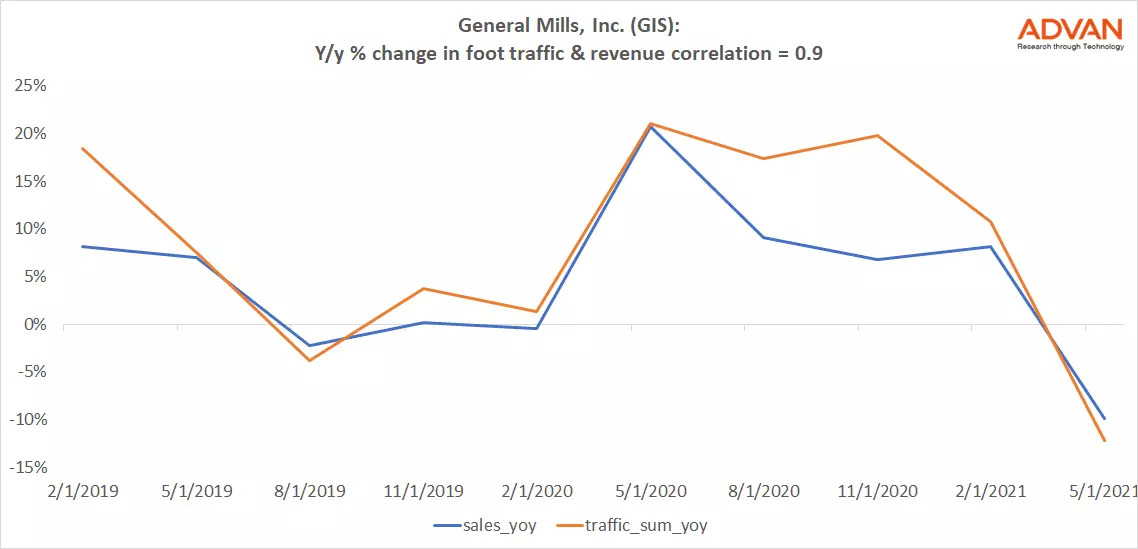

Notable Hit 1: (GIS:NYSE) On Wednesday June 30, 2021 General Mills, Inc. (GIS) posted better-than-expected revenues of $4.52bn surpassing the consensus estimate of $4.34bn (-3.95%) and in the same direction as Advan's forecasted sales. The revenue was -9.94% YoY - Advan's foot traffic data captured a decrease in traffic at its factories of -12.19% YoY. Advan's footfall data has 0.9 correlation on a YoY basis with General Mills' top-line revenue over the last 10 quarters.

