With the dockworkers’ strike that started at midnight disrupting port operations across the East and Gulf Coasts, it’s essential to understand how this will affect the flow of goods into and out of the U.S. Ports are critical infrastructure points, and the impact of strikes or delays can reflect across industries. This is where Advan’s location data offers a crucial lens for tracking foot traffic at major ports, providing almost real-time insights into how these disruptions play out across the economy.

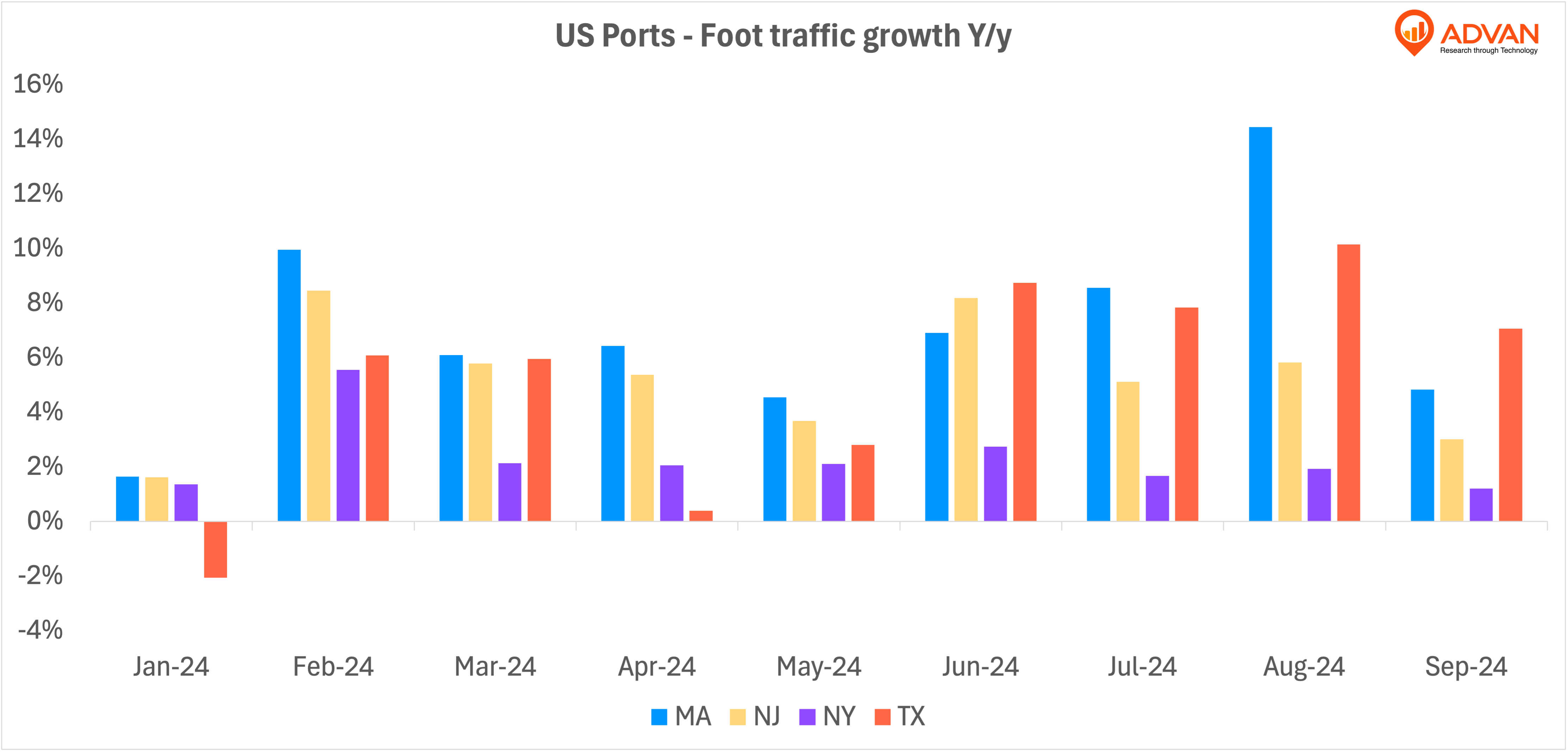

The year-over-year growth data for 2024 tells a fascinating story about port activity in key states such as Massachusetts (MA), New Jersey (NJ), New York (NY), and Texas (TX). These ports have seen fluctuations in foot traffic, likely influenced by a mix of economic factors and operational changes at the ports themselves.

For instance, in Massachusetts, foot traffic grew steadily from January to August, with a peak in August showing a remarkable 14.4% YoY growth. Similarly, Texas experienced an impressive 10.1% growth in August, indicating robust activity at the state’s ports. However, these gains could be jeopardized by the strike, especially considering September data, which already shows a slowdown, with Massachusetts down to 4.8% and Texas still holding at 7.1%.

