By Thomas Paulson, Head of Market Insights

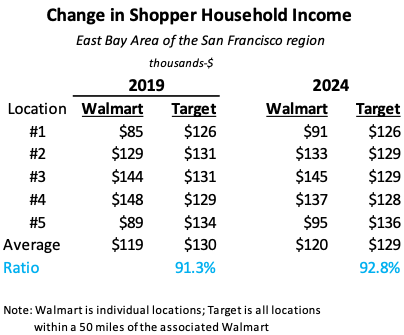

On Wednesday, Walmart had a well-timed investor day to make its pitch on why it is a steady ship in all sorts of tempests (and sunnier periods), and the justification for accelerating the number of Sam’s Club openings. Big picture, what we heard: (1) while Walmart sources mostly from US suppliers (2/3rds of COGS), China is also a large supplier, meaning that tariffs could be a meaningful impact on the business as they will be judicious on what gets passed through to the consumer, (2) February was a very soft period for its sales of discretionary goods, but March was much improve (something that we’ve broadly covered ), and (3) it’s US ecommerce business, as part of its omni-channel consumer offering, has flipped to profitable. For context, we estimate that US ecommerce in 2019 was a -$3B hit to profits, from which they’ve made steady progress over the past five years. What this means for competitors is that Walmart’s scale advantages are growing and that it’s not being constrained by the law-of-large numbers. As it relates to Walmart’s financials, this is to result in improved cash generation and returns of invested capital (ROIC). What’s interwoven into and enabling all of this is Walmart’s success of winning over higher-income households since 2019. We looked at a sample of five Walmart locations in the San Francisco region’s East Bay Area. The median income for the Walmart shoppers increased from $119K to $120K between periods; by contrast, the “control,” which are Targets within 50 miles and the associated store, fell from $130K to $129K. If we remove store #4 from the sample, the ratio between the two went from 85.5% to 89.7%, or +420 bps (vs. the +150 bps shown below), Wow!

Turning to Sam’s Club, CEO Chris Nicholas said that they strive to double membership and sales over the next decade. That equates to a high bar of +7% annualized growth, which is above general expectations for Costco to grow around +5-6%. What’s behind Sam’s high growth (and strong success since 2019) has been upgrading Sam’s merchandise assortment (especially Member’s Mark), diligent regional merchandising, tapping new Millennial and Gen-Z households, embracing omnichannel and new technologies (scan-&-go and personalized ads and recommendations), and “Plus” membership. Removing friction and eliminating compromises that were viewed as inherently part of the club channel was Sam’s “disruptive” strategy. Nicholas, “We’ve set a new bar for what club members expect,” including “not having to tolerate friction as a cost of shopping with us.”

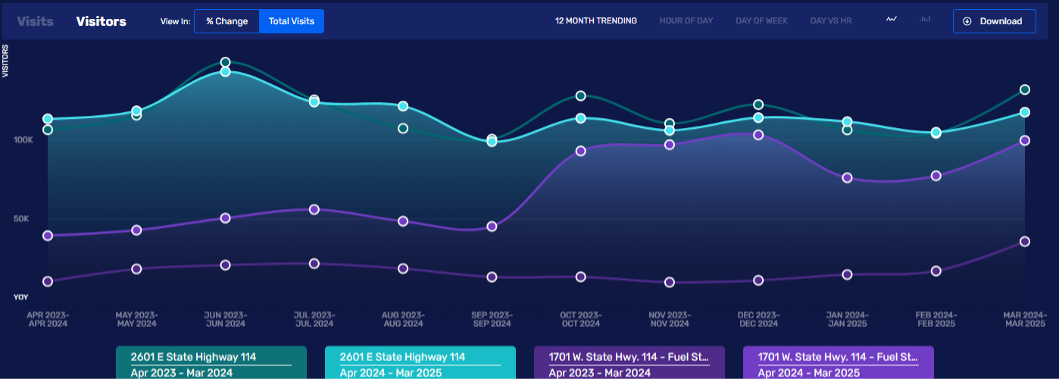

What that looks like can be seen at its upgraded location in Grapevine, TX. We show this store’s performance vs. the nearby Costco location in terms of monthly visitors (which is our proxy for membership). Monthly members for the Sam’s location are converging on Costco’s level, incredibly; moreover, Costco is down since the Sam’s upgrade opened. In terms of future drivers to growth, Nicholas stated that they will accelerate to 15 new clubs per year, remodel the entire fleet of stores to the Grapevine standard, and expand ecommerce from around 15% of non-fuel sales to 40%. And so, that’s how management expects to grow faster than Costco.

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.

LOGIN

LOGIN