By Thomas Paulson, Head of Market Insights

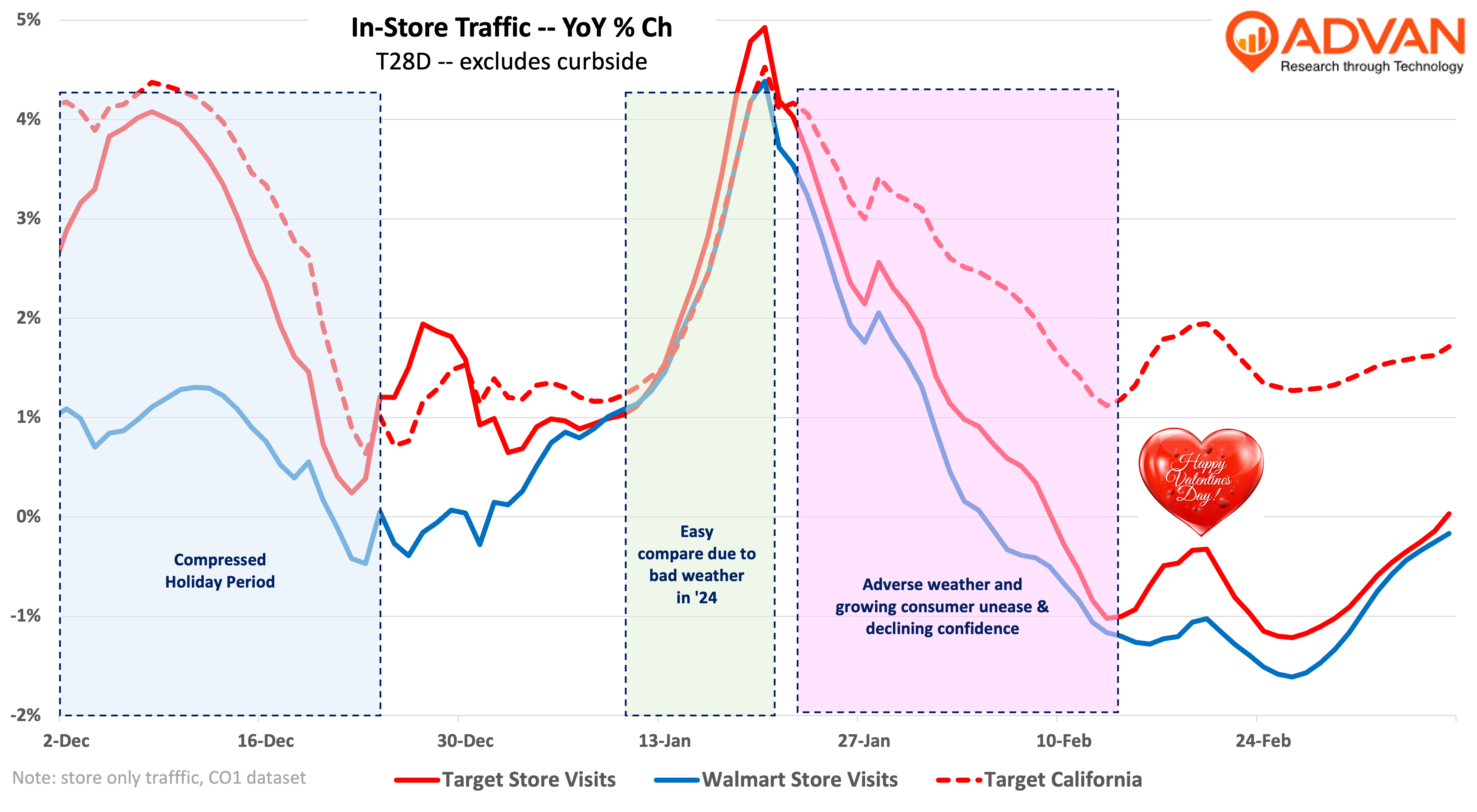

Last week’s analysis included management’s comments relative to any DEI backlash that they were seeing no impact to their business. However, over the weekend, media outlets wrote about a negative impact on Target store traffic and business from the backlash. Well, third-party data being third party (i.e. an estimate vs. ground truth first-party data) requires understanding the scope of the aggregation and its limitations. Data being data, means understanding how to smooth out distortions and aberrant base levels. For example, when looking at recent “weekly” YoY traffic, it’s important to acknowledge the absence of leap day in this year’s calendar weekly data vs. last year’s. One fewer day in a weekly series would have a meaningful impact on YoY change. We avoid that mistake by looking at trailing-7-day and trailing-28-day YoY change to traffic into the store. As shown in the chart below, we see zero evidence of any diminution in Advan’s estimated foot traffic for Target. Advan’s data for the trend on Target’s 7-day traffic, 28-day transactions, and 28-day transaction spend also all show no diminution.

