Key Takeaways and Industry Implications

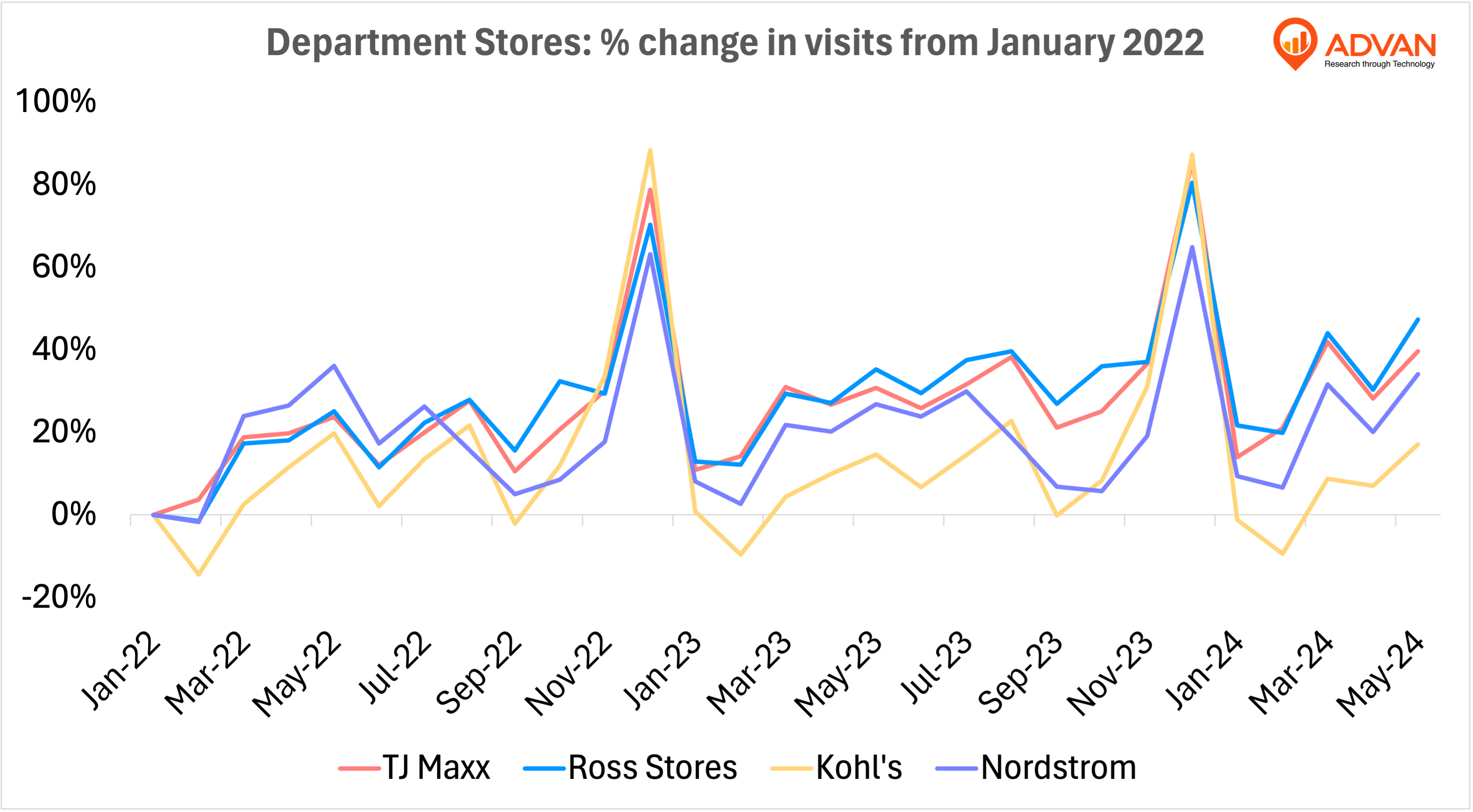

Advan’s foot traffic data from January 2022 to May 2024 reveals several key trends in the apparel retail industry:

- Resilience of Discount Retailers: TJ Maxx and Ross Stores have demonstrated robust growth, underscoring the enduring appeal of discount retailers. Their ability to attract shoppers seeking value for money remains a significant strength.

