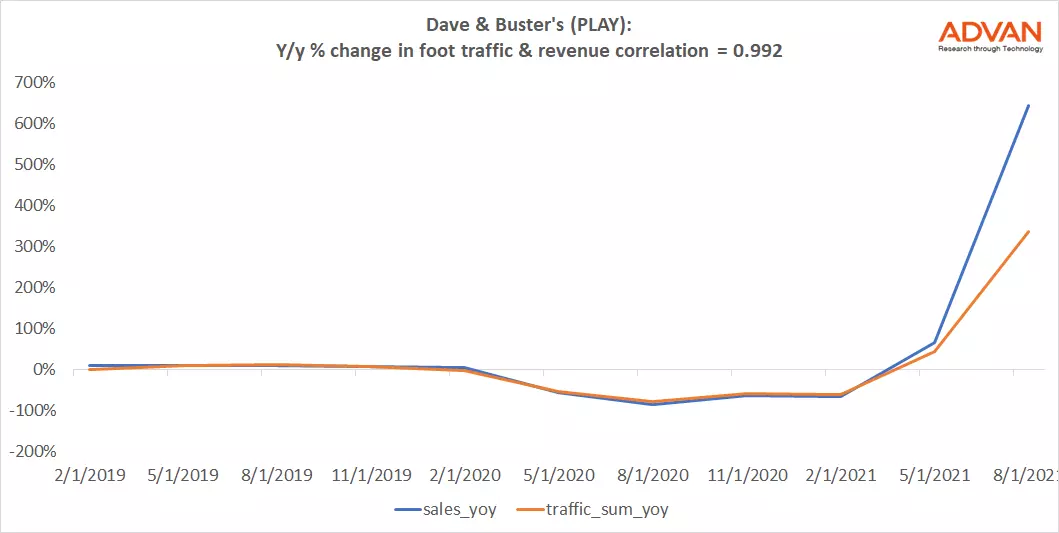

Notable Hit 1: (PLAY:NASDAQ) On Thursday September 9, 2021 Dave & Buster's (PLAY) posted better-than-expected revenues of $377.64mm beating the consensus estimate of $356.8mm (-5.5%) and in the same direction as Advan's forecasted sales. The revenue was +643% YoY - Advan's foot traffic data captured an increase in foot traffic of +337% YoY at its restaurants and arcade games for Q2 2021. As a result of beating the sales and EPS, the stock opened at $39.72, up +12% from its previous day's closing price. Advan's footfall data has a correlation of 0.99 on a YoY basis with PLAY's top-line revenue over the last 11 quarters.

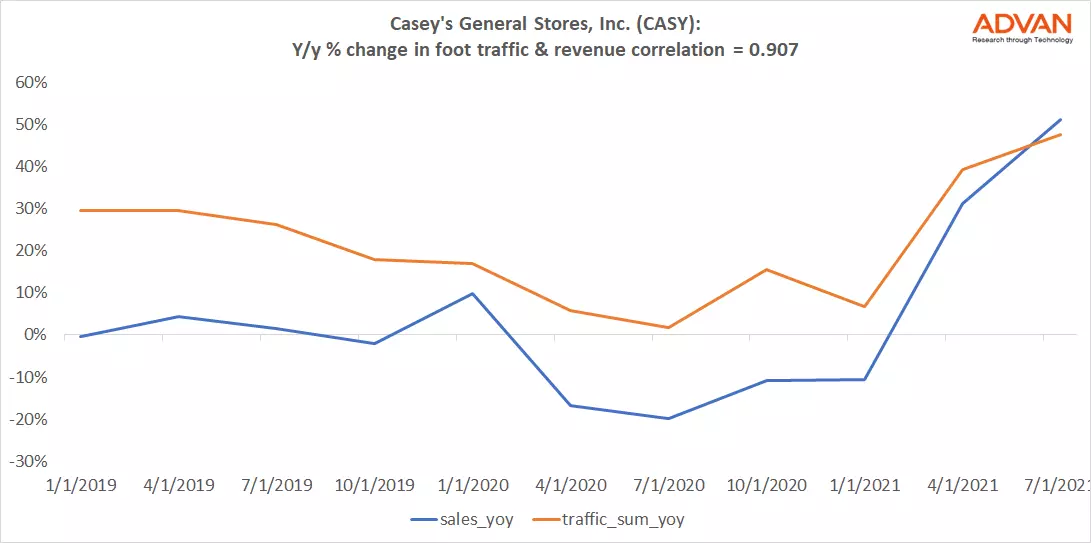

Notable Hit 2: (CASY:NASDAQ) On Wednesday September 8, 2021 Casey's General Stores, Inc. (CASY) posted better-than-expected revenues of $3.18bn beating the consensus estimate of 3.05bn (-4.13%) and in the same direction as Advan's forecasted sales. The revenue was +47.52% YoY - Advan's foot traffic data captured an increase in foot traffic of +51.16 % YoY at its stores for Q1 fiscal 2022. Advan's footfall data has a correlation of 0.9 on a YoY basis with CASY's top-line revenue over the last 11 quarters.