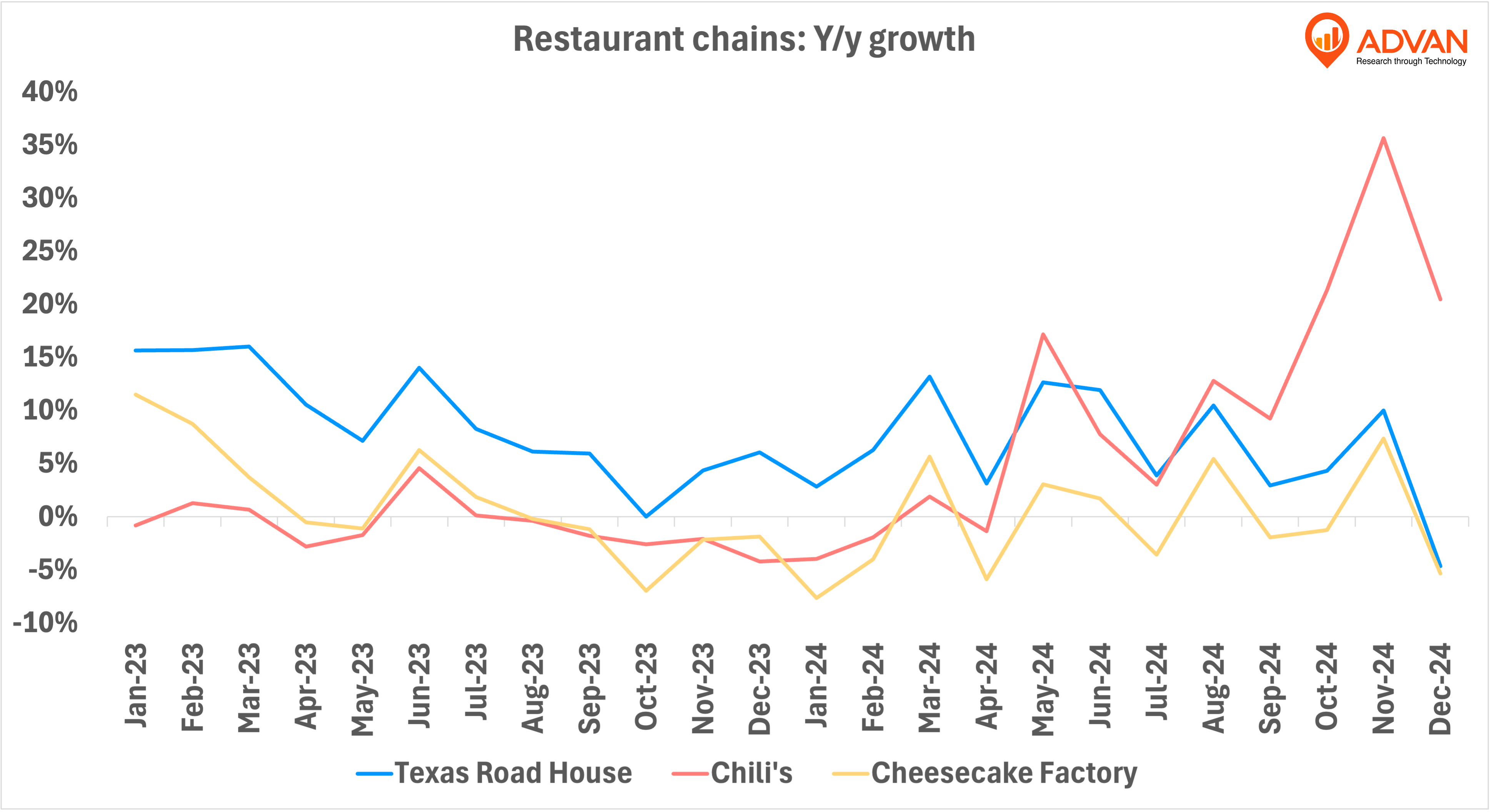

The casual dining scene in the U.S. has been a rollercoaster over the past two years, with some brands struggling to keep pace while others have found ways to thrive. Chili’s, Texas Roadhouse, and The Cheesecake Factory have all experienced their ups and downs, but Chili’s recent turnaround stands out the most.

At the start of 2023, things weren’t looking great for Chili’s. Foot traffic according to Advan's intelligence was down, with year-over-year restaurant visits slipping into negative territory for much of the year. By October, visits had declined 3% compared to the previous year, and the numbers remained in the red through the holiday season. But something changed in 2024. In March, foot traffic flipped into positive growth, rising 2% year-over-year, and then the momentum really picked up. May saw a 17% jump, followed by 21% in October, and an impressive 36% increase in November.

So, what’s driving this sudden success?

For one, Chili’s has doubled down on affordability, introducing menu items like the $10.99 Big Smasher burger and the $17 Triple Dipper appetizer. These wallet-friendly options have drawn in cost-conscious diners looking for a satisfying meal without breaking the bank. The company has also refreshed its marketing strategy, leaning into a playful, bold brand voice on platforms like TikTok, which has helped it connect with younger audiences.

Meanwhile, Texas Roadhouse has remained a model of consistency. The chain saw steady growth in 2023, with foot traffic climbing 16% year-over-year in the first three months. While there were some fluctuations throughout the year, it never dipped into negative territory. By November 2024, visits were still up 10% compared to the previous year. Texas Roadhouse attributes much of its success to its people-first approach, where restaurant operators are given more autonomy, and strong performance is rewarded—something that has helped build a loyal customer base.

The Cheesecake Factory, on the other hand, has faced a more turbulent path. While sales have seen modest growth, restaurant visits have been inconsistent. In late 2023, traffic was in decline, and even though the brand saw a brief recovery in early 2024, it struggled to maintain momentum. By October, visits were down 1%, rebounded with a 7% increase in November, and then dropped again in December. The company has faced pressure from activist investors who want it to rethink its business strategy, but executives believe in their diversified portfolio and are sticking to their plan.

Chili’s resurgence is the most striking of the three, proving that even in a tough market, the right mix of pricing, marketing, and brand positioning can bring customers back through the doors. Texas Roadhouse continues to show that a strong company culture and consistent quality keep diners coming back. Meanwhile, The Cheesecake Factory’s challenges highlight the difficulties of balancing multiple concepts while maintaining steady growth.

As 2025 unfolds, these brands will need to adapt to shifting consumer preferences and economic conditions. But for now, Chili’s seems to have found its winning formula, and it’ll be interesting to see if they can keep the momentum going.