- Strategic Shifts in Traditional Department Stores: Kohl’s mixed performance suggests that traditional department stores must continuously innovate and adapt to changing consumer preferences. Strategic partnerships and store redesigns can drive foot traffic, but consistent execution is crucial.

- Upscale Market Dynamics: Nordstrom’s growth highlights the complexities of catering to upscale consumers. While there is potential for strong foot traffic, it is essential to balance premium offerings with broader market trends.

The apparel retail industry has faced numerous challenges and transformations over the past few years. As we analyze the foot traffic trends in major department store chains like TJ Maxx, Ross Stores, Kohl’s, and Nordstrom from January 2022 as a base point, to May 2024, we can gain insights into consumer behavior and the overall health of the sector.

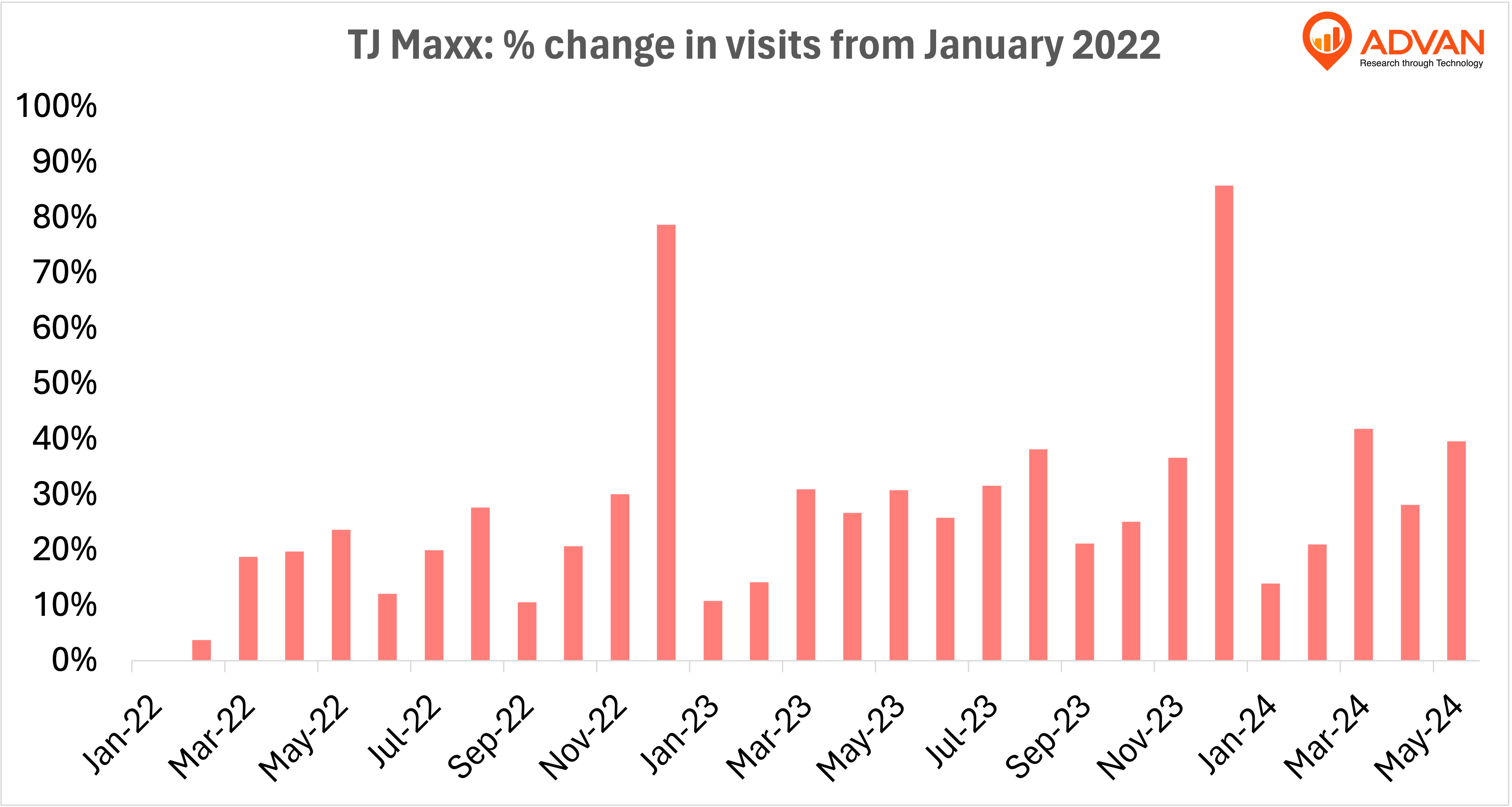

TJ Maxx: Steady Growth Amidst Volatility

TJ Maxx has exhibited a steady increase in foot traffic since January 2022. Starting at a baseline of 0% change in January 2022, the foot traffic has grown significantly over the period, with an average monthly increase of 27.1%. The trend showcases a notable resilience and adaptability to market conditions.

The consistent rise in foot traffic can be attributed to TJ Maxx’s value proposition of offering brand-name and designer goods at discounted prices. As consumers look for ways to stretch their dollars amidst persistent inflation and economic uncertainties, stores like TJ Maxx become increasingly attractive.

