By Thomas Paulson, Head of Market Insights

With Albertson’s quarterly results came the first public comments from incoming CEO Susan Morris (currently COO). Morris touched on management's current initiatives and didn’t introduce anything meaningfully different, i.e. they will continue to work from the same playbook. Morris, “Our Customers for Life strategy is working. We're growing digitally engaged customers, omnichannel households, loyalty members and increasing customer traffic. Our stores are operating more effectively and efficiently as new technologies take hold, and we're proactively reducing our costs. Our productivity programs are creating fuel for investments and are an offset to inflationary headwinds. We believe all of this puts us in a strong position to continue to transform the business and serve our customers even better.”

As it relates to the quarter, comp-sales increased +2.3%, driven by inflation (eggs), digital (+24%), and GLP-1 drugs. Advan estimates that store traffic declined -0.5%. Excluding these contributors, we estimate that basket size shrank by -3.1%, -70 bps worse QoQ, which isn’t what stakeholders want to see; they want volume growth and increasing share-of-stomach, not losses. Morris said, “Inflationary pressures have elevated our customers' needs for value. To address these needs, we're working with our vendor partners to strategically invest in price… We've also enhanced the breadth of our loyalty offerings to provide immediate savings and greater value. Finally, we're amplifying our own brand's presence to drive profitable unit growth and increased share of wallet. We will increase innovation, more prominently feature existing owned brands and offer products at attractive entry price points.”

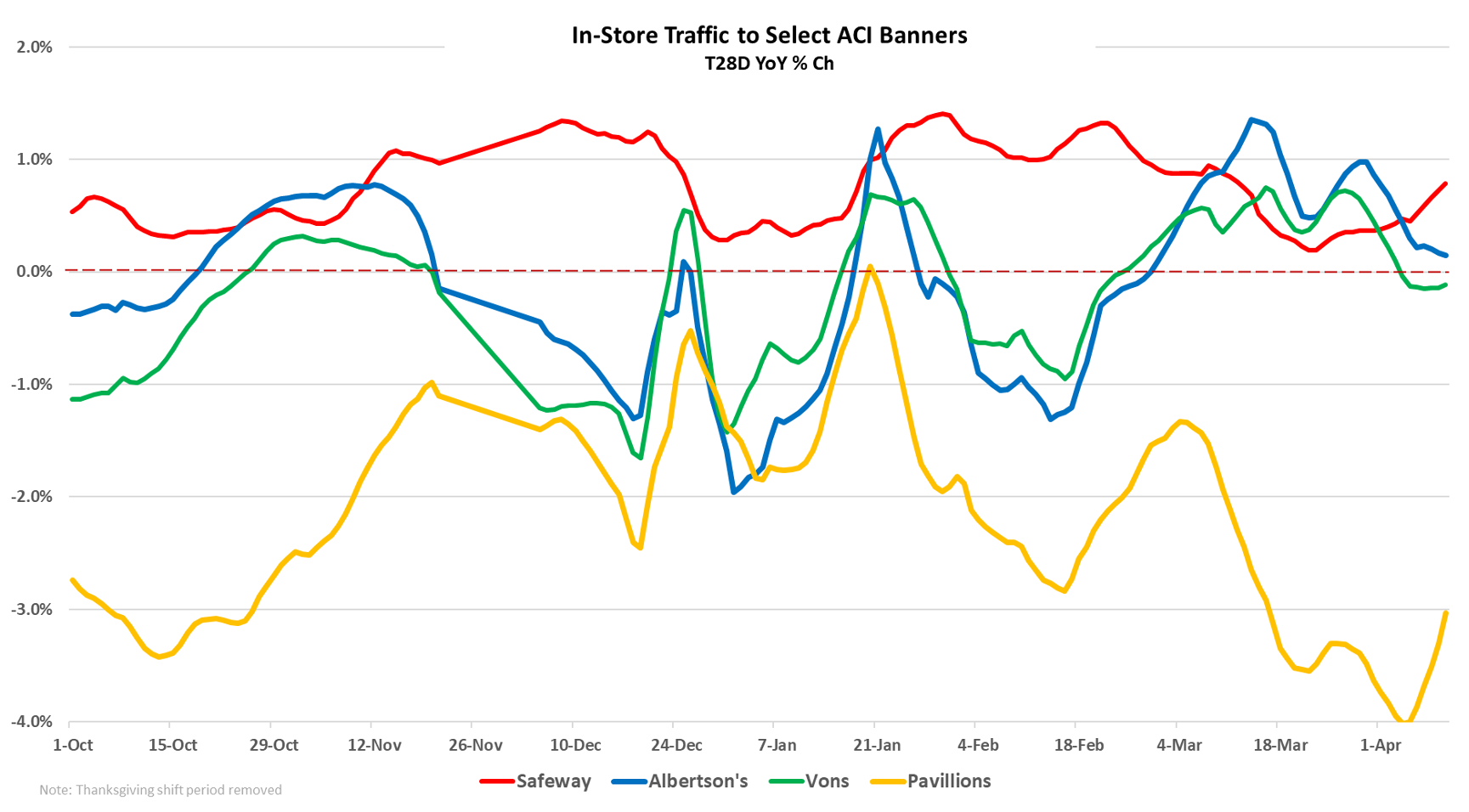

Looking at traffic by banner, Safeway has delivered the most consistent performance; shopper frequency and dwell time are also consistent YoY; monthly in-store shoppers is up slightly (+0.4%). Those combined suggest a stable basket size which is what we see in our transaction data. Traffic for Von’s and Albertson’s was down modestly, implying that these two brands are where the bulk of market share loss is occurring. Pavilions has been even softer and more volatile; shopper frequency is up +3.7% at Pavilions, but dwell time is down (-2.6%). Those combined suggest pressure on basket size which is what we see in our transaction data. Monthly in-store shoppers of Pavilions are down -6%, which is reflective of some households disengaging, but also the impact of more store-delivery to loyal households. (Two locations are also near areas impacted by the fires.) Company-wide for the quarter, app penetration increased by 1.3M to 45.6M for a 15% YoY gain, and this is the metric that management uses for “loyalty members.” Those gains and the traffic that they generate likely have a lower basket size attached to them, which is why volume isn’t matching traffic or loyalty member growth. (Confusing, yes, it is.)

In terms of the outlook, guidance on 2025 was for more of the same, with EBITDA down about 5%, with most of that coming from price investment in value for shoppers. On the consumer, Morris said, “We have not seen a dramatic shift in the recent months from consumer behavior. As we've mentioned before that we're seeing a shift towards value, they're clearly more responsive to promotion. When we listen to the voice of our internal customers, we recognize that our [lower income] customers are feeling more pressure. And the customers in general are thinking about their budgets and how to optimize them, maybe eating out less and making different choices, shopping our own brands, those kinds of things…. We are absolutely still seeing the customers navigate towards value and towards promotion. So our promotional volume is up, and this is where our work around buying better together and seeking to improve our cost of goods is going to be critical for us as we go throughout 2025. From a competitive perspective, I think like the rest of the industry, we're all seeing the pressures from mass, club stores, and value players… We understand exactly where those are and are very thoughtful about how we're investing in the areas where we have opportunity, very surgically using the tools and technologies that we have to help us make the best decision.”

Thomas has been Head of Market Insights for Advan Research since January 2025. Previously, he served as Director of Research and Business Development at Placer.ai, where he was instrumental in providing actionable insights derived from location analytics and the path for expansion into new verticals. His extensive background also includes two decades as a Wall Street analyst and portfolio manager in asset management at Alliance Bernstein, Cornerstone, and others. Linkedin profile.