved US comp-sales increase of 2.5%, a 510bps QoQ improvement. Advan data estimates that traffic improved 200bps QoQ and that ticket improved 300 bps to a +2.1% increase. The 2.1% increase is less than inflation (CPI) at 3.5% indicating that McDonald’s is underpricing the market in order to amplify its value positioning; we know that they are aggressively messaging “McValue” deals. CEO Chris Kempczinski said, “Overall, we’ve made good progress with our value offerings. The $5 Meal Deal continues to resonate with consumers as we recently celebrated the 1-year anniversary of the program.” Advan estimates their average check at $11.52, which is notably less than Burger King’s $13.70. Advan data estimates that McDonald’s visits-per-location increased 1.2% in Q2; whereas, Burger King traffic increased 50bps less. (That the increase in McDonald’s average ticket and visits (+3.3%) exceed the comp-sales increase (+2.5%) is a function of these figures being estimates and different underlying data sets.)

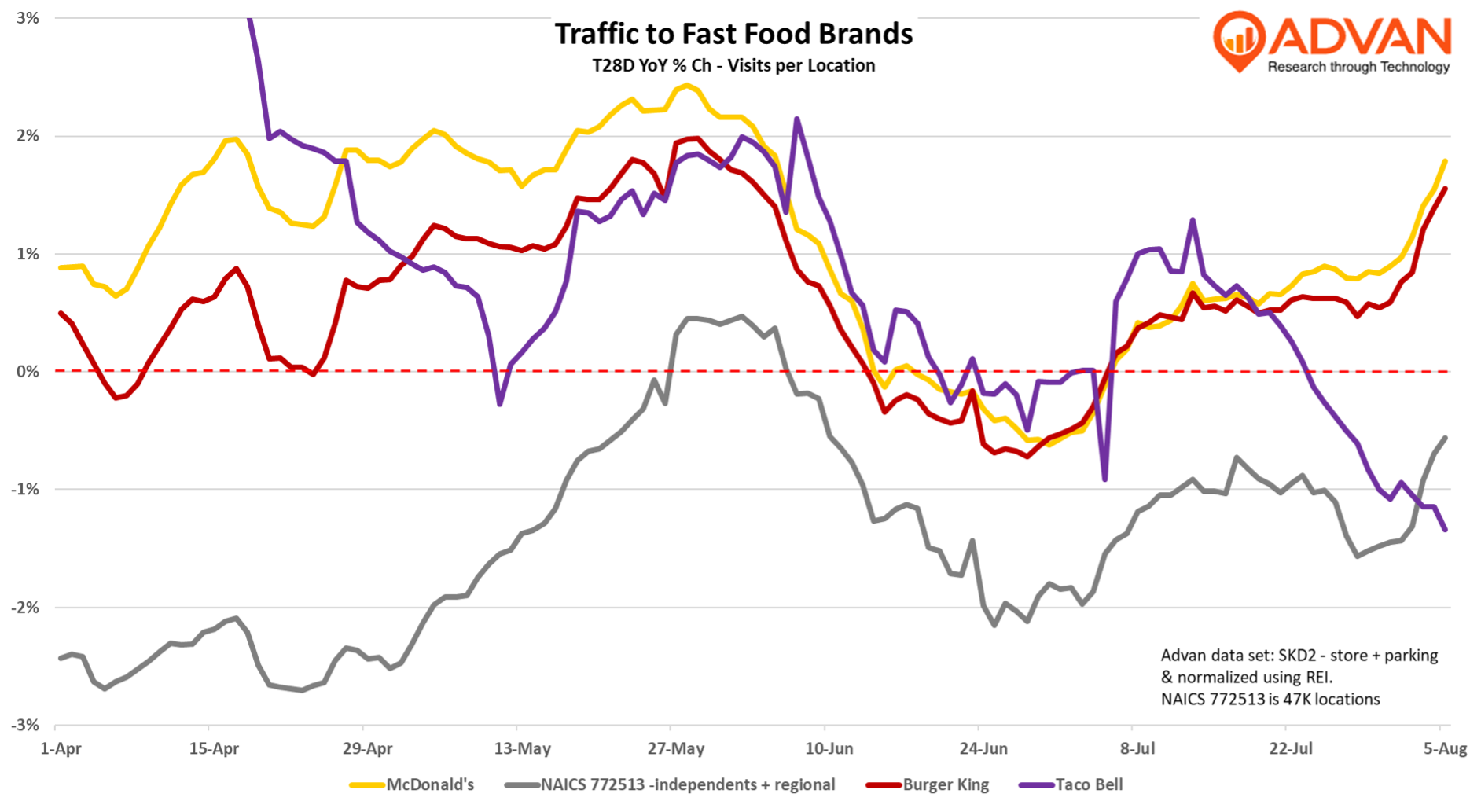

Advan’s NAICS code for the industry contains largely regional and independent limited-service restaurants; traffic to it declined -1.5% for the quarter and that’s the range that other data providers also peg the industry at. As shown in the chart, July has improved from June’s swoon, except for Taco Bell. Versus its competitors, McDonalds drove outperformance due to the Minecraft promotions, successful menu innovation (McCrispy Strips and $2.99 snack wraps), its value messaging, and a resonating loyalty program.

On the loyalty program, Kempczinski said, “Roughly one-quarter of our business in the U.S. is on our loyalty program. And what we see is, if you are a loyalty member at McDonald’s, we have exceptional value and affordability scores amongst those consumers. And probably that’s most evidenced by what I shared in the prepared remarks, which is the uptick that you see in terms of frequency when we have a loyal consumer in our loyalty program going from roughly 10 visits to 26 visits. So I think with our loyalty members, our most ardent McDonald’s customers, we’re in a really good position as it relates to value and affordability perception. If you move then to the McValue program, McValue is working. And if you think about what we have with McValue, we have the $5 Meal Deal, which is the anchor for