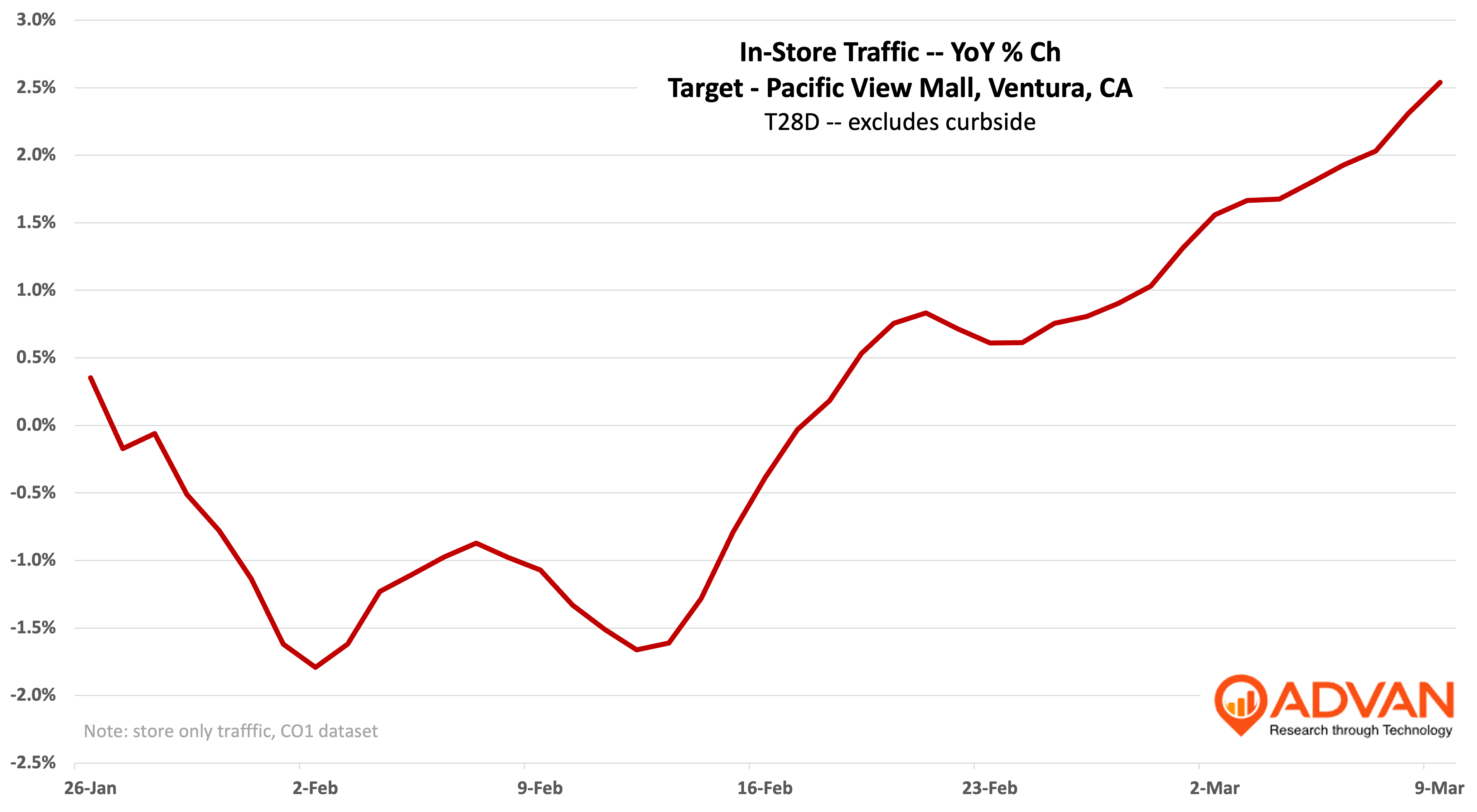

Showing Target’s trend vs. Walmart also shows little deviation. Additionally, one would naturally think that if there was any meaningful backlash impact, it would present itself in Target’s large markets in California; again, there is no impact evident for California. It’s also always good when looking at data to look at one’s own locality; which in our case is the Target store in Ventura, California. As shown in the chart below, looking as recently as this past Saturday, we see no diminution on a 24-day- and 7-day-trailing basis.

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.

LOGIN

LOGIN