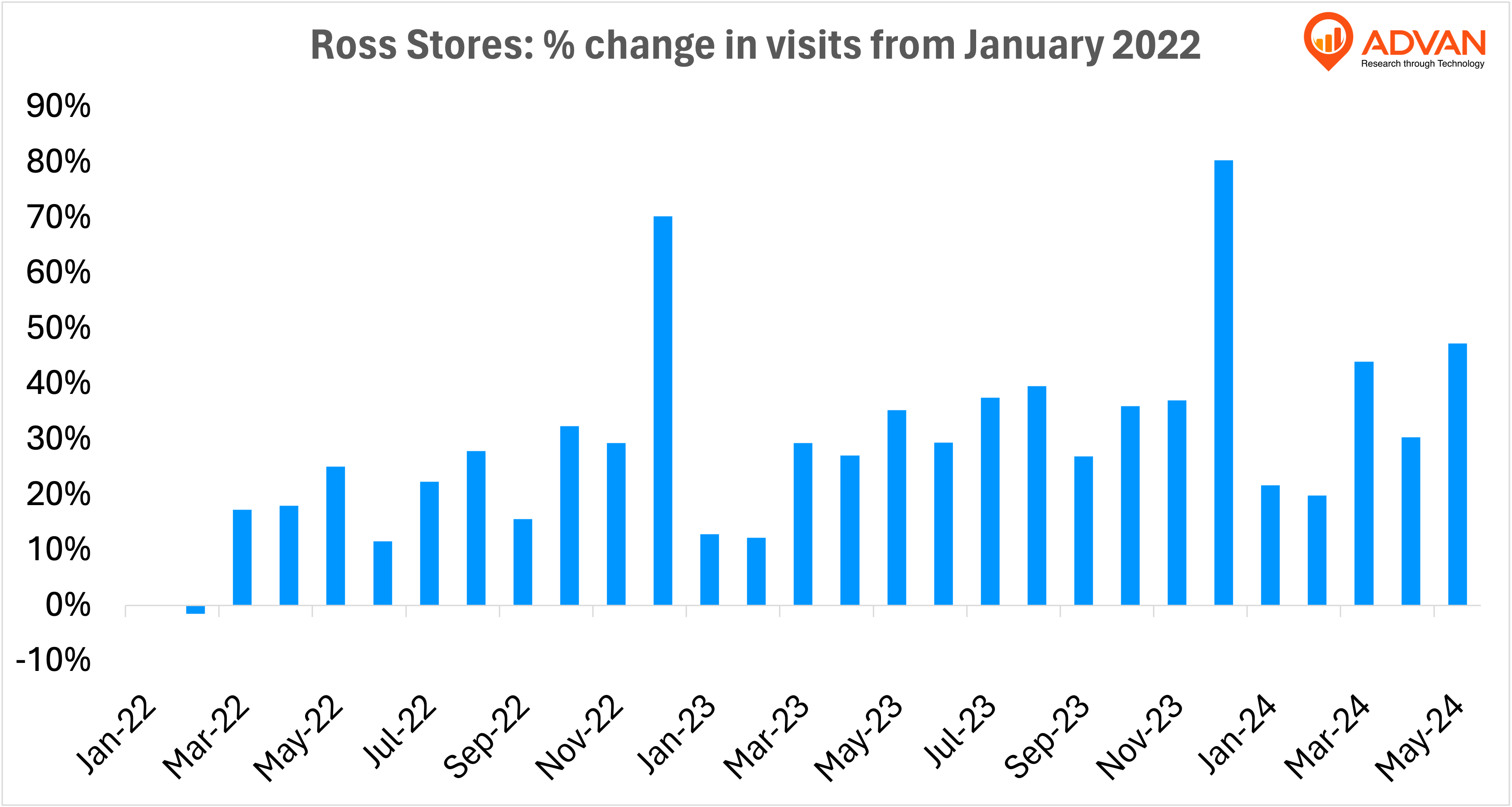

Ross Stores: Competitive Edge in Discount Retail

Ross Stores have also shown a positive trajectory in foot traffic, with an average monthly increase of 28.8% from January 2022. The data reveals that Ross Stores had some volatility, with the lowest point being a slight decline of -1.5% in February 2022. Despite this, the overall trend is upward averaging a 29% increase overall.

Ross Stores’ business model, similar to TJ Maxx, focuses on providing substantial discounts on various products. This has evidently resonated well with cost-conscious shoppers, helping the store maintain a competitive edge in the discount retail space.

