Vail Resorts, a leader in the ski industry, has long been defined by its aggressive expansion strategy and the introduction of the Epic Pass, which revolutionized how skiers access multiple destinations. However, recent challenges, including labor disputes, operational issues, and competition from alternative passes suggest that the company's dominant position is facing mounting pressure.

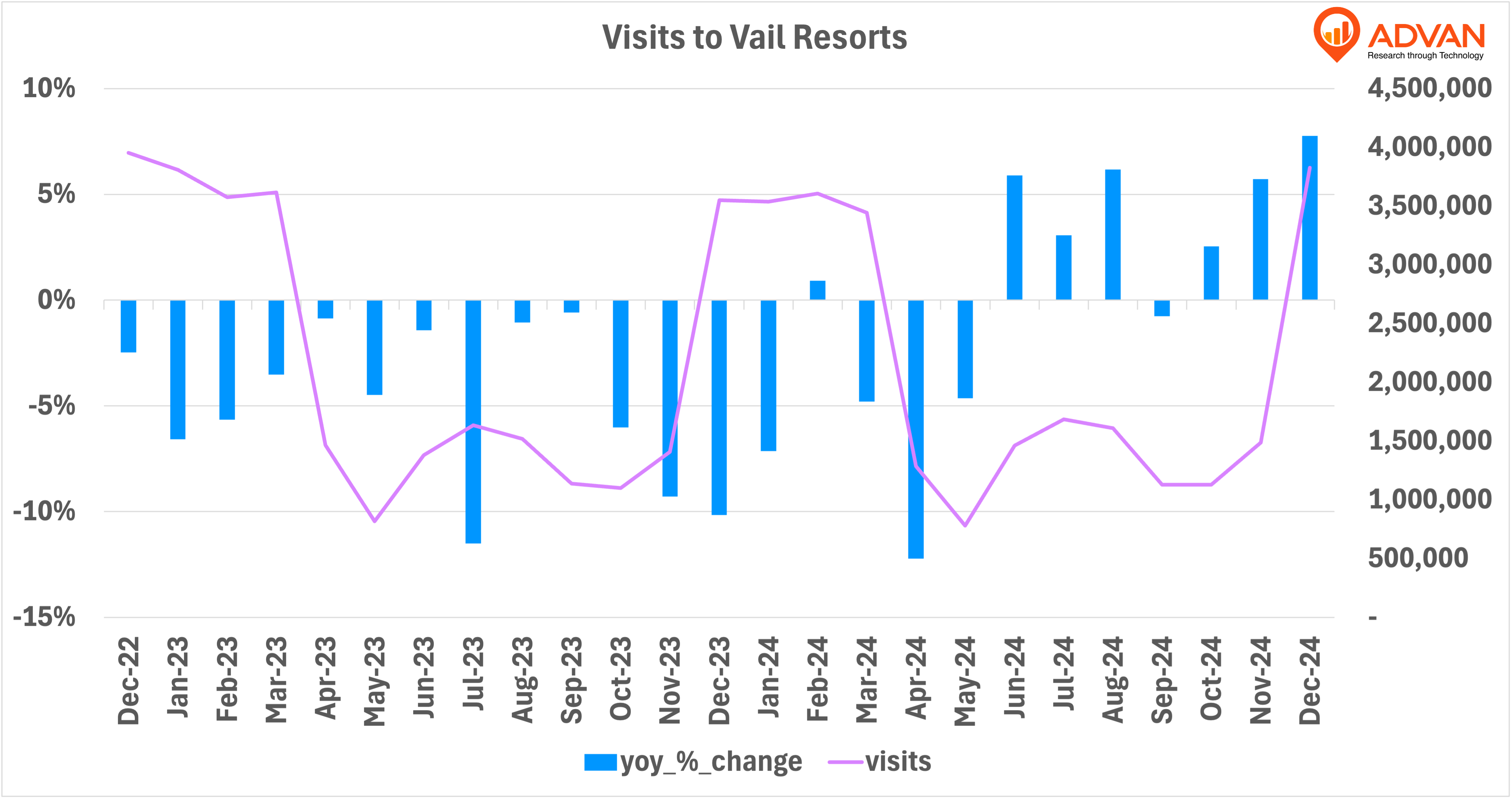

A recent Wall Street Journal report highlights that Vail Resorts saw a decline in Epic Pass sales for the first time, marking a shift that could have long-term implications. At the same time, Advan’s foot traffic data paints a broader picture of the challenges within the ski industry.

Analyzing Foot Traffic Trends at Vail Resorts

According to Advan’s location intelligence data, year over year (YoY) visits to Vail properties experienced notable declines for most of 2023, with some of the most significant drops occurring in traditionally peak months:

What’s Driving These Declines?

The data from Advan support the concerns raised in the WSJ article:

1 - Saturation and Competition: The ski industry is seeing an increase in competitors offering alternative multi-resort passes, making it harder for Vail to maintain its customer base.

2 - Pricing Challenges: With Epic Pass prices increasing annually, some skiers are opting out in favor of other destinations or even backcountry skiing.

3 - Operational Struggles: The Park City strike revealed deeper issues in labor relations and staffing shortages, which may have deterred some visitors from returning.

4 - Weather and Snowfall Variability: Poor snowfall, particularly at Whistler Blackcomb, has also played a role in driving down visitation numbers.

A Critical Inflection Point

Vail Resorts transformed the ski industry with the Epic Pass, but the latest data indicates that cracks are forming in its dominance. While recent foot traffic trends highlight significant declines, a potential recovery could be on the horizon if Vail successfully addresses its labor issues, improves operational efficiency, and offers better value to its customers.

As we are heading towards the middle of 2024-25 ski season, all eyes will be on whether Vail can turn the tide or if its competitors will continue chipping away at its once-invalnerable market position.

For businesses, investors, and ski enthusiasts, monitoring foot traffic data from Advan will remain an essential tool for understanding the evolving landscape of the ski industry.

*A previous version of this article stated that the strike began in December 2023 as opposed to December 2024