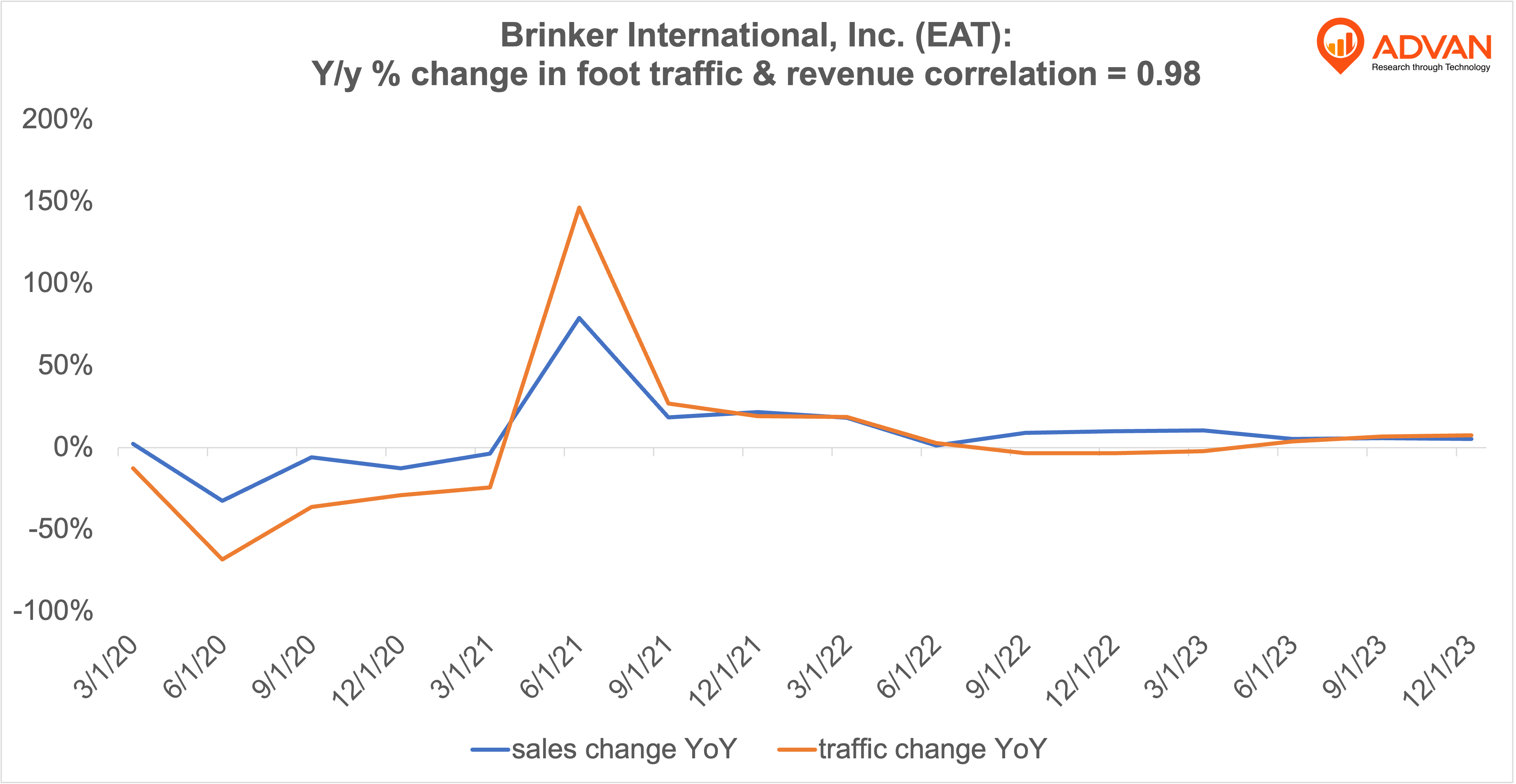

Notable Hit 1: (EAT:NYSE) On Wednesday January 31, 2024 Brinker International, Inc. (EAT) posted revenues of $1.07 bn slightly missing the analysts estimate by 0.4% and in the same direction as Advan's forecasted sales. Advan's foot traffic data showed 7.6% increase YoY at its restaurant chains in Q2 2024 fiscal; the company's revenue increased 5.4% YoY. Advan's footfall data has a correlation of 0.98 on a YoY basis with EAT's top-line revenue over the last 16 quarters.