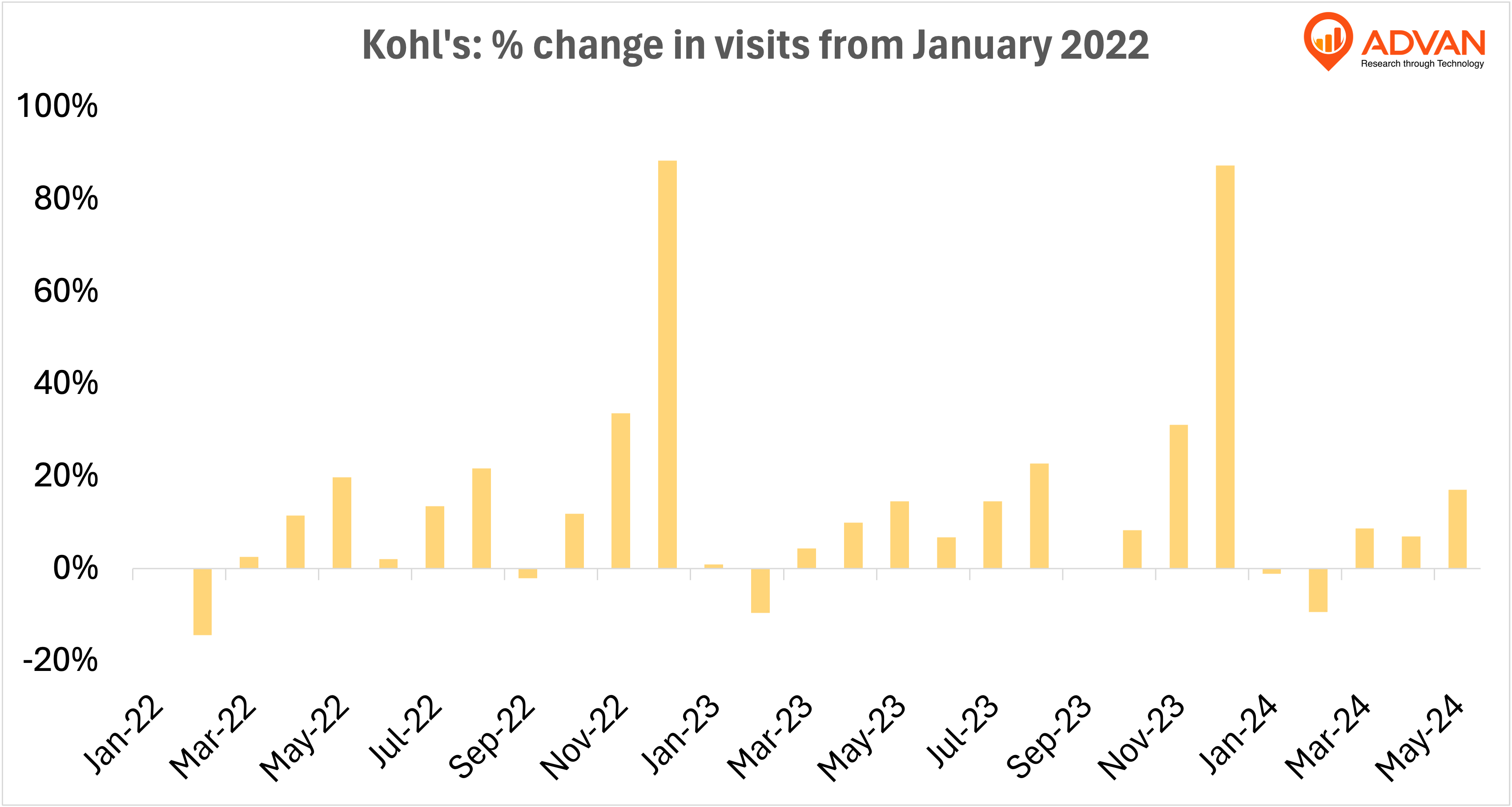

Kohl’s: A Mixed Performance

Kohl’s presents a more mixed picture. While the overall trend shows an increase in foot traffic, the growth has been more uneven compared to TJ Maxx and Ross Stores. The average monthly increase stands at 13.8%, with significant fluctuations. The foot traffic hit its lowest point at -14.5% in February 2022 but experienced substantial spikes throughout the period. This volatility may reflect Kohl’s broader range of product offerings and its ongoing strategic shifts.

Kohl’s has been actively revamping its store layouts, expanding partnerships (such as with Sephora ), and enhancing its digital presence. These initiatives seem to yield periodic boosts in foot traffic, although the retailer faces challenges in maintaining consistent growth.

