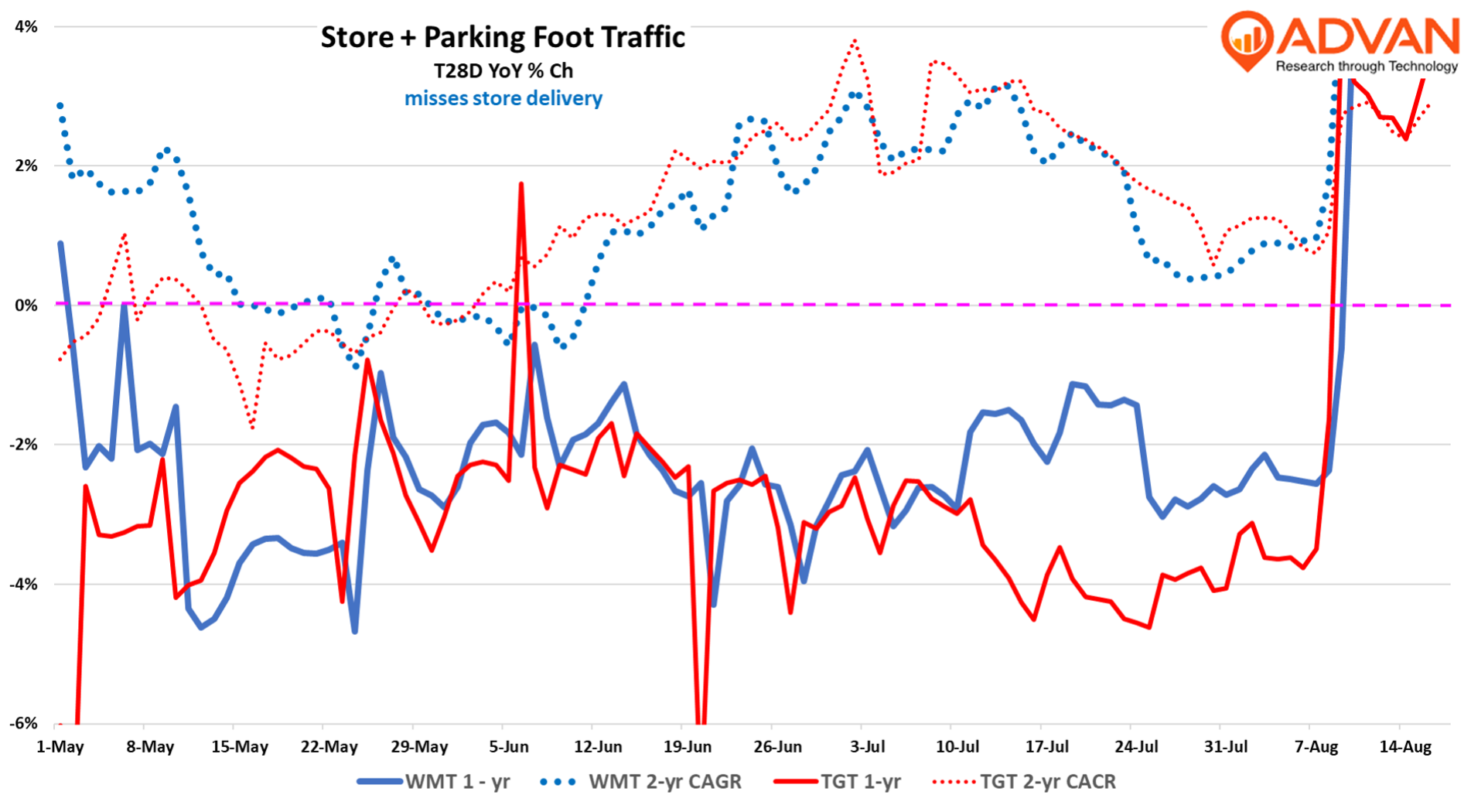

Thirteen years ago, when the lower-income and moderate consumer was under a lot of economic and budgetary strain, and Walmart was less “considered” by more affluent households, the US business was only able to deliver a +0.5% comp-sales increase (2011- 2014) and WMT’s valuation multiple was only 13X (price-to-earnings). Since then Walmart (and Sam’s) has gone through a “contemporization” of increased enhanced / enriched merchandise assortment, increased convenience (curbside, store delivery, in-stocks, .com, assortment), and overall **increased enterprise confidence. **Additionally, the current consumer preference is for being thrifty, by all income strata. Walmart contemporiztion has allowed in to tap into affluent households, thus increasing its addressable market, which has resulted in sustained +4.5% comps and a 36X valuation multiple. Additionally, one of the weights on Walmart’s valuation back in the 2010s was fear of competitive disruption by Amazon. Well Amazon is only getting stronger, and it too, just reported a very strong Q2. This contemporized-Walmart has also largely shake off any fear; however, that’s not true of other retailers, especially Target. And so, what do Walmart’s Q2 results (along with Advan data) show to support the case for ongoing success and a premium valuation? To keep it brief, we will keep this discussion to Walmart US (and call it just Walmart) and we’ll come back to Sam’s Club, which is also doing fantastic, on Monday. And, what about Target? But before we get into the detail, let’s set the table on what Walmart said about the US consumer as well as share what we see in store-level traffic. CEO Doug McMillion said, “Walmart U.S. sales were stronger than we expected when we started the quarter… As it relates to what we’re experiencing with customers and members here in the U.S., their behavior has been generally consistent. We aren’t seeing dramatic shifts. The way things have played out so far, the impact of tariffs has been gradual enough that any behavioral adjustments by the customer have been somewhat muted. But as we replenish inventory at post tariff price levels, we’ve continued to see our costs increase each week, which we expect will continue into the third and fourth quarters. Not surprisingly, we see more adjustments in middle and lower-income households than we do with higher-income households. In discretionary categories where item prices have gone up, we see a corresponding moderation in units