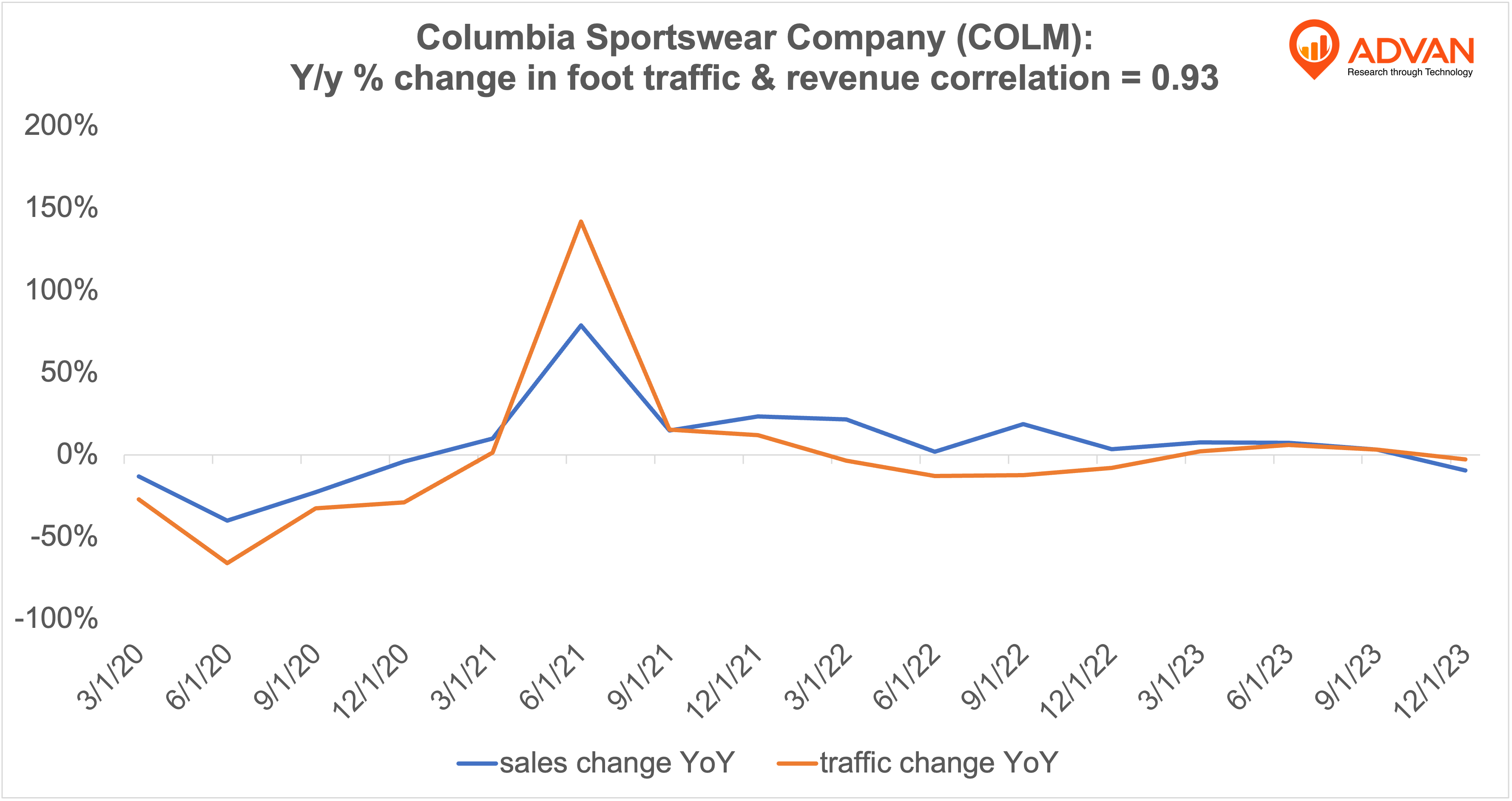

Notable Hit 2: (COLM:NASDAQ) On Thursday February 1, 2024 Columbia Sportswear Company (COLM) posted revenues of $1.06 bn missing the analysts estimate of $1.08 bn and in the same direction as Advan's forecasted sales. Advan's foot traffic data showed 3% decrease YoY at its sporting goods stores in Q4 2023; the company's revenue decreased 9% YoY. The stock next day opened down -9.9% from previous close. Advan's footfall data has a correlation of 0.93 on a YoY basis with COLM's top-line revenue over the last 16 quarters.

