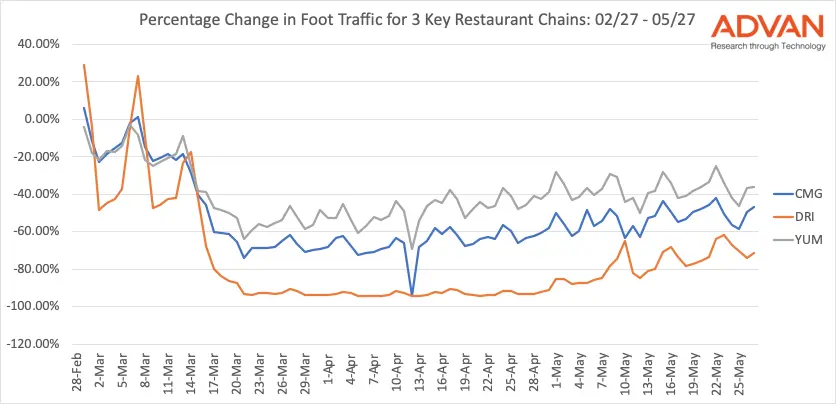

As the US restaurant sector starts to get back on its feet, we have been monitoring foot traffic numbers with interest to see which are turning around most quickly.

The 3 chains we analyzed saw significant falls in traffic between mid-March and the end of April. This was most dramatic for Darden, where foot traffic fell to almost zero given the sit-down nature of the chain's restaurants. Yum brands saw a 60% fall in foot traffic at the nadir and Chipotle a 70% drop.

Since the beginning of May, all have started to see a steady increase in foot traffic. Yum is up approximately 40% from its low, Chipotle is up almost 30% and foot traffic at Darden is up about 20% since the end of April.

Importantly, our analysis takes into account a manual review of opening and closing times of every location, to ensure the data is accurate - this is information that may not be available or accurate via other sources.

The steady increase in foot traffic to all three restaurant chains reflects two related trends: first, people are going out more as restrictions are lifted; and, secondly, some restaurants are now allowing people to enter and even dine-in, rather than picking up take-out at the door, which increases linger times at these locations.

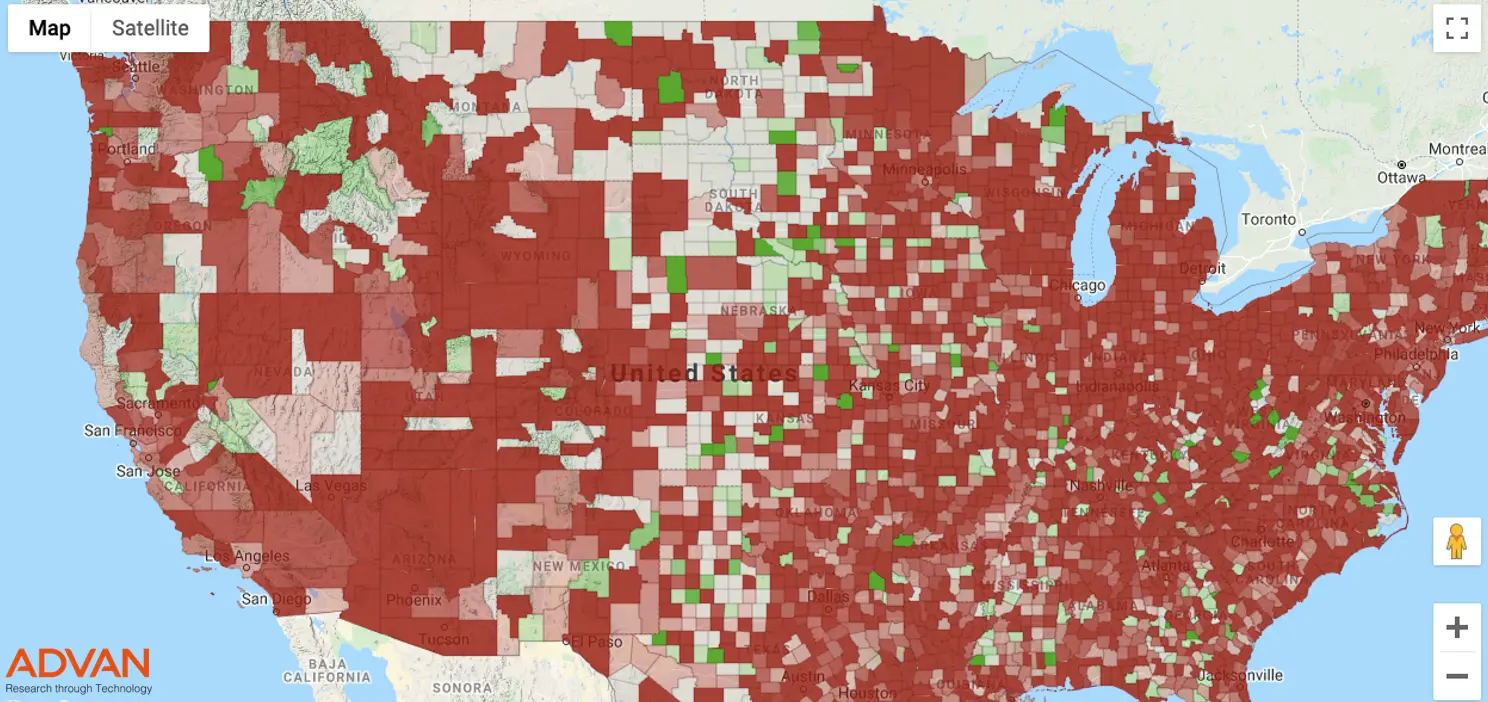

To complement this data, we also reviewed our Hotspots map. This interactive map highlights city blocks where more than 50 people have gathered for longer than 15 minutes, excluding residences.

The screenshot of our map below shows the difference in social gathering between April 1 and May 24 (red = more gathering, green = less). Based on the increased overall mobility of the US population between these dates, it seems restaurants may be a lagging indicator for recovery.

For more detailed data please contact us directly contact us.