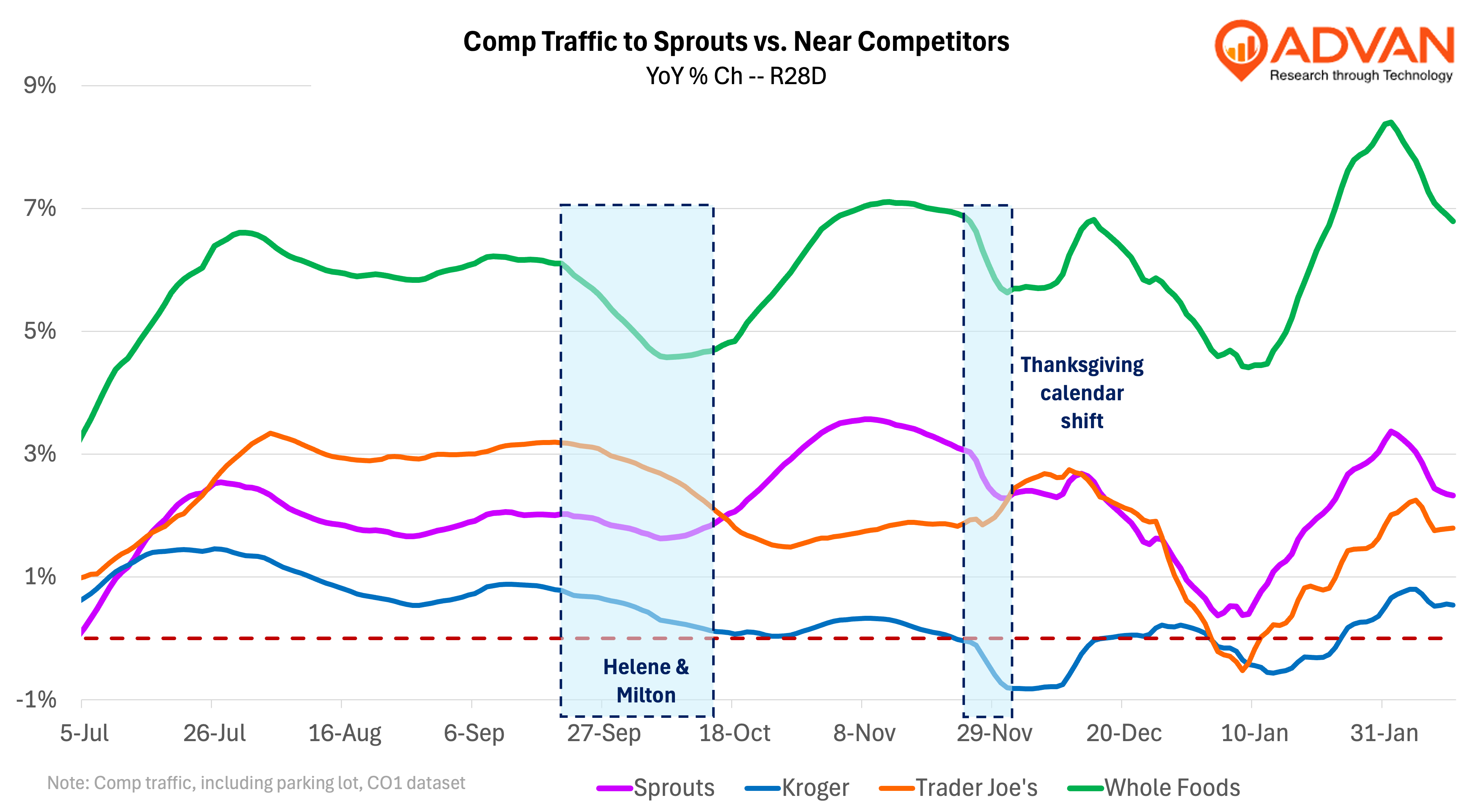

Differentiation was the key to growth in sales and market share in food retail in 2024 – a challenging year for conventional retailer offerings. As shown above, Whole Foods enjoyed robust comp-traffic all year long, and the traffic aligns with its reported sales growth rate of mid-single-digits-plus, with a Q4 increase of +8%. (Mid-February comp-traffic is +7% on a T4W basis.) In our observations at their locations, the success stems from leveraging the Amazon relationship, sharper value on its offering, and solid execution on retail fundamentals. For 2023 and 2024, Trader Joe’s won on its strong private brand offering; this is at a time when consumers are now picking their favorite retail brands and showing greater loyalty (as we wrote about earlier this week). Mid-February comp-traffic is +1.8%.) Looking forward, there is no reason to believe that 2025 won’t again be a strong year for the retailer.

Sprouts’ success came from these factors as well, along with its strong and distinct merchandise (in their parlance, they call their merchant buyers “foragers.”) Sprouts’ foragers deserve a large bonus for 2024. Sprouts will report Q4 results next week, and comp-store sales should be (+9.2% est) slightly above last quarter’s rate (+8.4%). That view is informed by our reading of their traffic, transactions, longer dwell times, and employee shifts worked. For the quarter, the frequency of visits was largely stable YoY; however, visits in the sweet spot of 15 to 45 minutes significantly outperformed total visits in YoY growth and accelerated +300 bps QoQ; those are the visits associated with a larger basket size. As such, we hope to hear about that on the earnings call and see it in the form of an improvement in comp-ticket. That, too, is a testament that the foragers have hit the mark with its shoppers.

The favorable early-2025 trend should also embolden management to issue decent sales guidance for the year. Sprouts’ merchandise differentiation this past year also allowed it to realize more merchandise margin and avoid the compression witnessed elsewhere. That, too, should be a contributor to 2025’s earnings growth. However, watching for ongoing comp-traffic gains will be the watch-out on Sprouts’ ability to deliver the margin expansion.

LOGIN

LOGIN