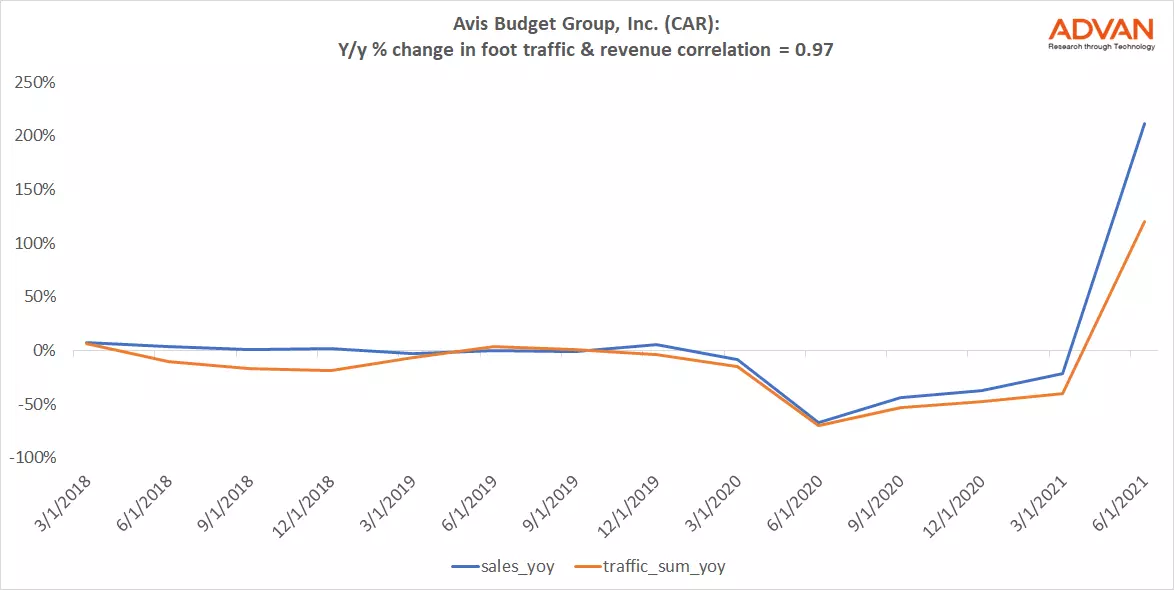

Notable Hit 1: (CAR:NASDAQ) On Tuesday August 3, 2021 Avis Budget Group, Inc. (CAR) posted better-than-expected revenues of $237bn beating the consensus estimate by 14% and in the same direction as Advan's forecasted sales. The revenue was +212% YoY - Advan's foot traffic data captured an increase in foot traffic of +120.38% YoY at Avis locations. Advan's footfall data has a correlation of 0.97 on a YoY basis with CAR's top-line revenue over the last 14 quarters.

