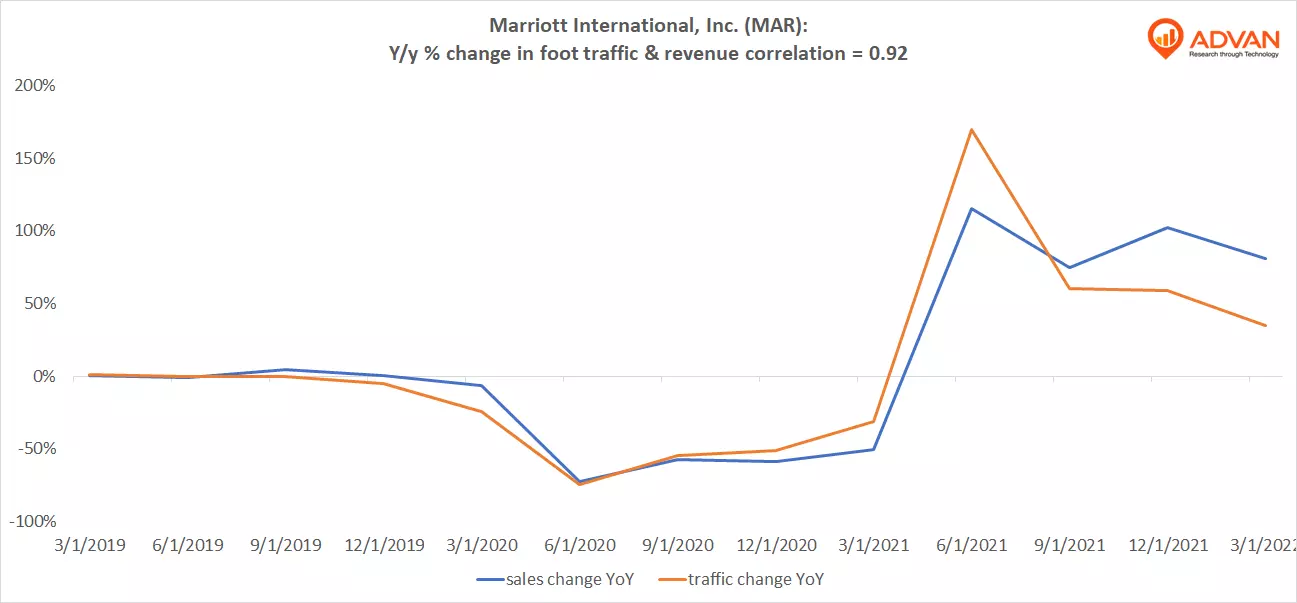

Notable Hit 1: (MAR:NASDAQ) On Wednesday May 4, 2022 Marriott International, Inc. (MAR) posted better-than-expected revenues of 4.2bn surpassing the consensus estimate of $4.15bn or by +1.2% and in the same direction as Advan's forecasted sales. The revenue was up 81% YoY and in line with Advan's foot traffic data increase of 35% YoY at its properties for Q1 2022. As a result of beating the sales and EPS the stock closed at $181.24, +4.7% from previous close. Advan's footfall data has a correlation of 0.92 on a YoY basis with MAR's top-line revenue over the last 13 quarters.

Notable Hit 2: (QSR:NYSE) On Tuesday May 3, 2022 Restaurant Brands International Inc. (QSR) posted better-than-expected revenues of $1.45bn surpassing the consensus estimate of $1.42bn or by +2.2% and in the same direction as Advan's forecasted sales. The revenue was up 15% YoY and in line with Advan's foot traffic data increase of 14% YoY at its restaurants for Q1 2022. As a result of beating the sales and EPS the stock opened at $58.4, +2.5% from previous close. Advan's footfall data has a correlation of 0.93 on a YoY basis with QSRs top-line revenue over the last 13 quarters.