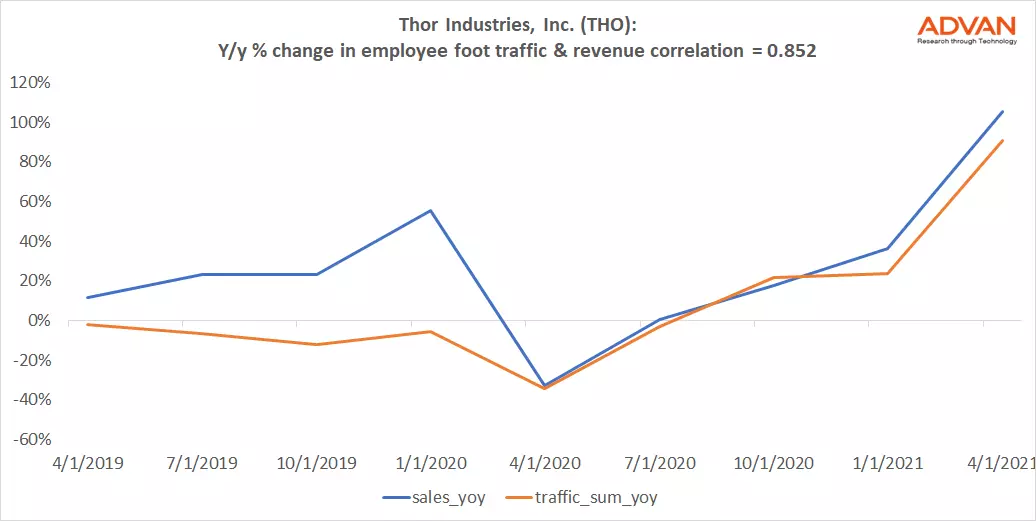

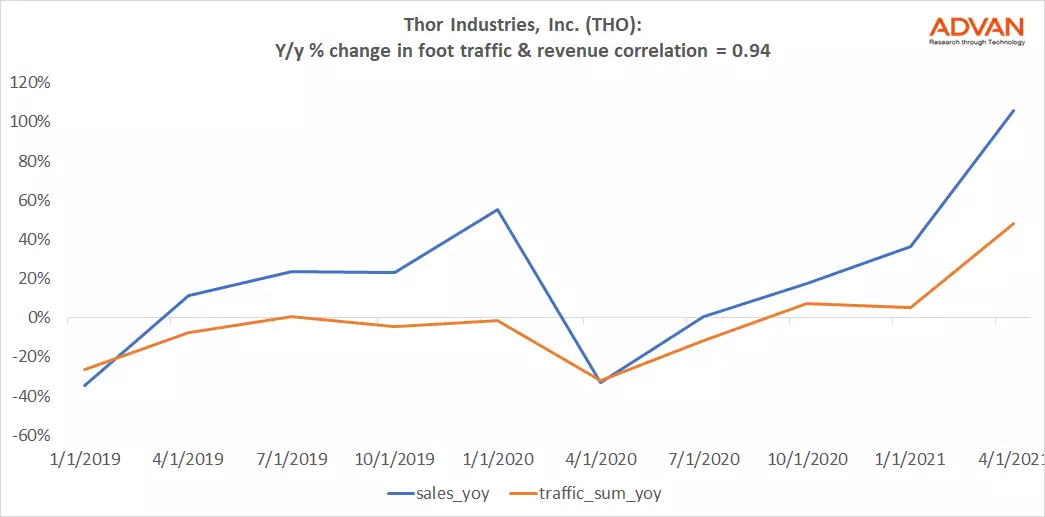

Notable Hit 1: (THO:NYSE) On Wednesday June 9, 2021 Thor Industries, Inc. (THO) posted better-than-expected revenues of $3.46bn surpassing the consensus estimate of $2.96bn (-14.54%) and in the same direction as Advan's forecasted sales. The revenue was +105.7% YoY - Advan's foot traffic data captured an increase in employee traffic of +90.85% YoY and +47.8% YoY in overall traffic at its factories. Advan's footfall (employee) data has over 0.85 correlation on a YoY basis with Thor's top-line revenue over the last 9 quarters and 0.94 correlation with overall traffic over the course of 10 quarters.

Notable Hit 2: (CASY:NASDAQ) On Wednesday June 9, 2021 Casey's General Stores, Inc. (CASY) posted better-than-expected revenues of $2.38bn surpassing the consensus estimate of $2.16bn (-8.97%) and in the same direction as Advan's forecasted sales. The revenue was +31.19% YoY - Advan's foot traffic data captured an increase in traffic of +36.63% YoY. Advan's footfall data has over 0.86 correlation on a YoY basis with Casey's top-line revenue over the last 10 quarters.

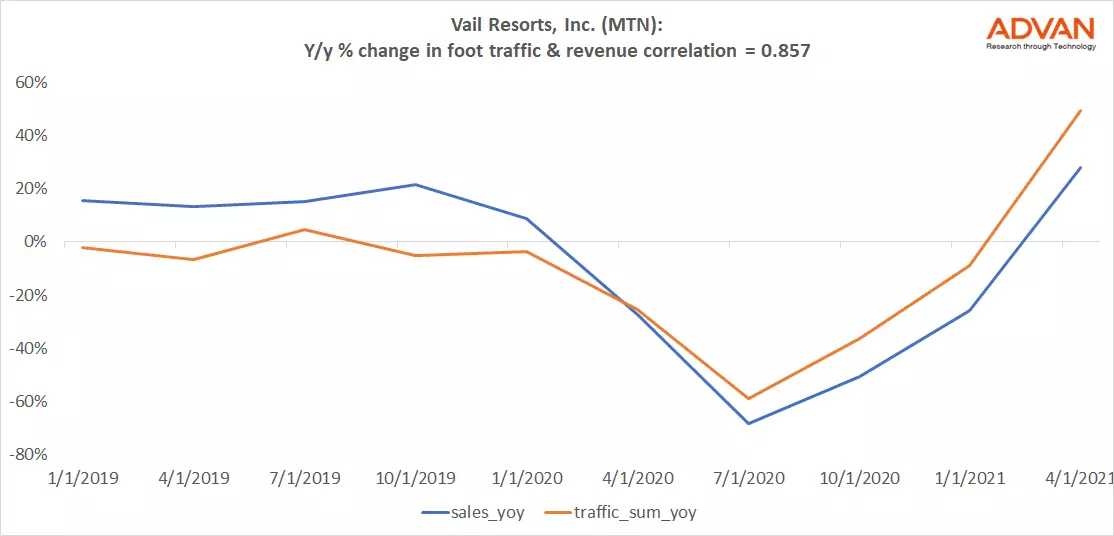

Notable Hit 3: (MTN:NYSE) On Tuesday June 8, 2021 Vail Resorts, Inc. (MTN) posted better-than-expected revenues of $889.08mm surpassing the consensus estimate of $885.23mm (-0.43%) and in the same direction as Advan's forecasted sales. The revenue was +28.09% YoY - Advan's foot traffic data captured an increase in traffic of +49.51% YoY. Advan's footfall data has over 0.85 correlation on a YoY basis with Vail's top-line revenue over the last 10 quarters.