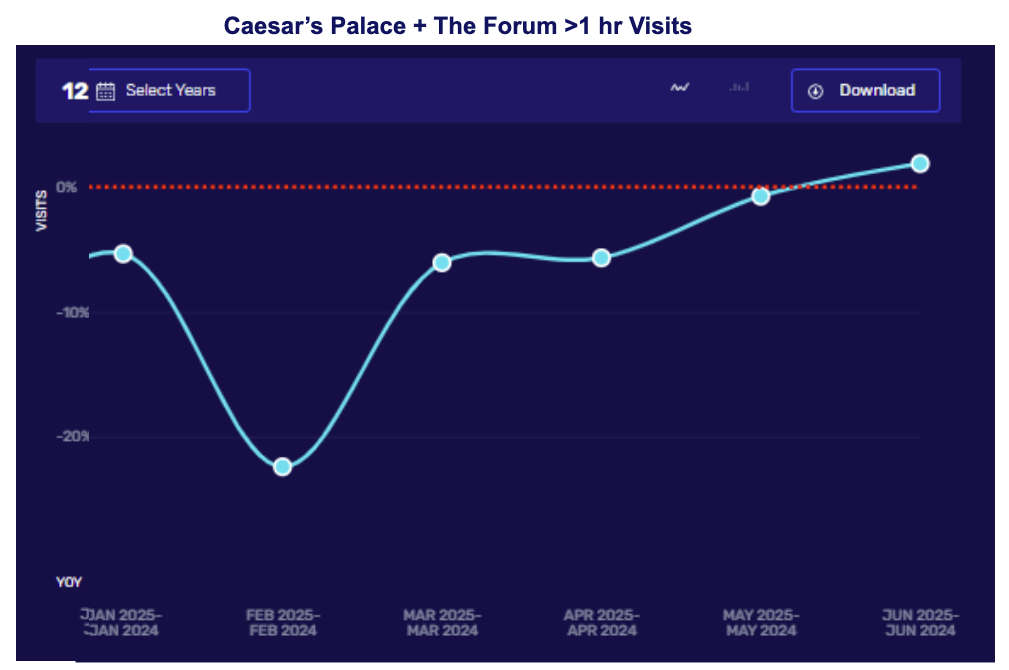

As the data implied, Caesars Entertainment’s Las Vegas segment results were down for Q2, including table drop falling -5%, food & beverage down -6%, other down -9% (which is last year’s strong concert programming), hotel occupancy down -190 bps, and EBITDA down -9%. That said, the higher-end (we put Caesar’s Palace in that category) pulled higher going through June, as shown in the chart below. (We filter for >1 hour visits when trying to estimate hotel and casino revenue. Also of note, the soft February is the comp to the Super Bowl.) In contrast to improvement for the higher-end, the mass-end of Vegas is having a far softer summer with the downward trend steepening.

In describing demand and the quarter, CEO Thomas Reeg said, “We started with a strong April, but May and June started to decline booking window, contracted booking window in Vegas is about as short as I’ve seen it at this point… Entertainment is we were missing in gaming. Recall, we had both Adele and Garth Brooks in last year’s second quarter, didn’t have them this year, missed out on some high-end trips that tend to resurface at other points during the year. But Vegas started leaking as a market kind of end of May that leak accelerated into June. I’d expect third quarter to be soft, but in the last 3 weeks or so as we monitor forward bookings, bookings have stabilized… But make no mistake, the summer is soft in Vegas. I would expect something in the third quarter that looks like the second quarter on a comparative basis.”

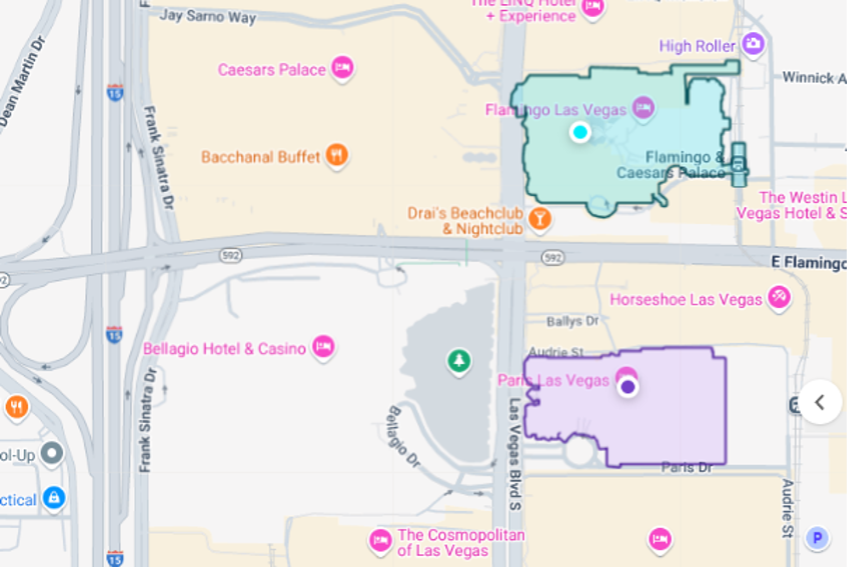

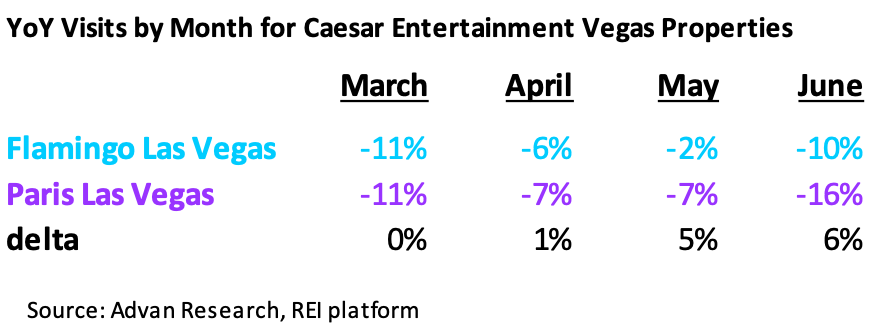

New attractions continue to be a driver of visitation; in May, The Flamingo opened its Go Pool – a $20M renovation that promises to be a hotspot for “high-energy parties” for the pool season. For May and June, the +1hr visits metric for the entire location (shown in the below geofence figure) strongly outperformed its sister property – Paris Las Vegas’.

LOGIN

LOGIN