at the item level as customers switch to other items or in some cases, categories… Back-to-school is usually something of an indicator of how the holidays will go, and we feel good about how it went for us in terms of units and dollars sold and inventory sell-through at both Walmart and Sam’s Club. We had our Walmart U.S. store managers together last week for our holiday planning meeting where they got to see many of our new items in pricing for the upcoming season. We liked what we saw and heard, and we like our position for the back half of the year. We’re expecting to have a good holiday season at Walmart.” Looking at store traffic, August has been much stronger for Walmart (and Target). Walmart reported comp-store transactions declined roughly -2.7%; Advan observed visits declined -2.5%, or roughly in line with the reported figure. (See our review of July retail sales and back-to-school here .)

Walmart reported a +4.6% comp-sales increase, which equates to $5,191M in additional sales. Digitally-originated sales (on Walmart.com and the app) contributed +$4,845 of the increase, and inside-the-store sales contributed +$346M (or +0.4%). Advertising revenue grew +31% and that is captured in the $4,845; if we assume that advertising contributed +$545M, excluding that, the growth was $4,200. The strongest contributor to digital- was store delivery, which increased +50%, or +$2,500 of the $4,200, per our estimate. Additionally, we estimate that curbside added +$782M. As curbside and store-delivery depend on the store, this is really “store” revenue and comp-sales, and their combined contribution of +$3,282 of 78% of the growth.

It is the curbside and delivery channels, i.e. convenience, that are capturing the more affluent household, which is powering Walmart’s comp-sales above its historical precedent. Moreover, there has been no diminution in their contribution to growth this year, and so one should expect that to continue for the 2H. Walmart CFO Jon David Rainey said, “Speed of delivery is important to customers, and we’re continuing to get faster. Approximately 1/3 of deliveries from store in recent weeks were fast delivery in 3 hours or less, reinforcing the value of our store network and driving speed and 20% of those deliveries arrived to our customers in 30 minutes or less.” This capturing of affluent households is one of the larger encroaching factors for Target (comp’ed down -1.9%) and an issue for its new CEO to address ; i.e. how does Target light up Target Circle 360?