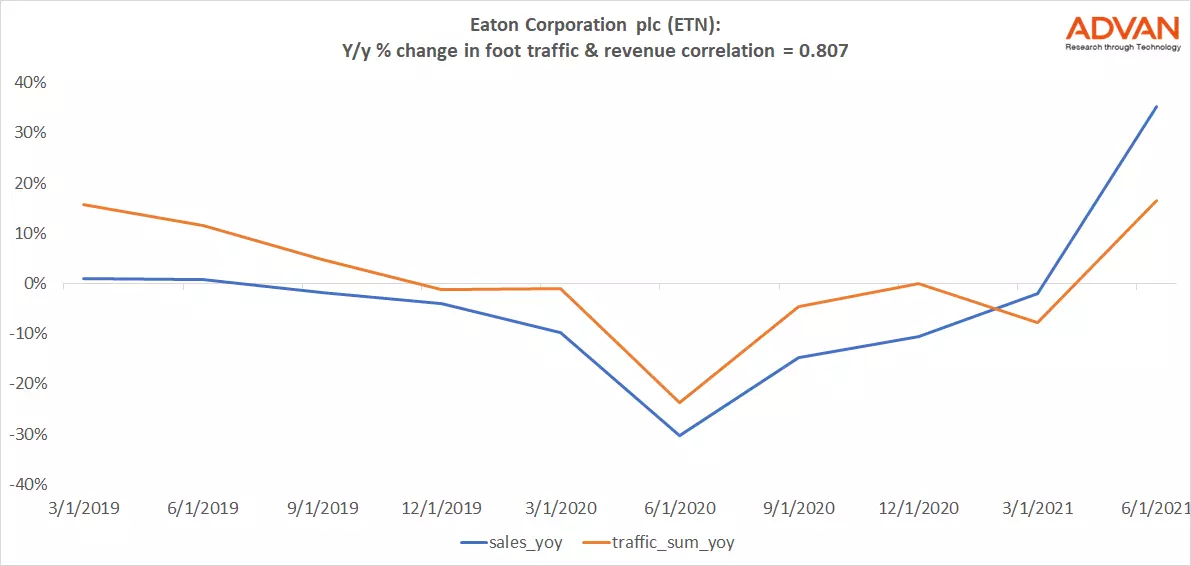

Notable Hit 2: (ETN:NYSE) On Tuesday August 3, 2021 Eaton Corporation (ETN) posted better-than-expected revenues of $5.21bn beating the consensus estimate of $4.94bn (-5.34%) and in the same direction as Advan's forecasted sales. The revenue was +35.24% YoY - Advan's foot traffic data captured an increase in employee foot traffic of +16.61% YoY at its factories. Advan's footfall data has a correlation of 0.8 on a YoY basis with ETN's top-line revenue over the last 10 quarters.

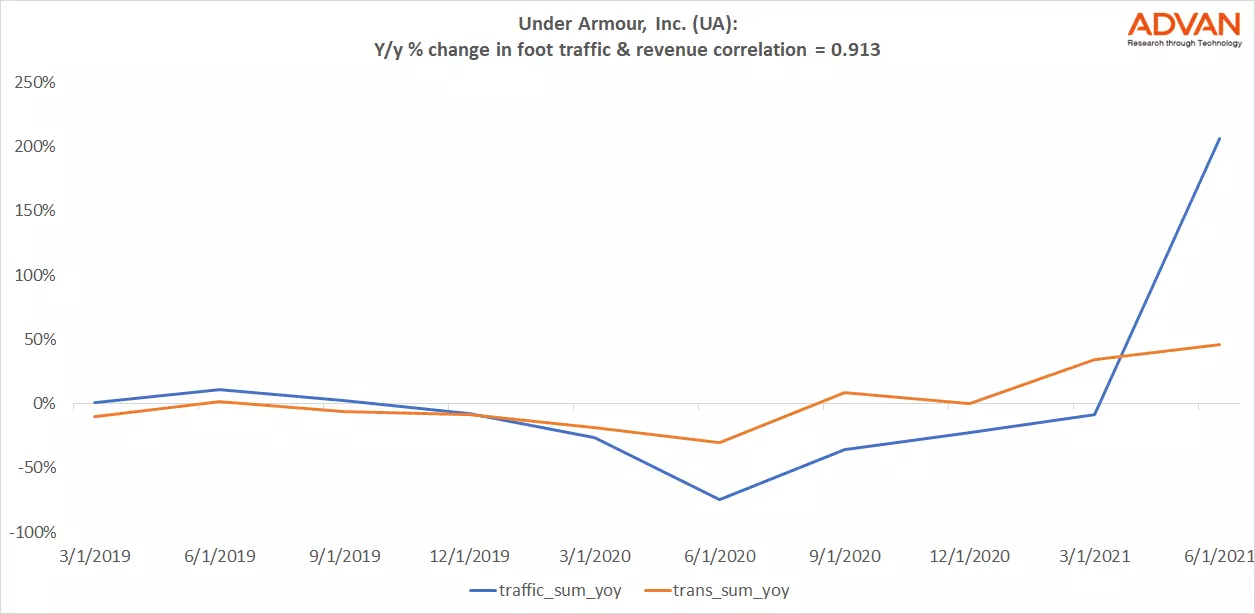

Notable Hit 3: (UA:NYSE) On Tuesday August 3, 2021 Under Armour, Inc. (UA) posted better-than-expected revenues of $1.36bn beating the consensus estimate of $1.21bn (-10.65%) and in the same direction as Advan's forecasted sales. The revenue was +91.39% YoY - Advan's foot traffic data captured an increase in foot traffic of +206.24% YoY at Avis locations. Advan's footfall data has a correlation of 0.91 on a YoY basis with UA's top-line revenue over the last 10 quarters.