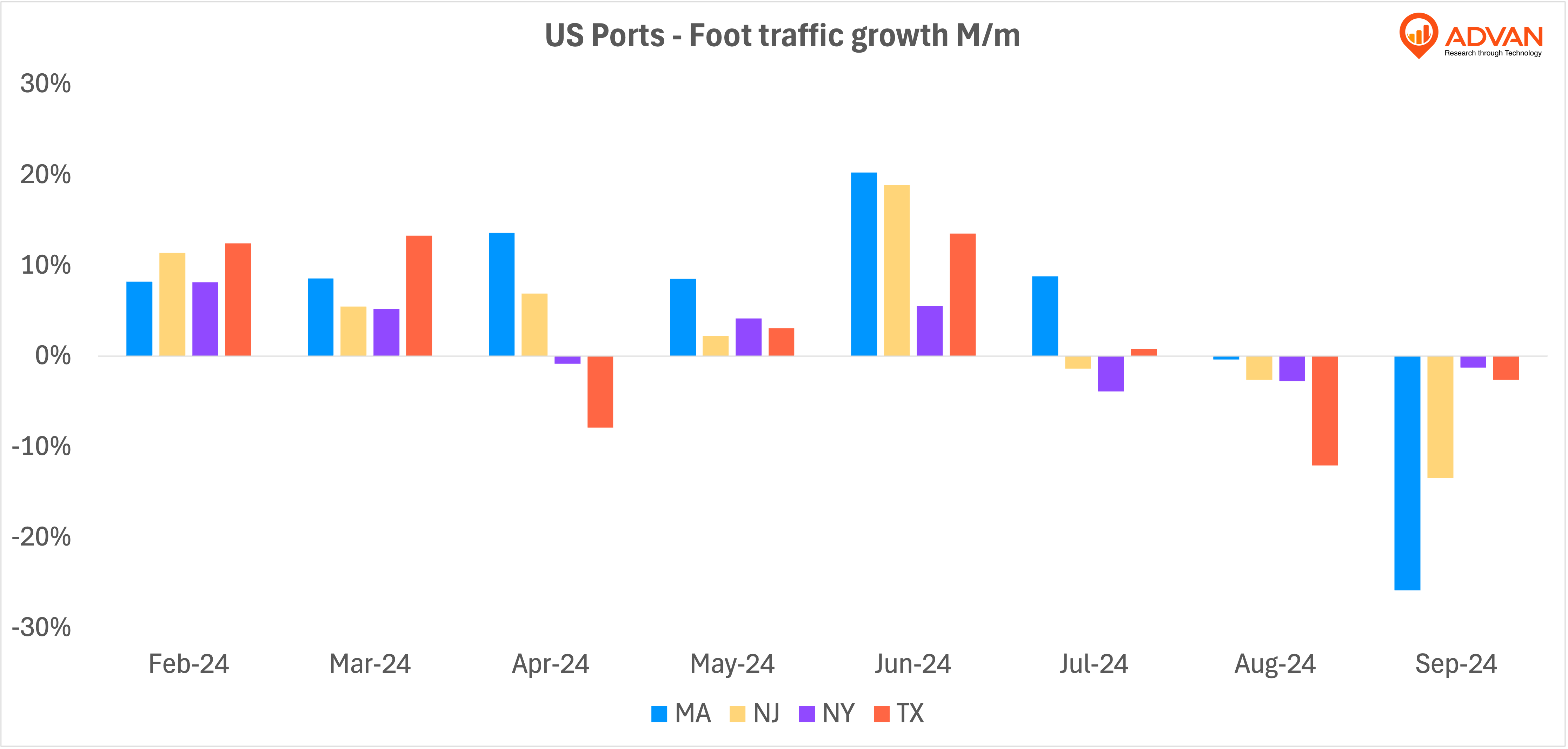

In contrast, the month-over-month changes reveal more dramatic shifts. Notably, Massachusetts had a substantial MoM drop of 25.9% in September, likely signaling early signs of strain on port operations even before the strike. Texas also saw a decline of 2.6% during the same period, further illustrating the downward pressure on port activity.

Looking at New Jersey and New York, we observe mixed results. While New Jersey posted strong gains in June, peaking at an 18.9% MoM increase, by September, it had declined by 13.5%. New York, meanwhile, saw a significant MoM drop in July (-3.9%) and continued to struggle through August and September.

This data provides a window into how port activity is evolving across the country and offers clues as to what might happen next. With Advan’s location data tracking foot traffic at these crucial entry points, businesses and policymakers can anticipate bottlenecks and address supply chain challenges before they escalate.

While port activity has remained resilient through much of 2024, this strike could be the tipping point that halts the recent growth and sends shockwaves across the logistics sector. By closely monitoring foot traffic at these ports using location intelligence from Advan, companies can stay one step ahead in navigating the ripple effects of this strike on the broader economy.

The Power of Location Data in Times of Crisis

This strike underscores the importance of real-time data to monitor port activity and anticipate economic disruptions. Advan’s geolocation insights offer a critical view of how foot traffic at every port, or any other location, is evolving. As this strike continues, companies and investors using Advan’s data can gain a competitive advantage by responding to changes in port activity, adjusting supply chains, and making informed decisions to mitigate risk.

This is an example of how Advan’s location data can be utilized to track critical infrastructure points and respond to real-world events. As the situation with the dockworkers strike develops, Advan will continue to provide valuable insights into how this disruption will affect supply chains and the broader economy.

By leveraging Advan’s products, companies and investors can not only track port activity but also stay ahead of disruptions, navigate challenges, and make better decisions in an increasingly complex and volatile economic environment.

LOGIN

LOGIN