Looking at just general merchandise, Walmart’s increased around +1% on a comp-sales basis; whereas Target’s declined by about -2.6%. Where Walmart is finding advantage is: one, its rising confidence to increase the quality and style of the make, which is resonating with its shoppers. And two, taking the learnings from its rapidly growing marketplace business (+20% YoY) and its third-party sellers, which informs Walmart about what’s working from a category / style perspective, but also what to assort into its stores from a regional / trade area perspective, i.e. more micro-merchandising at scale. These are contributing to increased units and units-per-transaction (UPTs) / basket size. US leader John Furner said, “Our fashion business, in particular, has been great. More and more customers are choosing Walmart as a destination for fashion, and that’s exciting. We’ve had growth across the board from shoes to ladies to men’s, kids, and baby. We have done a lot of great work in style. We have done a lot of great work on our inventory.” Lastly, Target’s general merchandise comp-sales increase also looks like it was hit by fewer tariff cost path-through given the merchandise margin performance; Walmart expanded its gross margin rate by +26bps; by contrast, Target’s merchandise margin declined -270bps (clearance was also a headwind). Per Target, incoming CEO Michael Fiddelke spent a lot of time on his earnings call speaking to getting the Tarjay back and firing like a machine gun, both on singular launch events, but more importantly, on the everyday items and store visits. In retail vernacular, this is called “retail is detail.”

Walmart has a vastly different sales mix to Target, dominated by grocery and including a large pharmacy business (Target only receives a fee on the CVS business inside Target). Walmart’s Health & Wellness business increased by +$2B in the quarter. Excluding that contribution, Walmart’s inside-the-stores comp contribution shrinks to -$1.7B, or a decline of -1.5%, which compares to Target’s -3.2% store-comp decline. So yes, worse, but now the spread is really narrowing, which makes the point that Walmart’s outperformance relies heavily on its much larger store-delivery and marketplace business, as well as its different business mix, areas that Target is scaling (but do they need to put more money behind it in order to accelerate the scaling).

If we deconstruct Walmart’s average ticket increase of +3.1%; +110bps of this is from inflation, +100bps or more from sales mix due to strong sales of GLP-1 drugs, with the remainder due to more items in the basket (UPTs). The UPT increase is due to the faster growth in store-delivery and curbside, which inherently have more UPT. However, Advan data shows that store dwell time increased +2.4% in Q2; increases in dwell time are typically associated with increases in UPTs / basket size. And so, the improvement in UPTs was also at the store-level as well, and it supports Furner’s claims about success in general merchandise.

Walmart’s grocery business increased mid-single-digits, which is ahead of the BEA’s read for calendar Q2 (+3.5%) and Census read for the conventional grocery industry (NAICS #4451) for the May – July period (+2.6%). Target reported only “slight” growth in food & beverage for the quarter. Last week, most industry followers will have seen Amazon’s announcement that it now offers same-day perishable grocery delivery in over 1,000 cities with plans to double the reach by year’s end. That push and Walmart’s (and Sam’s and Costco’s) ongoing momentum in the category is going to make for a challenging next year for the conventional industry, especially those without extreme differentiation and scale, with the only “help” being at-home’s share-of-stomach gains from fast food . Per Target, incoming CEO Michael Fiddelke is a Target insider and it is interesting that the Board did not select a tenured grocery executive for the top spot. Target does not currently have a “President of Food and Beverage”; instead, Lisa Roath is the Executive Vice President and Chief Merchandising Officer of Food, Essentials, and Beauty, a role that includes oversight of the company’s entire food and beverage business as of early 2025. She took over this responsibility from Rick Gomez, who was promoted to Chief Commercial Officer. On this week’s call, Fiddelke said nothing boldly new about the category, and so, we’d characterize Target’s strategy in food & beverage as both “critical” and a “TBD.”

Target’s valuation multiple currently is 13X. Can they pull off “a Walmart” in ten years ’ time? Or said differently, it took Walmart over ten years to reach its current level of success.

LOGIN

LOGIN