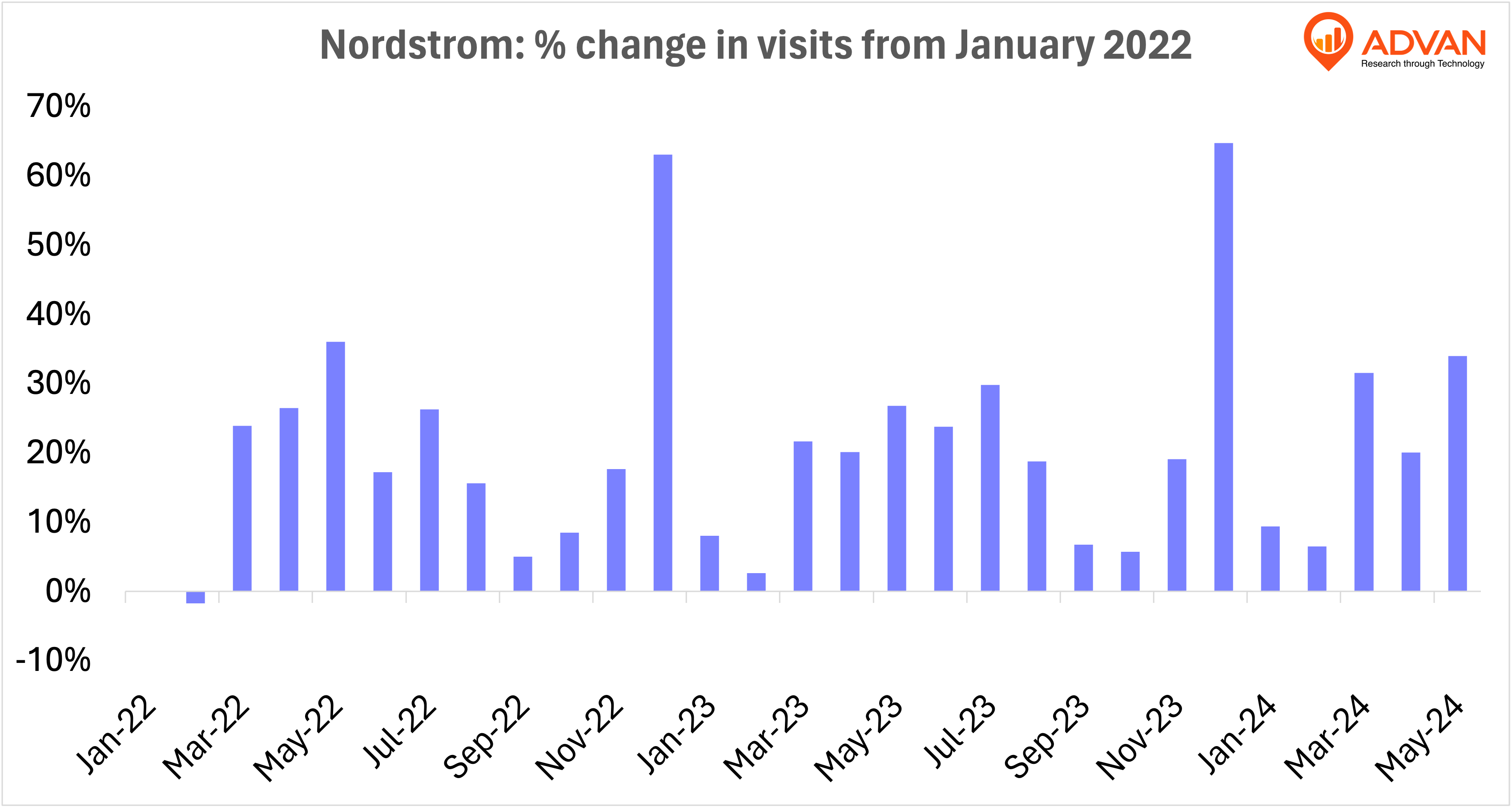

Nordstrom: Navigating the Upscale Market

Nordstrom, catering to a more upscale market, has also seen positive foot traffic trends, albeit with some fluctuations. The average monthly increase in foot traffic is 20.3%. The data shows that Nordstrom experienced its lowest point at just -1.7% and various peaks throughout the period.

Nordstrom’s performance highlights the nuanced dynamics of the upscale retail segment. While the store benefits from a loyal customer base willing to spend on premium products, it also contends with broader economic pressures that can impact discretionary spending. Nordstrom’s efforts to integrate online and offline shopping experiences and enhance customer service likely contribute to its ability to attract foot traffic.

Seasonality and Overall Trend

It’s obvious that the largest increase in foot traffic is observed during the holiday period, which ultimately takes place throughout December. This seasonal surge is a common trend across all retail sectors, reflecting heightened consumer activity during the holiday shopping season.

Overall, the apparel retail industry appears to be on a path of recovery and transformation. Retailers that can effectively adapt to consumer demands, leverage their unique value propositions, and innovate their shopping experiences are likely to thrive in this evolving landscape.

As we move forward, it will be interesting to see how these trends continue to develop and what new strategies retailers will employ to attract and retain customers in an increasingly competitive market.

LOGIN

LOGIN