that. That continues to perform very well for us. And then we also have the Buy One, Add One for $1 program. What’s interesting is those two programs are very complementary.” Advan data estimates that McDonalds was able to boost frequency of visit (i.e. loyalty) by +3.5%, far outperforming the industry which is broadly experiencing declines in visit-frequency.

McDonald’s management again emphasized that visits for the lower-end consumer for the category are down meaningfully; however, Advan + Personal live data for McDonald’s dispel that notion and point to declines by higher-income households, which is what we presented to UBS clients two weeks ago. The cohorts Ultra Wealthy Families, Wealthy Suburban Families, and Upper Suburban Diverse Families compose 25% of McDonald’s visits, and likely 40- 50% of sales; in Q2, visits to these were down -0.3% vs. the +1.2% overall. Our explanation for the decline remains that it’s due to wellness trends, GLP-1 usage, and share-of-stomach shift to food-at-home. Looking at visits to McDonalds by day-part for the work week, dinner was the softest and lunch outperformed dinner by 360bps. This is the daypart that would most likely be impacted by the switching to food-at-home. It’s also where one is lining up across from their spouse which may compel one to hold true to their dietary promises.

Switching to Yum Brands, Taco Bell’s US comp-sales increased by 4%; Advan data estimates that visits-per-location increased by +0.9% and ticket by +2.8%. By contrast, Pizza Hut and KFC US comps-sales each declined by -5%, reflecting a sequential deterioration and more market share loss. For background, Yum has named their turnaround strategy for KFC, “The Kentucky Fried Comeback Campaign.” Being “Chicken” isn’t its problem; for example, Taco Bell’s total chicken sales have grown over 50% over the last two years, and management cited room for further momentum as Crispy Chicken becomes a permanent next year. “More chicken” has also been a meaningful turnaround driver for McDonalds’s. As such, KFC issues are more brand, product, and value. Looking ahead, KFC aims to increasingly focus on attracting younger consumers by leveraging bold and creative innovation and marketing, as seen with the UK’s launch of Dirty Louisiana Burger and partnership with Limitless Live. Plus, more sauces, sauces, and sauces.

LOGIN

LOGIN