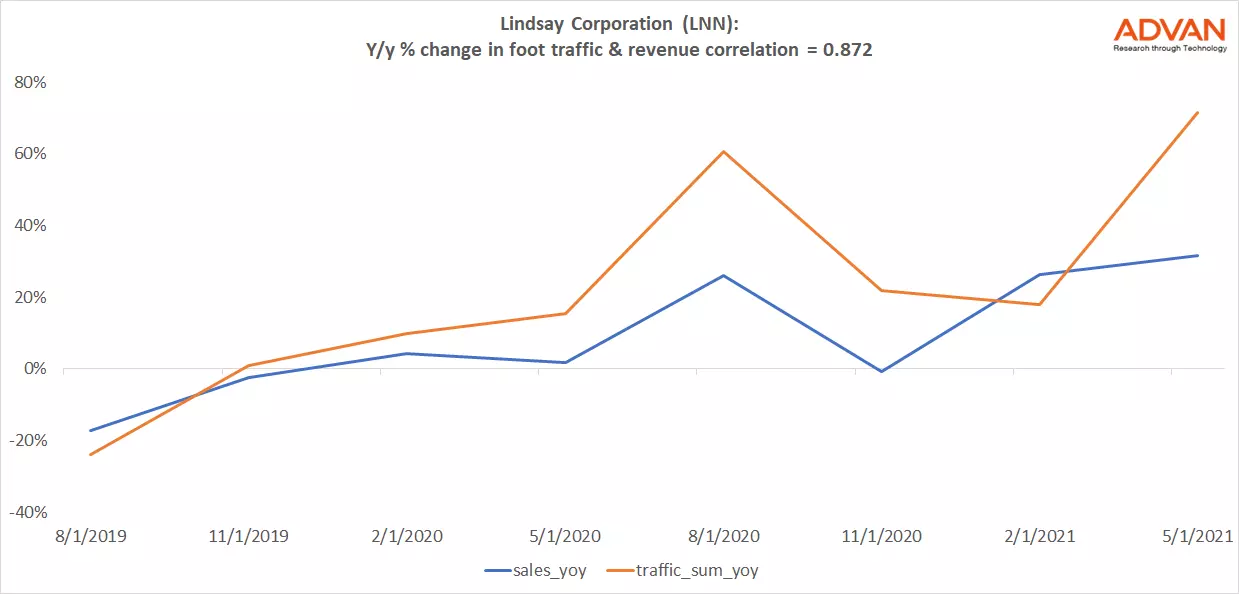

Notable Hit 2: (LNN:NYSE) On Friday July 2, 2021 Lindsay Corporation (LNN) posted better-than-expected revenues of $162mm surpassing the consensus estimate of $147mm (-10%) and in the same direction as Advan's forecasted sales. The revenue was +31.6% YoY - Advan's foot traffic data captured an increase in employee traffic at its factories of +71.65% YoY. Advan's (employee) footfall data has over 0.87 correlation on a YoY basis with Lindsay's top-line revenue over the last 8 quarters.

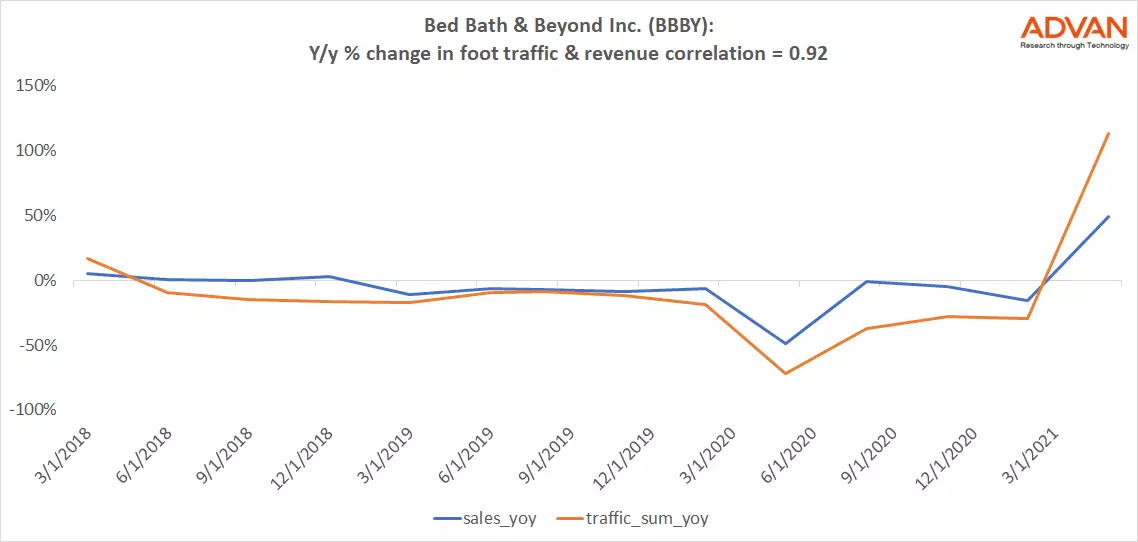

Notable Hit 3: (BBBY:NASDAQ) On Thursday July 1, 2021 Bed Bath & Beyond Inc. (BBBY) posted better-than-expected revenues of $1.95bn surpassing the consensus estimate of $1.86bn (-4.59%) and in the same direction as Advan's forecasted sales. The revenue was +49.5% YoY - Advan's foot traffic data captured an increase in traffic of +111% YoY. Advan's footfall data has 0.92 correlation on a YoY basis with Bed Bath & Beyond top-line revenue over the last 14 quarters.