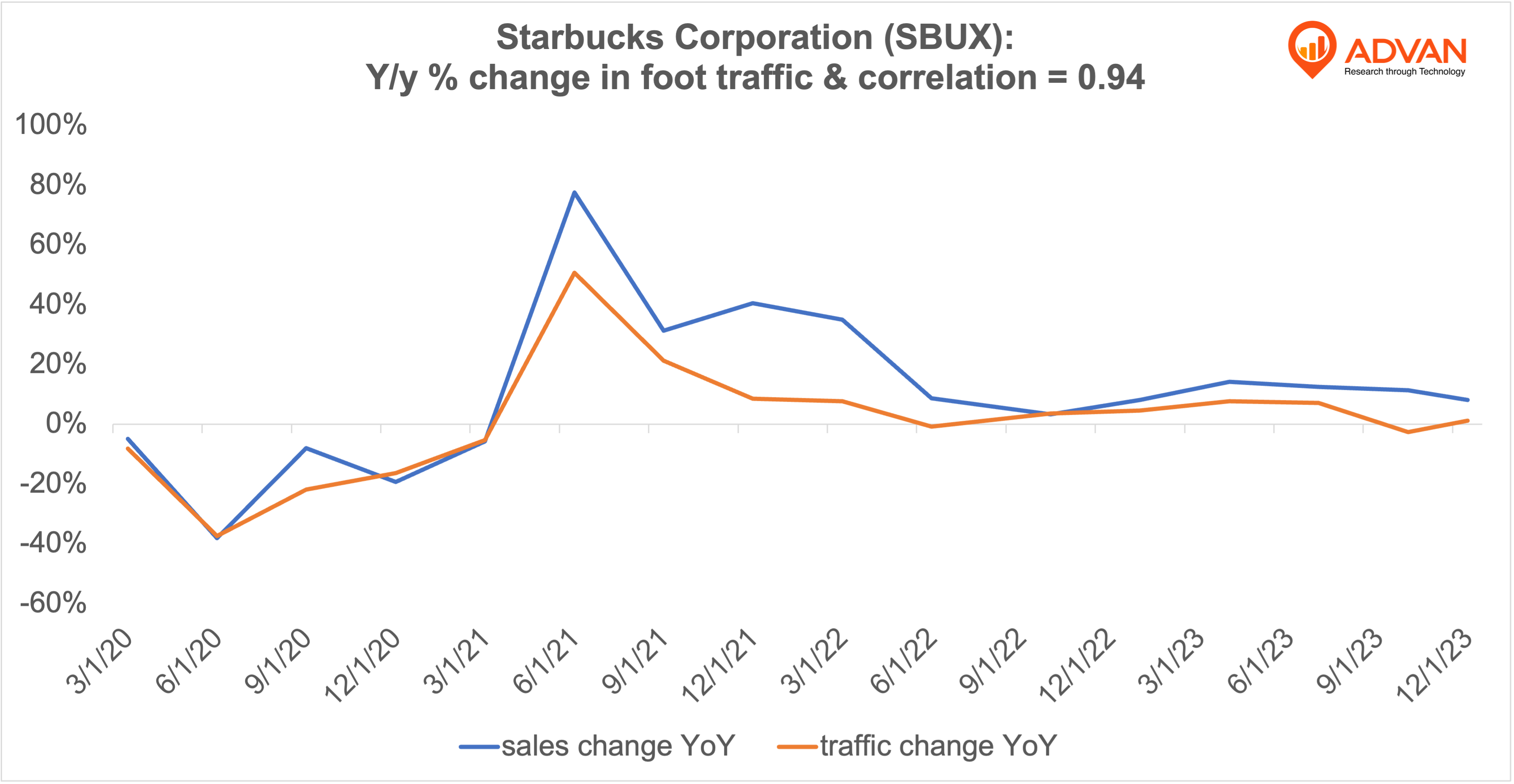

Notable Hit 3: (SBUX:NASDAQ) On Tuesday January 30, 2024 Starbucks Corporation (SBUX) posted revenues of $9.4 bn slightly less than the analysts estimate of $9.5 bn and in the same direction as Advan's forecasted sales. Advan's foot traffic data showed 1.1% increase YoY at its coffee shops in Q1 2024 fiscal; the company's revenue increased 8.2% YoY. The stock next day jumped +5.6% from previous open. Advan's footfall data has a correlation of 0.94 on a YoY basis with SBUX's top-line revenue over the last 16 quarters.