It is everyone's favorite game to perfectly forecast earnings by looking in the rear view mirror. We are trying really hard not to fall into the same trap ourselves.

Here is why: it is very easy to make random predictions, some of which come true, and then look back and cherry-pick the ones that you were right. Really, a monkey can do it. If you give them a banana for each correct prediction they would get pretty fat, fast!

What really distinguishes a good forecasting method from random chance is, the percentage of times you get it right versus the ones you get it wrong. If you are correct more often than not, even 51% correct vs 49% wrong, then you have something to say. Even if you are wrong more often but you have higher conviction (and therefore make more money) when you are correct, that also has value.

Advan's Machine Learning algorithms take the foot traffic data we compute and forecast top-line revenue. We get it right about 60% of the times. 2 out of 3. If that doesn't sound impressive, consider that many quantitative funds can build profitable algorithms from a mere 51% advantage. And in our own "paper trading" backtests, the performance of a long/short neutral portfolio constructed using Advan's foot traffic data has a Sharpe ratio over 2.

Considering we do not claim to be experts in either Portfolio Construction nor Machine Learning, these performance results are pretty good, if we may say so ourselves. The average Hedge Fund has Sharpe under 1 (not to ding Hedge Funds, actual trading is much harder than paper trading).

Having said that, we can't resist the urge to brag about individual hits. Just this once:

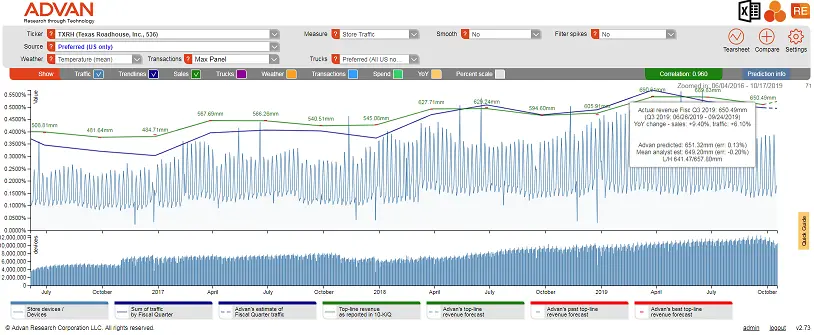

• Texas Roadhouse (TXRH):

The consensus estimated revenue in Q3 2019 was $649.2mm. Advan forecasted $651.32 on foot traffic growth of 6.1%. The actual revenue reported on October 28th after the market close was $650.42mm. The stock closed at $50.17 on the 28th and traded up 20% the next day!

Advan's Year over Year reported traffic and TXRH top-line revenue have correlation of 0.7 over the last 8 fiscal quarters; Quarter over Quarter traffic and top line revenue have correlation 0.96. This correct forecast wasn't an accident.