Savers Q4 results showed US sales up +10.5% and comp-sales up +4.7%. The sales increase was ahead of Advan’s +8.2% estimate* (+/- 40 bps T4Q Moe, 95% T5Q correlation). The 230 bps of outperformance largely reflects a +580 bps contribution from the bolus of new stores opening in the 2H (vs. the 6-month trend of 390 bps). (The year-end U.S. store count was up +11.6% vs the 1H’s +8.6%.) Unfortunately for the company, its large Canadian business continues to be an anchor with comp-sales down -2.5% and segment profits down nearly -20%. (Canada was nearly equal to the US segment’s profits in 2023 at $190m. For 2024, it produced only $165m in profits and 2025 will also see a meaningful decline from there.) In terms of the outlook, management was constructive on the U.S. segment, but very guarded on the Canadian business. The Canadian consumer is under duress and has disengaged from spending on home and apparel; moreover, the tariffs and even the threat of them are going to worsen the pullback.

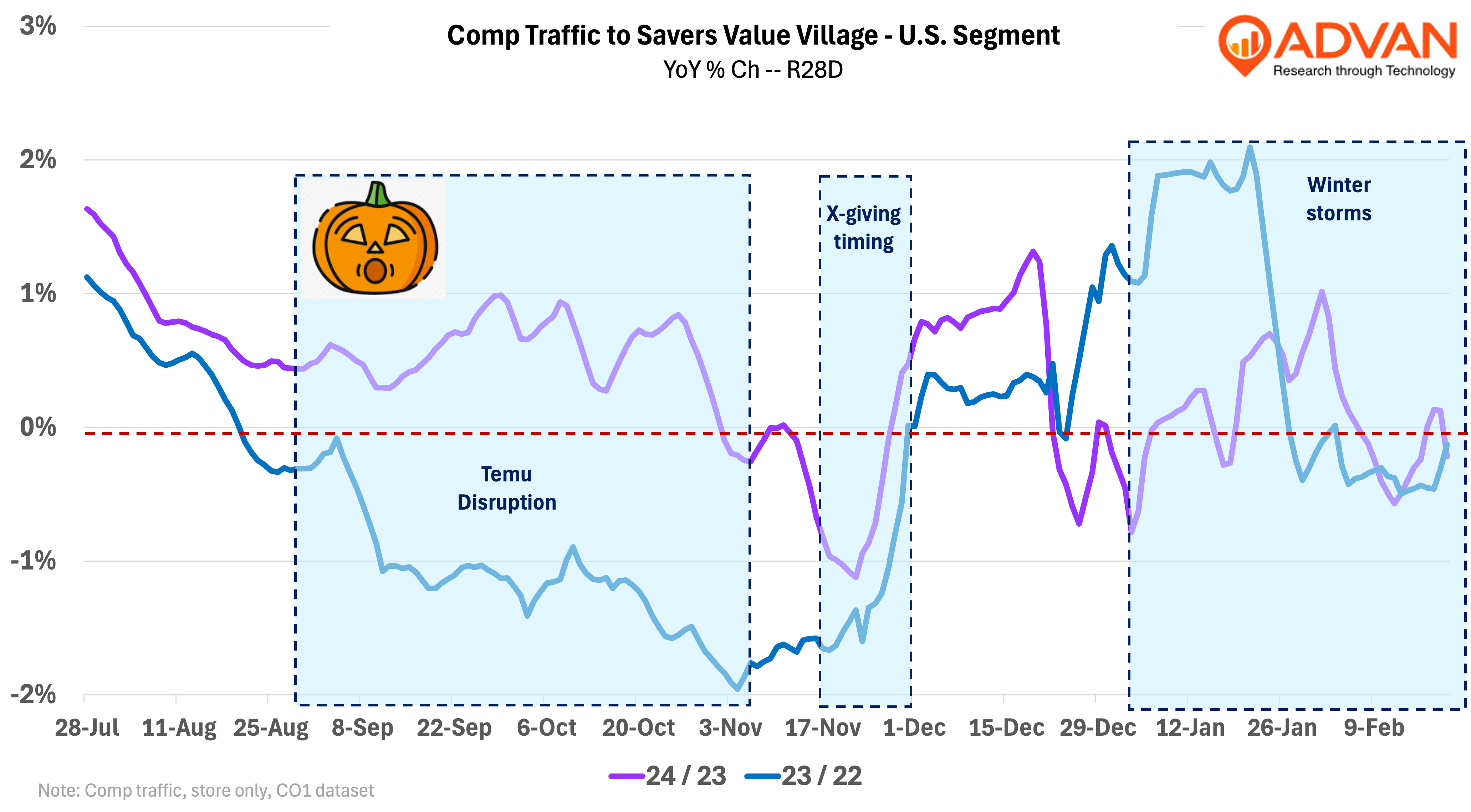

Speaking of just the US business, the +310 bps improvement in comp-sales largely reflected easy comparisons as the 2- and 3-year comp-CAGRs were little changed. The 2H of 2023 was dented by Temu’s aggressive marketing campaign to drive consumer trial resulting in a large drop in traffic as shown in the chart below; a campaign that is far more muted this year. Separately, the 3-year CAGR is still subdued from 2022’s and ‘23’s levels due to a low-income consumer that’s still under enormous economic pressure, i.e. the bottom of the so-called K-shaped consumer. (The U.S. went “K” in early 2023.) However, that dynamic is not dissuading Savers from a large new store plan; above we noted the large increase in US stores in the 2H, for the year 24 units were added to end at 155 locations. For the 2025 plan, it’s up to 30 new locations. What’s their driving management’s confidence in the expansion plan is the brand’s capture of a higher-income consumer (a future topic of ours).

*Utilizing the Maiden Century model.

LOGIN

LOGIN